Thursday 20th March: European Open Briefing

Global Markets:

- Asian stock markets: Nikkei up 0.40 %, Shanghai Composite gained 1.10 %, Hang Seng declined 0.10 %, ASX rose 0.35 %

- Commodities: Gold at $1168 (-0.10 %), Silver at $16.08 (-0.20 %), WTI Oil at $45.50 (-0.10 %), Brent Oil at $54.55 (+0.30 %)

- Rates: US 10 year yield at 1.956, UK 10 year yield at 1.53, German 10 year yield at 0.186

News & Data:

- Bank of Japan: A Few Members Noted That Could Buy More JGBs, But Check Feasibility First — BBG

- EU Statement: Greece To Present Reform Plan In Coming Days

- RBA Governor Stevens: Australian Firms, Households Getting Less Optimistic — BBG

- RBA Governor Stevens: Decline In Exchange Rate Assisting Economic Transition

- RBA Governor Stevens: Fed Policy Likely Expansionary For Some Time

- RBA Governor Stevens: If Fed Raises Rates, Likely Some Disruption In Markets

- RBA Governor Stevens: A$ Adjustment Probably Not Yet Finished

Markets Update:

While US equities closed in the red yesterday, Asian stock markets are mostly higher this morning. There were no data releases overnight and though we had the release of the Bank of Japan minutes and some comments from RBA Governor Stevens, nothing new was said. It is likely to remain quiet in the European session, but later in the day, we’ll see the release of Canadian CPI and Retail Sales data. It is also worth noting that there are several large option expiries for today’s NY cut at 14:00 GMT. $3.7 billion of USD/JPY, options are expiring at 121.00, €1 billion EUR/USD at 1.06 and 1.07 each and $1.2 billion USD/CAD at 1.2750 and 1.28 each.

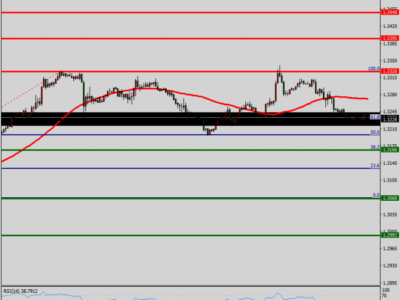

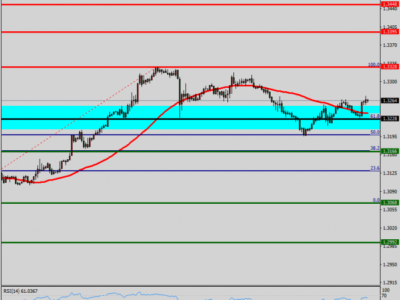

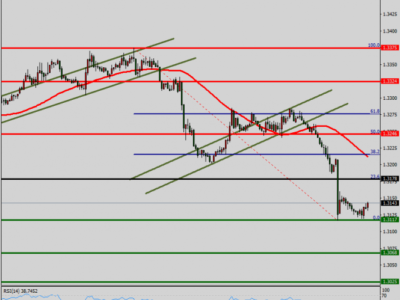

EUR/USD is consolidating within a 1.06-1.07 range after a very volatile post-FOMC session. The key levels to watch are 1.0580/85 to the downside and 1.0830/40 to the topside. GBP/USD came under renewed pressure in yesterday’s NY session after very dovish comments from Bank of England member Haldane. Almost all of the FOMC gains have been erased and the pair is likely to test the 1.4640 low soon.

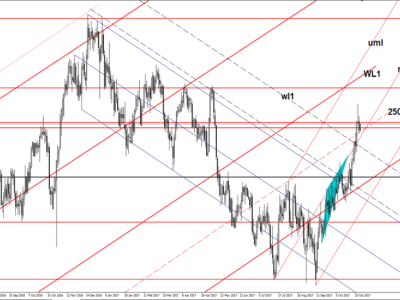

USD/CAD will be in the focus today given the key data releases out of Canada. Strong support can be expected in the 1.2600-20 area, while 1.2820 remains the next major obstacle for bulls.

Upcoming Events:

- 07:00 GMT – German PPI (0.2 % m/m, -1.9 % y/y)

- 12:30 GMT – Canadian Core CPI (0.5 % m/m, 2.1 % y/y)

- 12:30 GMT – Canadian CPI (0.7 % m/m, 0.9 % y/y)

- 12:30 GMT – Canadian Retail Sales (-0.3 % m/m)

- 12:30 GMT – Canadian Core Retail Sales (0.1 % m/m)

The post Thursday 20th March: European Open Briefing appeared first on .