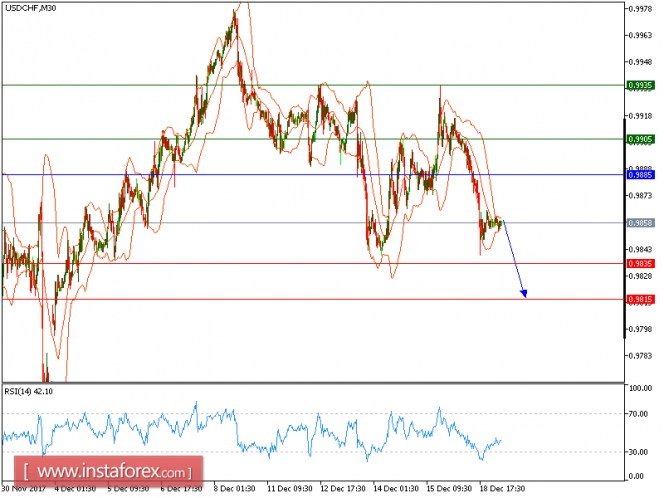

Technical analysis of USD/CHF for December 19, 2017

Our first target which we predicted in yesterday’s analysis has been hit. USD/CHF is Under pressure. The pair is trading below its declining 20-period and 50-period moving averages, which play resistance roles and maintain the downside bias. The relative strength index is bearish and calls for a further drop.

The U.S. dollar gave up some gains made in the prior two sessions, as investors took profits ahead of Congress’ voting on the tax-reform bill.

Hence, as long as 0.9885 holds on the upside, another drop to 0.9835 and even to 0.9815 seems more likely to occur.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot points indicates a short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: SELL, Stop Loss: 0.9885, Take Profit: 0.9835

Resistance levels: 0.9905, 0.9935, and 0.9975

Support levels: 0.9835, 0.9815, and 0.9795

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Technical analysis of USD/CHF for December 19, 2017