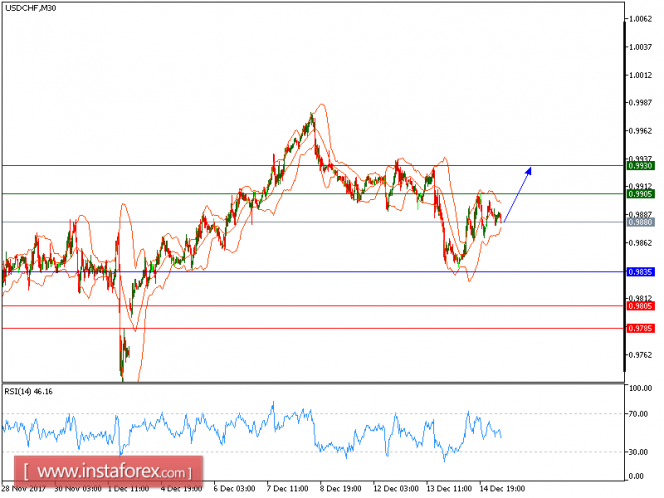

Technical analysis of USD/CHF for December 15, 2017

USD/CHF is expected to trade with a bullish outlook. The pair posted a rebound after touching the 50-period moving average. In addition, the 50-period moving average is turning up. The relative strength index lacks downward momentum. The downside potential should be limited by the key support at 0.9835.

The U.S. Commerce Department reported that retail sales grew 0.8% on month in November, faster than +0.3% expected and +0.5% in October. The Labor Department said initial jobless claims dropped 11,000 to a seasonally adjusted 225,000 in the week ended December 9, lower than 235,000 new claims expected.

To sum up, as long as this key level holds on the downside, look for the continuation of the rebound to 0.9905 and even to 0.9930 in extension.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot points indicates a short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY, Stop Loss: 0.9835, Take Profit: 0.9905

Resistance levels: 0.9905, 0.9930, and 0.9960

Support levels: 0.9805, 0.9785, and 0.9755

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Technical analysis of USD/CHF for December 15, 2017