Technical analysis of GBP/JPY for August 31, 2017

Our targets which we predicted in yesterday’s analysis has been hit. we are still long on GBP/JPY as it is expected to trade with a bullish outlook. The intraday outlook remains positive on the prices. A support base at 130.95 has formed and has allowed for a temporary stabilization. In addition, the relative strength index is turning up and also broke above its neutrality area at 50, confirming a bullish outlook.

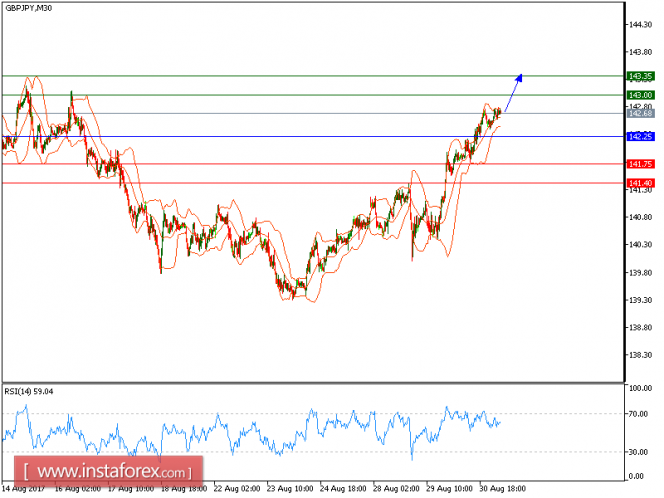

To sum up, as long as 142.25 is a support level, look for further advance to 143 and 143.35 in extension.

Alternatively, if the price moves in the direction opposite to the forecast, a short position is recommended below 142.25 with the target at 141.75.

Strategy: BUY, Stop Loss: 142.25, Take Profit: 143.00.

Chart Explanation: the black line shows the pivot point. The price above the pivot point indicates the bullish position; and when it is below the pivot points, it indicates a short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Resistance levels: 143.000, 143.35, and 143.85

Support levels: 141.75, 141.40, and 141.00

The material has been provided by InstaForex Company – www.instaforex.com