Technical analysis of USDX for July 13, 2017

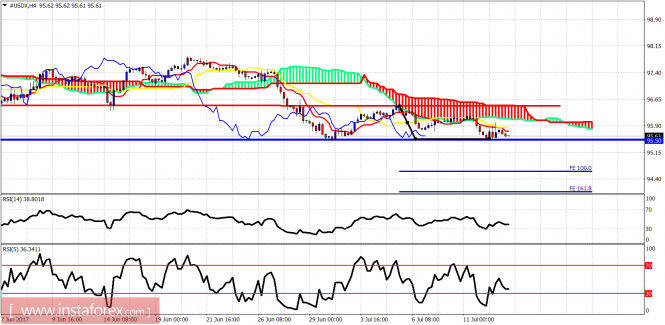

The Dollar index has weakened significantly after the speech by FED Chairwoman Janet Yellen. Price is now testing the recent lows and critical short-term support. Breaking below 95.50 gives us a target at 94.60. Trend remains bearish as long as price is below 96.40.

Red line – resistance

Blue line – support

The Dollar index got rejected by the Ichimoku cloud resistance at 96.30 and reversed back to its recent lows. The bearish scenario of a downward break has more chances as long as price is below 96.10-96.30. Trend remains bearish. If support fails to hold, next target is at 94.60.

Blue lines – bearish channel

The Dollar index weekly chart remains bearish with oversold signs running since late April. Price is on top of the lower channel boundary. I believe we should focus on the bounce as I believe the downside is limited.

The material has been provided by InstaForex Company – www.instaforex.com