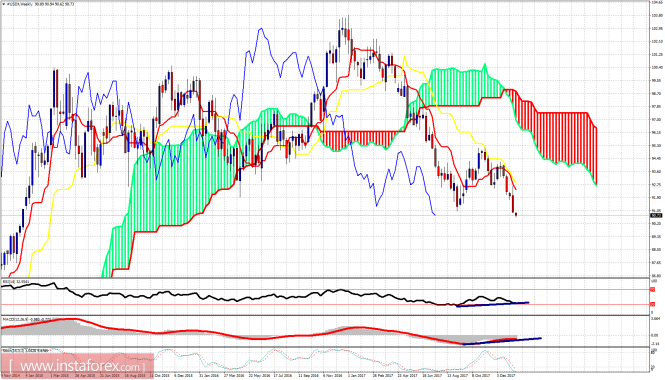

Technical analysis of USDX for January 15, 2018

The Dollar index as expected made new lows below 91. The price trend has remained bearish showing no sign of strength or upside reversal. The price got rejected at all major resistance levels giving more strength to the downside momentum. There are some warning signs for Dollar bears but no reversal sign.

Blue lines – bearish channel

The Dollar index is trading near the lower blue channel boundary. Oscillators are diverging and oversold. The decline from 94.30 area might soon be complete. Support is at 90.50 and resistance at 91.75. Previous support is now resistance. Only a break above that area will make me consider that the downside is over.

On a weekly basis, the trend remains clearly bearish. price is making lower lows and lower highs. Oscillators are diverging but on a weekly basis, this is just a heads up warning and far from a reversal signal. Only on a move above 92.60 could we say on a weekly basis that the price is showing reversal signs.

The material has been provided by InstaForex Company – www.instaforex.com