Technical analysis of USDX for March 1, 2017

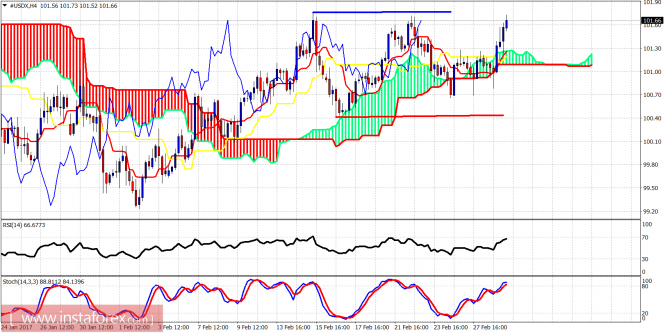

The Dollar index strengthened last night after the speech by US President Donald Trump at the Congress. However the price has only managed so far to reach important resistance area of 101.80. There is no break out yet. Traders should be very cautious in case we see another rejection.

Red line – support

Blue line – resistance

The Dollar index is above the Ichimoku cloud and is testing important short-term resistance at 101.80. I believe we are going to see another rejection at current levels and another pullback towards 100.40 support. The sideways action continues and I prefer to be neutral in the short term or slightly bearish as long as the price is below 102.

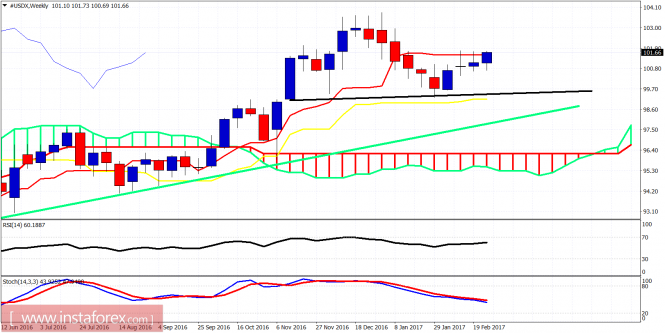

Black line – neckline support

Green line – long-term support trend line

The Dollar index is trying to break out above the weekly tenkan-sen that gave two weekly rejections during the last couple of weeks. Will there be a third time? It is still too early to be sure, though medium-term trend continues to favor bulls as long as price is above the neckline support at 99.25. This week’s low is very important so a break below 100.70 will be a bearish sign.

The material has been provided by InstaForex Company – www.instaforex.com