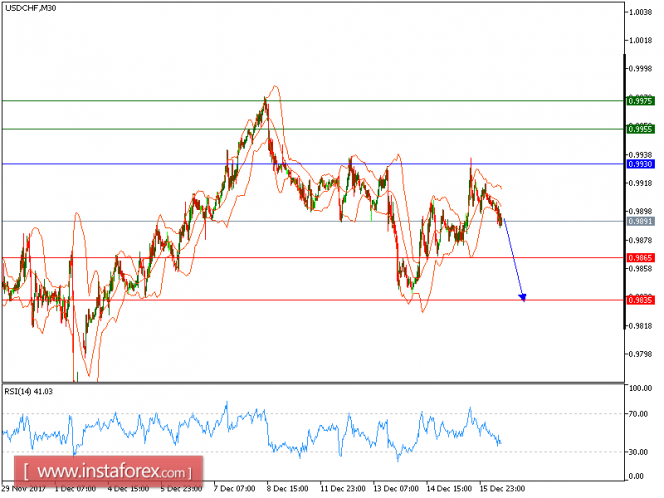

Technical analysis of USD/CHF for December 18, 2017

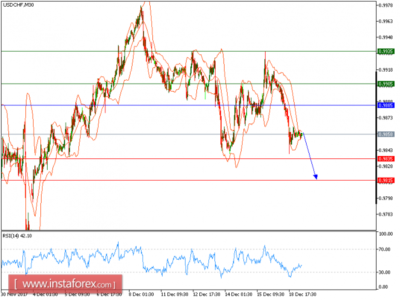

USD/CHF is expected to trade with a bearish outlook. The pair retreated from 0.9930 and broke below its 20-period and 50-period moving averages. The relative strength index is below its neutrality level at 50.

The U.S. dollar strengthened further, boosted by optimism on Congress, getting closer to passing a tax-cut plan.

Hence, below 0.9930, look for a further drop with targets at 0.9865 and 0.985 in extension.

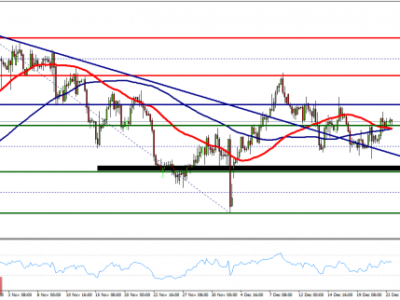

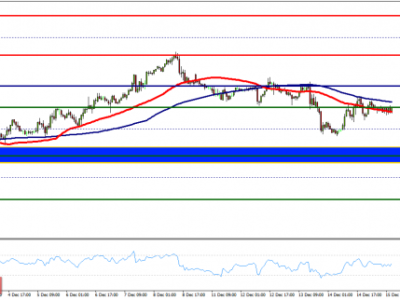

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot points indicates a short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: SELL, Stop Loss: 0.9930, Take Profit: 0.9865

Resistance levels: 0.9955, 0.9975, and 1.0015

Support levels: 0.9865, 0.9835, and 0.9795

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Technical analysis of USD/CHF for December 18, 2017