Technical analysis of Bitcoin for 03.06.2019

Crypto Industry News:

The Japan House of Representatives officially approved a new bill to amend national laws regulating the cryptographic industry.

The draft law – prepared by the Japanese Financial Services Agency (FSA) and approved by the House in mid-March this year – was adopted by a majority of votes at the plenary session of the Chamber of Councilors, in accordance with the current update of the FSA on the official website.

The project is aimed at introducing changes to two national laws regarding cryptographic assets – the act on settlement of funds and the law on financial instruments and exchange. Now that the bill has been adopted, the amended acts are expected to enter into force in April 2020.

The proposed changes to Japanese financial instruments and payment services will ostentatiously tighten the regulation of cryptocurrencies to promote user protection, more stringent regulation of trading in cryptographic instruments, mitigate industry risk, such as stock market busts, and the broad establishment of a more transparent legal framework for new asset classes.

According to earlier reports, the bill also introduces a legal change in the name of cryptocurrencies as “cryptographic assets”, previously marked in the country as “virtual currencies”. The draft also provides for stricter rules regarding trading in margins, limiting the leverage to double and four times the initial deposit.

Technical Market Overview:

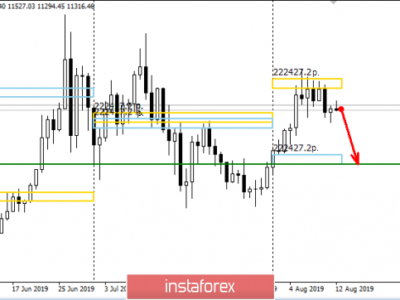

The BTC/USD pair has bounced from the level of $7,978, broke above the 61% Fibonacci retracement of the last wave down and made a local high at the level of $8,786. The volatility is limited as the price movements are not that big, the market is trading around the weekly pivot level, which is quite typical for the wave 4 correction in progress. The nearest technical resistance is seen at the level of $8,925 and the nearest technical support is seen at the level of $8,306. According to the Elliott Wave theory, there is still one more wave down missing to terminate the ABC correction in wave 4.

Weekly Pivot Points:

WR3 – $10,284

WR2 – $9,622

WR1 – $9,121

Weekly Pivot – $8.545

WS1 – $8,037

WS2 – $7,438

WS3 – $6,960

Trading Recommendations:

The best strategy in the current market conditions is to trade in the direction of the main trend, which is still up. All the local bounces and correction should be treated as another opportunity to open the buy orders for a better price. Please notice, the larger time frame trend is up and there are no signs of any trend reversal.

The material has been provided by InstaForex Company – www.instaforex.com