Technical analysis recommendations for EUR/USD and GBP/USD on Mar 10, 2020

EUR / USD

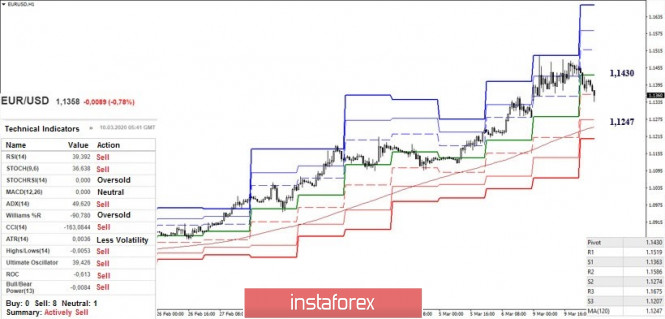

Yesterday, the pair stayed at all maximums all day. Players to increase did not allow the opponent to organize an active decline and win back the surge in prices. However, the strength for a long time was still not enough. As a result, we are seeing a successful decline in the euro today. In the case of the closing of the ascending gap on Monday, the pair will return to the position of the previous week (closing 1.1284), throwing up a long shadow of oil disagreement. On the other hand, the zone of attraction, which will now hold back the bearish return, is the accumulation of worked targets, the boundaries can be designated 1.1370 (the upper boundary of the weekly cloud) and 1.1479 (100% completion of the daily goal according to the Chikou). The nearest support from the levels of upper time intervals today is concentrated in the area of 1.

At the lower time intervals, the players to decline have already managed to reach a change in the balance of forces. Enlisting the support of technical indicators and consolidating under the central Pivot level, the bears are now implementing a decline, whose reference points of which on H1 are the weekly long-term trend (1.1248) and S3 (1.1207). Testing these supports will close Monday’s upward gap. If you fix below these levels, it is better to evaluate the situation again. Rise and return to the side of the bulls of the central Pivot level (1.1430) is most likely able to hold the pair for a long time in the zone of attraction of the higher halves (1.1370 – 1.1479).

GBP / USD

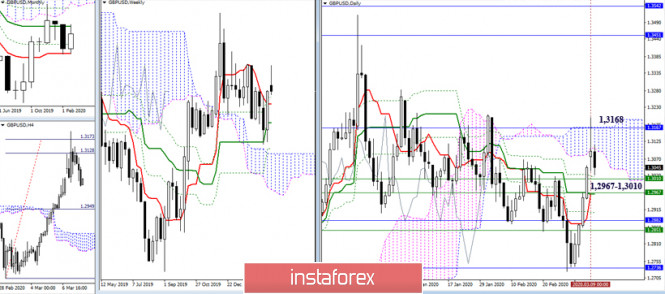

Having tested important resistance near the level of 1.3168 (the upper boundary of the daily cloud + monthly Kijun), the pair failed to break through the levels or at least consolidate near the area. As a result, we observe a decrease at which the bears have already declined under the daily cloud to the supports of the daily and weekly Ichimoku crosses (1.2967 – 1.3001). Fixation under these supports will lead to the formation of a new effective rebound from key resistance levels (1.3168). This circumstance is able to return further bearish activity. At the same time, the return under 1.3168 and its new testing will testify to the desire of players to increase to form new upward benchmarks and continue to rise.

At the moment, we are developing a downward correction on H1, which has led the pair to support S1 (1.3020), then the weekly long-term trend (1.2942) serves as a reference for players to decline. Fixing below will change the current balance forces, giving all the main advantages to the bears, and will allow you to consider new bearish guidelines. The market will return to the level of 1.3109 (central Pivot level of the day) and consolidation above will serve as the basis for restoring bullish sentiment and advantages.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Technical analysis recommendations for EUR/USD and GBP/USD on March 10