Thursday 21st August: Daily technical outlook and review.

For the readers’ benefit:

Price action confirmation: Simplymeans traders will likely wait for price action to confirm a level by consuming an opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

EUR/USD:

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly TF: At the time of writing, a break below the weekly demand area at 1.32940-1.34847 has been seen. The path south, on this timeframe appears clear down to the weekly demand area at 1.31037-1.32262 which may be hit very soon.

- Daily TF: Yet another impressive full-bodied bearish candle has formed. We are still watching for a retrace north back up to the daily level of interest at 1.33559, but at the time of writing, it seems that we may not see this and price will just continue on down to the daily demand area at 1.31037-1.31755 (which is conveniently located within weekly demand – see above).

The sellers have broken below the round number 1.33, leaving any traders attempting to go long there very little choice but to cover their position. Buying interest was then seen around the 4hr decision-point level at 1.32758, this did not last long though, and any traders who went long there (like us) would have been lucky to come out at breakeven on this one.

The situation to the far left of current price shows the path is very likely clear down to at least a 4hr demand area at 1.31559-1.31879, which is located just within the aforementioned daily demand area, and deep within the aforementioned weekly demand area. Do be aware though, just below this is another 4hr demand area, and in our opinion looks even better at 1.31037-1.31278 (again located within the aforementioned higher-timeframe demand areas).

If pro money’s intent is to bring price that far down, they will need liquidity to do so in the form of buy orders to sell into, so pro money may buy into price here (they likely have enough sell orders to buy into from all the traders recently stopped out – stops in this case were sell orders once hit) pushing back up to the 4hr decision-point level at 1.32758 for a retest, before pushing price south once again. However do be prepared that with effort, pro money may push higher to either the round number 1.33 or even the 4hr D/S flip area at 1.33360-1.33619, where we’ll set P.A confirmation sell levels under each area (1.32731/1.32973/1.33322) as it is very difficult to tell which area will react at this point in time.

Pending orders/P.A confirmation levels:

- The pending buy order (Green line) set just above the 4hr decision-point level (1.32758) at 1.32798 has been stopped out.

- The P.A confirmation buy level (Red line) set just above the round number 1.33 at 1.33046 has been removed since price has dropped too far from the entry level.

- No pending sell orders (Green line) are seen in the current market environment.

- New P.A confirmation sell levels (Red line) are seen just below the 4hr decision-point level (1.32758) at 1.32731. The reason for not placing a pending sell order here is simply because price could ignore this level and trade on up to the round number 1.33 above.

- New P.A confirmation sell levels (Red line) are seen just below the round number 1.33 at 1.32973. The reason for not placing a pending sell order here is simply because price could ignore this level and trade on up to the 4hr D/S flip area above at 1.33360-1.33619.

- New P.A confirmation sell levels (Red line) are seen just below the 4hr D/S flip area (1.33360-1.33619) at 1.33322. The reasoning behind setting a P.A confirmation sell level here and not a pending sell order is because we have no logical area for a stop-loss order meaning price could push straight through this area.

Quick Recap:

The path seems relatively clear south down to at least a 4hr demand area at 1.31559-1.31879, however a retracement back up to one of the following levels/areas (4hr decision-point level at 1.32758, the round number 1.33, and finally the 4hr D/S flip area at 1.33360-1.33619) may be seen before reaching this area as pro money may not have the required amount of liquidity to push prices this far south just yet.

- Areas to watch for buy orders: P.O: No pending buy orders are seen in the current market environment P.A.C: No P.A confirmation buy levels are seen in the current market environment.

- Areas to watch for sell orders: P.O: No pending sell orders are seen in the current market environment. P.A.C: 1.32731 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed). 1.32973 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed) 1.33322 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

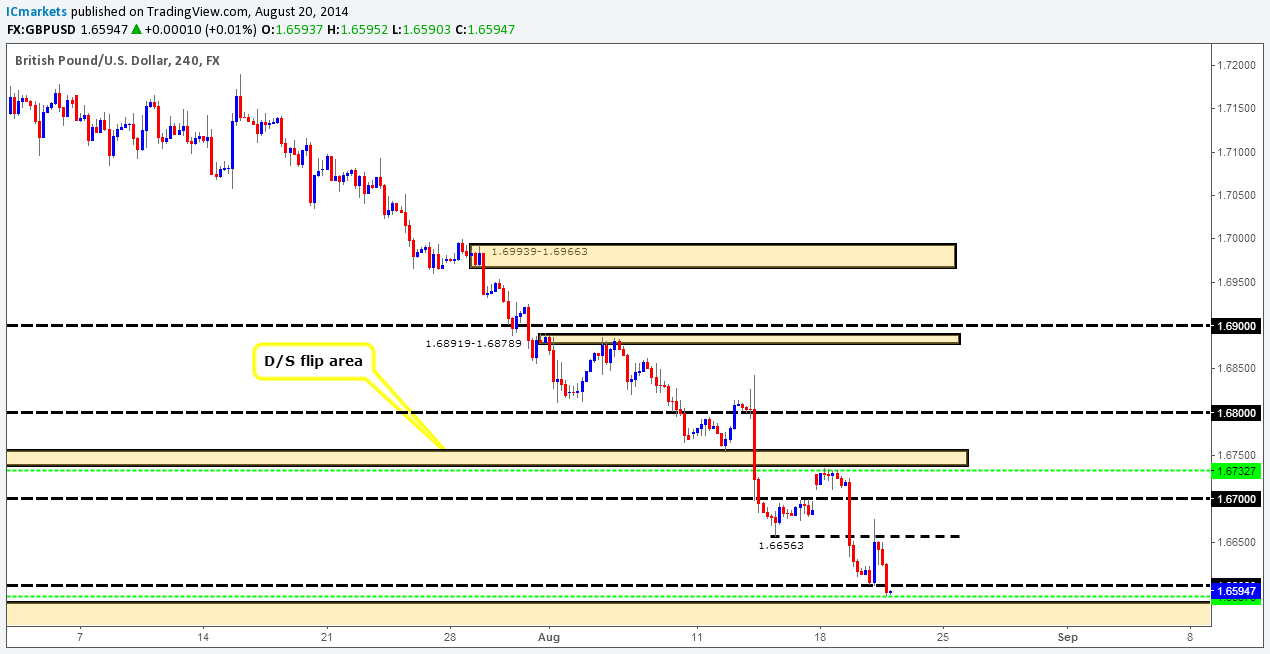

GBP/USD:

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly TF: The next weekly demand area at 1.64589-1.66339 has been hit, price now remains capped between this area and a weekly D/S flip area above at 1.66917-1.67939.

- Daily TF: A nice-looking daily demand area at 1.65492-1.66044 has recently seen a touch, and at the time of writing, little buying interest is being seen.

For anyone who took a long trade off of the round number 1.66 had a nice bit of profit to cash in, however for the traders who did not want to settle for what the market was offering, they are now likely in the red!

A solid break below the round number was seen, and at the time of writing, price is trading just above the 4hr demand area at 1.65492-1.65809 (our pending buy order is yet to be filled set just above at 1.65878). We do expect this 4hr demand area to see a bullish reaction due to where it is located on the higher timeframe-picture (Daily demand at 1.65492-1.66044, Weekly demand at 1.64589-1.66339). The first trouble area we see for the buyers here is around the minor 4hr S/R flip level at 1.66563.

Pending orders/P.A confirmation levels:

- Pending buy orders (Green line) are seen just above 4hr demand (1.65492-1.65809) at 1.65878. The reasoning behind setting a pending buy order here is mainly because price would be then trading deep within a daily demand area at 1.65492-1.66044, and also a weekly demand area at 1.64589-1.66339.

- No P.A confirmation buy levels (Red line) are seen in the current market environment.

- Pending sell orders (Green line) are seen just below the 4hr D/S flip area (1.67389-1.67561) at 1.67327. We have set a pending sell order here because (which was a requirement at the time) the sellers proved this area by consuming the low below at 1.66757.

- No P.A confirmation sell levels (Red line) are seen in the current market environment.

Quick Recap:

Our pending buy order is very close to being filled set just above the 4hr demand area (1.65492-1.65809) at 1.65878. We very much expect a bullish reaction here up to at least the 4hr S/R flip level at 1.66563.

- Areas to watch for buy orders: P.O: 1.65878 SL: 1.65357 TP: Dependent on how price approaches). P.A.C: No P.A confirmation buy levels are seen in the current market environment.

- Areas to watch for sell orders: P.O: 1.67327 (SL: 1.67621 TP: Dependent on how price approaches) P.A.C: No P.A confirmation sell levels are seen in the current market environment.

AUD/USD:

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly TF: Price is still frustratingly trading within a weekly consolidation area with the upper limits seen at 0.94600, and the lower at 0.92046, with no signs of a break happening just yet.

- Daily TF: Price still remains caught trading between the daily demand area 0.92046-0.92354, and a daily decision-point level at 0.93529. A break above could see prices test daily supply at 0.94729-0.94175, conversely, a break below will likely see a push south towards a daily R/S flip level at 0.91323. Let’s also not forget, if a break below is indeed seen, this would effectively mean that price has broken below the weekly consolidation area (levels above) as well.

Our pending buy order set just above the 4hr R/S flip level (0.92815) at 0.92857 is now well and truly filled. Meaning we now have two active long positions on this pair.

Ideally, what we’re looking for is a higher push from where price is currently trading to at least the 0.93278 level marked with a green arrow (first take-profit level from the buy at 0.92857), if we see a break above there, we can then very likely expect price to reach the final take-profit target around 4hr supply at 0.93728.

Pending/P.A confirmation levels:

- The pending buy order (Green line) set just above the 4hr decision-point level (0.92384) at 0.92417 is now active. Our second take-profit target has recently been hit at 0.93, so do keep an eye out for our third and final take-profit target set at 0.93728.

- The pending buy order (Green line) set just above a minor 4hr R/S flip level (0.92815) at 0.92857is now active, so do keep an eye on our first take-profit target set at 0.93278.

- No P.A confirmation buy levels (Red line) are seen in the current environment.

- No pending sell orders (Green line) are seen in the current environment.

- No P.A confirmation sell levels (Red line) are seen in the current market environment.

Quick Recap:

Our next pending buy order set just above the 4hr R/S flip level (0.92815) at 0.92857 has been filled, what we would like to see from here is a push higher up to the next level of supply marked with a green arrow at 0.93278.

- Areas to watch for buy orders: P.O: 0.92417 (Active) (SL: 0.92228 TP: [1] 0.92815 [2] 0.93 [3] 0.93728) 0.92857 (Active) (SL: 0.92700 TP: [1] 0.93278 [2] 0.93728). P.A.C: No P.A confirmation buy levels seen in the current market environment.

- Areas to watch for sell orders: P.O: No pending sell orders seen in the current market environment. P.A.C: No P.A confirmation sell levels seen in the current market environment.

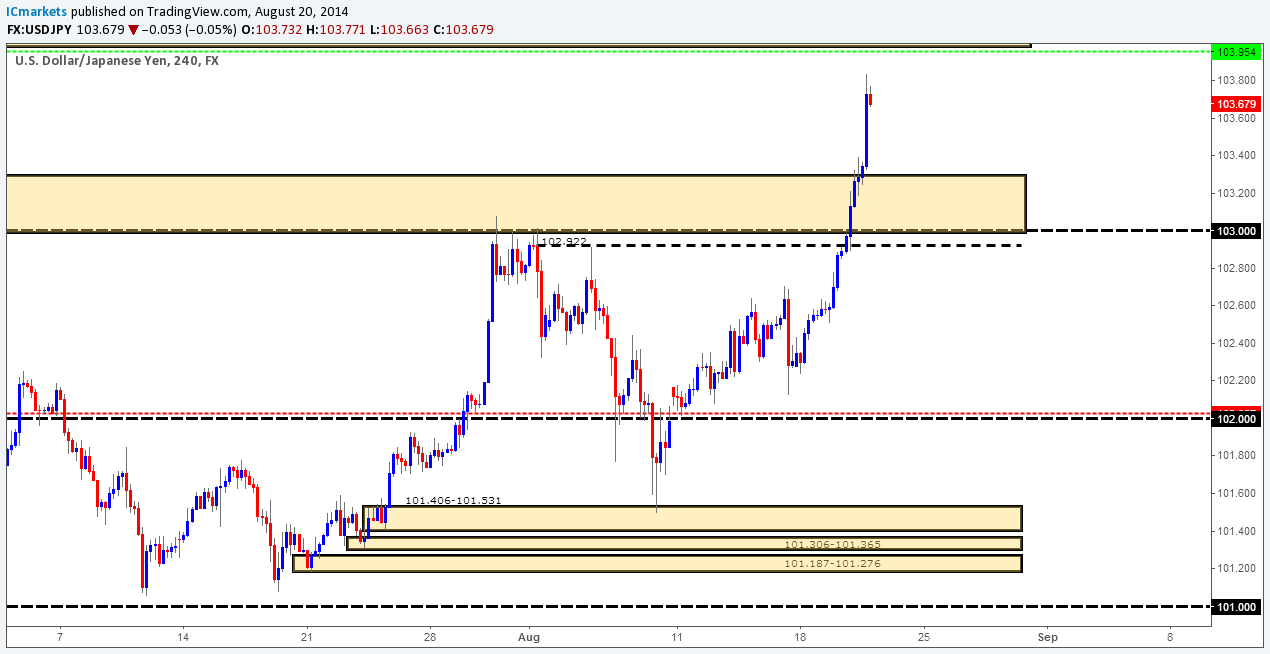

USD/JPY:

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly TF: price still remains trading between a long-term weekly R/S flip level at 101.206 and a weekly supply area above at 105.432-104.065 with price now seen trading just below the aforementioned weekly supply area.

- Daily TF: As expected, a big push has been seen up to the daily supply area at 104.104-103.802 where at the time of writing sellers seem to be showing a little interest.

The sellers have shown little to no interest during this buying onslaught at the moment! A break above a 4hr supply area at 103.294-102.983 cleared the path north for buyers to push higher it seems.

Taking into consideration the higher –timeframe picture for a moment (Trading around a weekly supply area, and also a nice-looking daily supply area – levels above). The 4hr timeframe show a stunning area of 4hr supply a little higher up at 104.104-103.981, which is obviously located deep within the aforementioned higher-timeframe supply areas. We have set a pending sell order here just below at 103.954, since this area will very likely see a nice first-time reaction. So do keep an eye on this area today, and also watch for any trouble areas of demand that may form before price hits this 4hr area of supply.

Pending/P.A confirmation levels:

- No pending buy orders (Green line) are seen in the current market environment.

- P.A confirmation buy levels (Red line) are seen just above the round number 102 at 102.027. The reason behind setting a P.A confirmation buy level here, and not a pending buy order is simply because as explained many times over, these round number levels are sometimes subject to deep test/spikes, which consequently stops out countless traders, we do not want to be one of them, hence the need for confirmation here.

- New pending sell orders (Green line) are seen just below a 4hr supply area (104.104-103.981) at 103.954. We have set a pending sell order here because of where this area is located on the higher timeframes moment (weekly supply area at 105.432-104.065, and also a nice-looking daily supply area at 104.104-103.802).

- The P.A confirmation sell level (Red line) set just below a 4hr decision-point level (102.922) at 102.900 has been removed since price rallied too far past the entry level for the time being.

Quick Recap:

Price is seen trading around/within higher-timeframe supply areas at the moment (weekly supply area at 105.432-104.065, daily supply area at 104.104-103.802), so we’re currently watching a beautiful-looking 4hr supply area at 104.104-103.981 (pending sell order set just below at 103.954) just above current price. If we see a push up to this area sometime today, or even tomorrow, we expect a first-time reaction to be seen.

- Areas to watch for buy orders: P.O: No pending buy orders are seen in the current market environment. . P.A.C: 102.027 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 103.954 (SL: 104.135 TP: Dependent on how price approaches). P.A.C: No P.A confirmation sell levels are seen in the current market environment.

EUR/GBP:

4hr TF

The higher-timeframe picture resembles the following:

- Weekly TF: A small spike above the weekly decision-point area has been seen at 0.80328-0.79780, this spike above has likely cleared some of the sellers out indicating the path north to around weekly supply above at 0.81397-0.80805 is relatively free.

- Daily TF: A spike (0.80351) above daily supply at 0.80328-0.80024 has been seen, this spike has likely stopped out a lot of sellers attempting to fade the area. With these sellers consumed, price is very likely free to move up to the next area of interest around the daily S/R flip level at 0.80809. However, before this happens, do be prepared for decline in value back down to daily demand at 0.78862-0.79206 at least, since pro money may not have the required liquidity (sell orders for their buys) for a push further up just yet.

There were clearly some very active sellers around the 4hr supply area at 0.80264-0.80133, which has slammed price back down deep into a 4hr S/D flip area at 0.79792-0.79689.

With the daily timeframe suggesting prices may decline further before a rally higher is seen, we have to be prepared for a break below the aforementioned 4hr S/D flip area, which will likely push price down to around the 4hr demand level at 0.79189, where history has proven this to be a valid level to buy off of. However, the same still stands as the last analysis, only with a different high, if we see a rally higher from here, and we see a break above the high 0.80266 marked with a red circle, then there’s very little stopping price from hitting the 4hr supply area at 0.80619-0.80409. Here’s why, The wick/high seen at 0.80351 marked with a green arrow likely cleared most of the remaining sellers around the supply area marked with a black circle at 0.80309, meaning there is very little to stop price hitting the aforementioned 4hr supply area, where we currently have a pending sell order ready and waiting at 0.80387.

Pending/P.A confirmation levels:

- No pending buy orders (Green line) are seen in the current market environment.

- New P.A confirmation buy levels (Red line) are seen just above a 4hr demand level (0.79189) at 0.79215. The reason for setting a P.A confirmation buy level, and not a pending buy order is simply because this level has seen a touch already indicating some of the buyers may have been consumed, thus weakening this area, hence the need for confirmation on this one.

- Pending sell orders (Green line) are seen just below 4hr supply (0.80619-0.80409) at 0.80387. The reasoning for placing a pending sell order here is simply because the momentum from the supply base was very good, and this area remains fresh.

- No P.A confirmation sell levels (Red line) are seen in the current market environment.

Quick Recap:

Price is currently seen trading within a 4hr S/D flip area at 0.79792-0.79689, a break below here could force prices all the way down to a 4hr demand level at 0.79189, where we have a P.A confirmation buy level set just above at 0.79215. Nonetheless, the buyers decide to push higher from here, we will be looking for a break above the high marked with a red circle at 0.80266, as this will be likely all the buyers need for a full push up to 4hr supply above at 0.80619-0.80409, where we have a pending sell order ready and waiting just below at 0.80387.

- Areas to watch for buy orders: P.O: No pending buy orders are seen in the current market environment.P.A.C: 0.79215 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 0.80387 (SL: 0.80648 TP: Dependent on how price approaches) P.A.C: No P.A confirmation sell levels are seen in the current market environment.

USD/CAD:

The higher-timeframe picture resembles the following:

- Weekly TF: Upon price closing above the weekly supply area at 1.09592-1.08133, the path north is relatively free to hit the small weekly supply area above at 1.10522-1.09996, however before this happens a decline in value may well be seen all the way back down to weekly demand at 1.05715-1.07008, since pro money may need more liquidity (sells for their buys) for a further push up.

- Daily TF: A mini tug of war was being seen around daily supply at 1.09592-1.09156 which very likely cleared the sellers out, leaving the path relatively clear up to the daily supply above at 1.10522-1.10133 (located within the weekly supply area at 1.10522-1.09996). Pro money may not have the liquidity to push prices further yet, so a decline may be seen down to the following levels: daily S/R flip level at 1.08277, a daily minor R/S flip level at 1.07932, or even the daily demand area at 1.05874-1.06680 which is conveniently located within weekly demand at 1.05715-1.07008. However, price has yet to reach any of the aforementioned levels, and we are seeing some very serious buying activity at the moment!

Strong buying pressure has recently been seen on this pair, if you remember in the last analysis, we reported that if price were to break above the high marked with a green flag at 1.09179, the path north would very likely be clear up to at least the 4hr supply area at 1.09830-1.09652. However we were hoping before price reached this high, a drop back down to the 4hr demand area at 1.08441-1.08650 would be seen where we would have considered entering long.

Price is very near to touching the aforementioned 4hr supply area, where we have a P.A confirmation sell level set just below at 1.09624. The reason we have not set a pending sell order here is simply because of the above price action. Take a look at what price could fakeout (spike above) to! A 4hr decision-point level at 1.09865, the round number 1.1, and finally where we believe price may see the biggest reaction at is a 4hr supply area at 1.10388-1.10163. So, we will be watching all of the aforementioned areas/levels very carefully for the time being.

Pending/P.A confirmation levels:

- No pending buy orders (Green line) are seen in the current market environment.

- No P.A confirmation buy levels (Red line) are seen in the current market environment.

- New pending sell orders (Green line) are seen just below a 4hr supply area (1.10388-1.10163) at 1.10127. This area remains fresh, and likely contains unfilled sell orders indicating a bounce south at the very least will be seen if/when price reaches this area.

- New P.A confirmation sell levels (Red line) are seen just below a 4hr supply area (1.09830-1.09652) at 1.09624. The main reason we have set a P.A confirmation sell level here is because we are concerned that this area could see a deep spike above towards either the round number 1.1, or even the 4hr supply area at 1.10388-1.10163.

Quick Recap:

Price is very near to triggering our P.A confirmation sell level (1.09624) just below 4hr supply at 1.09830-1.09652. If a push above this area is seen, watch the following areas for a bearish reaction: the mighty round number at 1.1, and the 4hr supply area above at 1.10388-1.10163.

- Areas to watch for buy orders: P.O: No pending buy orders are seen in the current market environment. P.A.C:No P.A confirmation buy levels seen within the current market environment.

- Areas to watch for sell orders: P.O: 1.10127 (SL: 1.10440 TP: Dependent on how price approaches) P.A.C: 1.09624 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

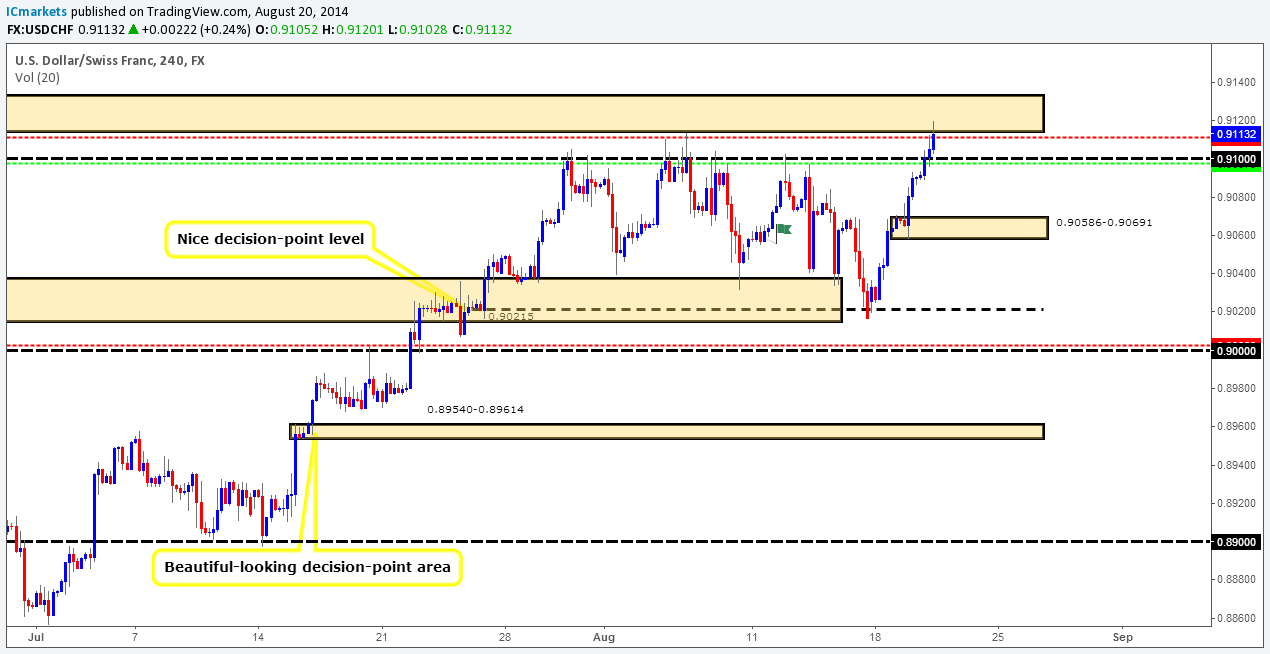

USD/CHF:

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly TF: Price is still seen dancing around the weekly decision-point level at 0.90927 and has been for three weeks now. A push south could see a touch of weekly demand at 0.85664-0.88124, likewise a push above could see price testing weekly supply at 0.94546-0.93081.

- Daily TF: Price is still trading within a daily range. Daily supply is seen above at 0.91556-0.90985 and a daily S/D flip area below at 0.90372-0.90042. At the time of writing, price is seen pushing deeper within the aforementioned daily supply area.

Our active buy order set at 0.90233 has now been closed in full profit as price has just hit its second and final target at the round number 0.91 for a 6R plus win.

The buyers have rocketed prices up to, and past the round number 0.91 consequently filling our pending sell order set just below at 0.90975, we have a big stop loss on this one, so no need to panic just yet! Price is now seen trading just below a 4hr supply area at 0.91329-0.91141 and this has also triggered our P.A confirmation sell level at 0.91112.

It would be wise to remember where we are on the higher timeframes at the moment (trading within daily supply at 0.91556-0.90985, and around a weekly decision-point level at 0.90927, so naturally we are still expecting lower prices from here down to at least the 4hr demand area at 0.90586-0.90691.

Pending/P.A confirmation levels:

- The pending buy order (Green line) set just above the decision-point level (0.90215) at 0.90233has been closed in full profit since price hit the final take-profit target at the round number 0.91.

- P.A confirmation buy levels (Red line) are seen just above the round number 0.9 at 0.90026. The reasoning behind not placing a pending buy order right away is simply because this level could see a deep test, or even worse, be completely ignored!

- The P.A confirmation sell level (Red line) set just below 4hr supply (0.91329-0.91141) at 0.91112is now active. For this area to be confirmed, the sellers must consume some or most of the buyers around the 4hr demand area below at 0.90586-0.90691.

- The pending sell order (Green line) set just below the round number 0.91 at 0.90975 is now active, so do keep an eye on our first take-profit level set at 0.90725.

Quick Recap:

Price is currently trading around a 4hr supply area at 0.91329-0.91141 (P.A confirmation sell level triggered at 0.91112), where we very much expect to see lower prices from here down to at least the 4hr demand area at 0.90586-0.90691, since we are trading within daily supply at 0.91556-0.90985, and also around a weekly decision-point level at 0.90927at the moment.

- Areas to watch for buy orders: P.O: 0.90233 (Closed in full profit) (SL: 0.90117 TP: [1] 0.90621[2] 0.91). P.A.C: 0.90026 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 0.90975 (Active) (SL: 0.91355 TP: [1] 0.90725 [2] 0.90215 [May be subject to change]) P.A.C: 0.91112 (Active-awaiting confirmation) (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

XAU/USD (Gold):

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly TF: Price still remains trading between the weekly supply area above at 1391.97-1328.04 and a nice-looking weekly decision-point level below at 1244.04; however, current trading action is taking place nearer the weekly supply area for the time being.

- Daily TF: Price is capped between the daily R/S flip level at 1292.52 (where price is currently trading around at the moment), and a daily decision-point level at 1318.96. If a break above is seen, watch for price to likely test daily supply at 1344.91-1333.55, conversely, a break below could see a drop in price down to a major daily S/R flip level at 1277.36.

Unfortunately, a return to the 4hr S/R flip level at 1304.77 was not seen, so our pending sell order set just below at 1304.21 was not filled, and to add to the pain, price has dropped down, coming a few pips from hitting our first (planned) take-profit target around the 4hr decision-point level at 1290.72, we have been left no choice but to remove the aforementioned pending sell order.

Considering we are now trading around a daily R/S flip level support at 1292.52 at the moment, and with the weekly timeframe not showing any signs of price hitting the immediate weekly supply area just above at 1391.97-1328.04, we are expecting higher prices soon. A P.A confirmation buy level has been set just above the aforementioned 4hr decision-point level at 1291.36 which has nearly been triggered. Price could very well break below this area to the more sturdy 4hr S/D flip area at 1284.77-1280.53 (a pending buy order is set just above at 1285.71) before higher prices are seen

Pending/P.A confirmation levels:

- Pending buy orders (Green line) are seen just above 4hr demand (1258.40-1264.53) at 1266.09. The reason a pending buy order has been set here, is because this area in our opinion remains the overall origin of a big rally to the upside, likely meaning there are a lot of unfilled buy orders siting in and around this area.

- Pending buy orders (Green line) are seen just above the 4hr S/D flip area (1284.77-1280.53) at 1285.71. We have set a pending buy order here since the buyers have proved this to be an area of interest (they traded above the high marked with a green flag at 1297.20 – which was at the time a requirement for a pending buy order to be set), so for the time being we are now awaiting a return back to this area where our pending buy order will likely be filled in the process.

- New P.A confirmation buy levels (Red line) are seen just above a 4hr decision-point level (1290.72) at 1291.36. The reason we have not set a pending buy order here is simply because price could ignore this level and push south down to the more attractive 4hr S/D flip area at 1284.77-1280.53.

- The pending sell order (Green line) set just below the 4hr S/R flip level (1304.77) at 1304.21 has been removed, since current price has nearly hit the first proposed target at 1290.72, thus invalidating our original pending sell order (level above).

- P.A confirmation sell levels (Red line) are seen just below the 4hr R/S flip level (1323.04) at 1321.55. We have set a P.A confirmation sell level here simply because price could easily break above this level, and head for the 4hr supply area at 1342.30-1335.74, hence the need to wait for confirmation.

Quick Recap:

All eyes are on the 4hr decision-point level at 1290.72 for the time being (a P.A confirmation buy level is set just above at 1291.36) for a bullish reaction, if we see break below, expect price to likely drop down to the 4hr S/D flip area at 1284.77-1280. 53 before higher prices are likely seen, as we are now trading around a daily R/S flip level support at 1292.52.

- Areas to watch for buy orders: P.O: 1266.09 (SL: 1256.40 TP: Dependent on price approach) 1285.71 (SL: 1278.53 (TP: Dependent on price approach). P.A.C: 1291.36 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: No pending sell orders are seen in the current market environment. P.A.C: 1321.55 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).