Technical Analysis on SP500 and WTI Crude [Video]

2000 now has to be seen as significant resistance and we have now widened the trading range to 1900-2000. The last 2 bearish candles point at further short term weakness to come. Next week traders should be looking to go Short on any retracement of Friday’s candle with a view for price to re-test 1900 and possibly below.

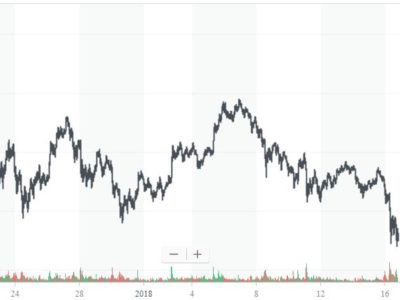

Interesting picture shown by the weekly chart. Price stuck at 45$ level which acted as strong support end of 2014 and beginning of 2015. Then market broke through it and is now meeting with resistance just above it. This dynamic can mean further downside to come.

(Daily)

The daily chart shows how price seems to be trading in a triangular pattern and within it attempted to break above the 50 sma and the 38.2 Fib level but failed. So next week we should see a re-test of the bottom of this consolidation pattern around 43$ which we will be watching closely as a key level.

Thank you for watching .. please take a look at our subscription service STTS (Short Term Trade Setups) which covers also gold and the major currencies and includes entry levels, stops and targets combined with our tried and tested risk management strategy

Come and find us on tff-onlinetrading/market analysis

Have a great week!