Thursday 24th July: Daily Technical Outlook and Review.

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming an opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

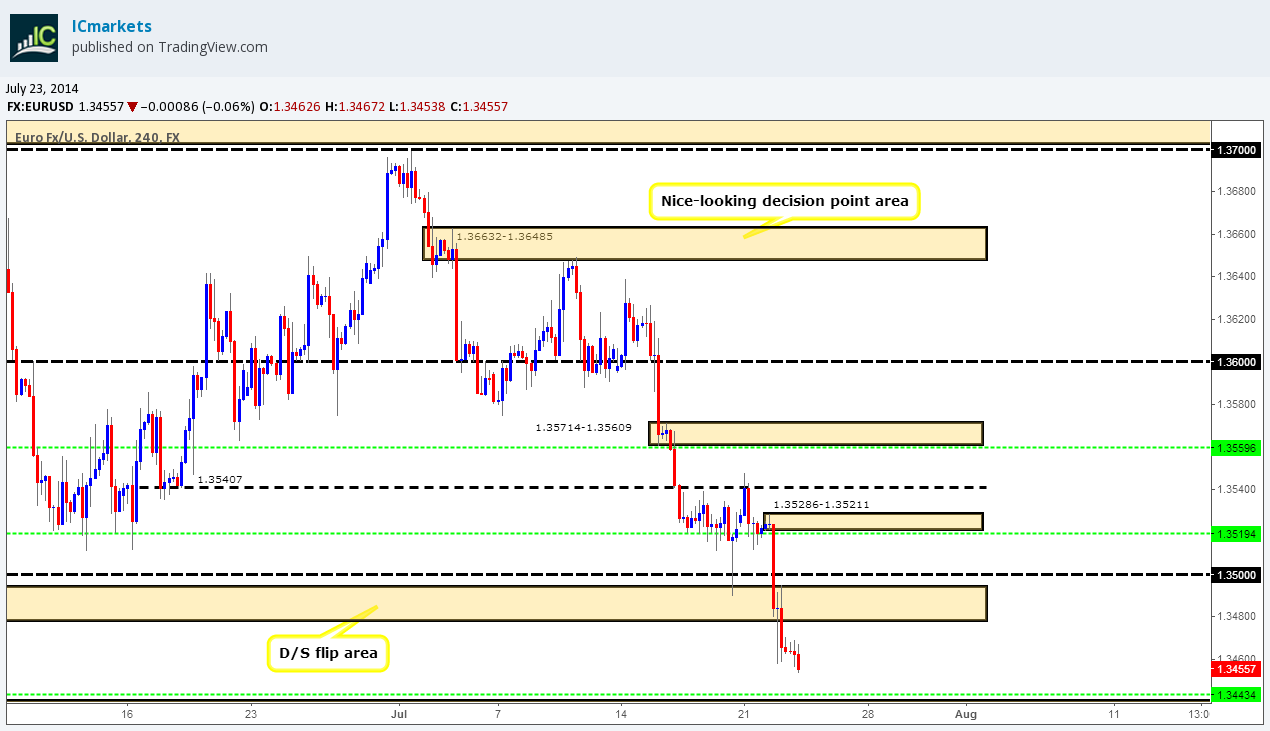

EUR/USD:

4hr TF.

The higher-timeframe picture resembles the following:

- The sellers at this point in time seem to have broken the weekly demand area at 1.34760-1.36314, as a result price has dropped into the next weekly demand area directly below at 1.32940-1.34847 (Stacked demand).

- The daily timeframe shows that the sellers have pushed below the daily demand area at 1.34760-1.35265. Price will very likely now test the daily demand area below at 1.33984-1.34397.

Selling, selling and more selling! Pro money sellers have broken the 4hr demand at 1.34760-1.34943, price is now very likely going to test the 4hr demand below at 1.33984-1.34404 as there is very little to the left that will likely stop price from doing so.

This selling momentum could very well continue on to the next aforementioned 4hr demand area without a retracement seen, nonetheless price could very well reverse up to either the 4hr decision-point area at 1.35286-1.35211 (an important area as this is where pro money sellers made the overall decision to break the 4hr demand area at 1.34760-1.34943) or a 4hr decision-point area further up at 1.35714-1.35609, so do be prepared for that. The reasoning behind our thinking is that pro money may need liquidity to drop price further so a rally higher will give them the opportunity to manipulate price action to gain the much-needed liquidity (in this case buy orders for pro money sell orders).

Pending/P.A confirmation orders:

- The pending buy order (Green line) set just above demand (1.34760-1.34943) at 1.34966 has been stopped out.

- New pending buy orders (Green line) are seen just above demand (1.33984-1.34404) at 1.34434. Once/if price reaches the aforementioned demand area; a bullish reaction is very much expected as we will be trading at the base of daily demand (1.33984-1.34397) as well.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- The pending sell order (Green line) set just below the decision-point supply area (1.36632-1.36485) at 1.36416 has been cancelled, for the time being price is too far from the entry level.

- Pending sell orders (Green line) are seen just below the 4hr decision-point area (1.35714-1.35609) at 1.35596. The reason a pending sell order was allocated here is because this is where pro money (on this timeframe) possibly made the decision to sell price into (what was) the 4hr demand (1.35018-1.35375) area at the time.

- New pending sell orders (Green line) are seen just below a decision-point area (1.35286-1.35211) at 1.35194. We have decided to place a pending sell order here because price could very well rally to this area before dropping further south.

- The P.A confirmation sell order (Red line) set just below supply (1.37224-1.37028) at 1.36894has been cancelled, for the time being price has dropped too far away from the entry level.

Quick Recap:

With a break of weekly demand at 1.34760-1.36314 and also daily-timeframe demand at 1.34760-1.35265 being seen, sellers are certainly in control for the time being. 4hr demand at 1.34760-1.34943 has also been broken south which also gave us a clean loss with our pending buy order set just above at 1.34966. This break south likely opened up the possibility of price trading to 4hr demand below at 1.33984-1.34404. However traders should remain aware that price may not drop straight to the aforementioned 4hr demand area, price could very well rally to either the 4hr decision-point areas above at 1.35286-1.35211 or just above at 1.35714-1.35609.

- Areas to watch for buy orders: P.O: 1.34434 (SL: 1.33942 TP: Dependent on price approach)P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 1.35194 (SL: 1.35319 TP: Dependent on price action approach) 1.35596 (SL: 1.35768 TP: Dependent on price approach). P.A.C: No P.A confirmation sell orders are seen in the current market environment.

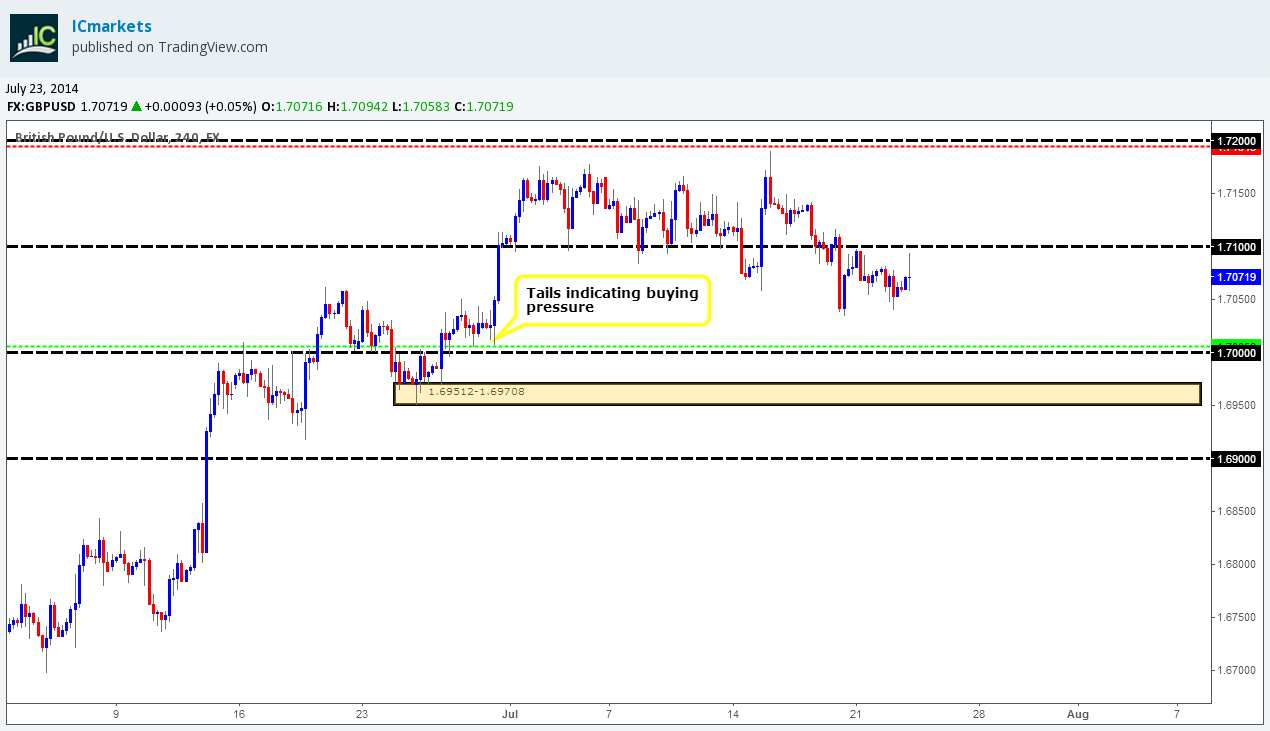

GBP/USD:

4hr TF.

The higher-timeframe picture resembles the following:

- Sellers are starting to finally show interest within weekly supply at 1.76297-1.67702, could a move down to the weekly demand area at 1.66917-1.67939 be in order?

- Most of the current trading action on the daily timeframe is taking place just above a minor daily S/R flip level at 1.70597. A strong push from here could see price testing daily supply at 1.76297-1.73024, conversely a drop below this level would likely see a test of the daily S/R flip level at 1.69712.

This pair for the time being is rather frustrating to trade, the 4hr timeframe at present shows very little movement worth noting, other than a push up to the round number 1.71000 recently being seen, could this be a push up to collect liquidity for a possible drop in price? Only time will tell on this one!

Here is a snippet from the analysis conducted a few days ago, although old, it still holds true:

Could a drop down to the big round number level 1.70000 be seen soon? It is very possible as we know, and it is highly likely pro money know, there are millions upon millions of orders sitting around that level just waiting to be filled, or in a most cases stopped out.

As we can see from above, the daily timeframe is trading around a current daily S/R flip level at 1.70597, a drop below here would no doubt trigger a lot of the traders’ stops who are currently long there, thus giving pro money their stops (sell orders to buy into). Not only this, a deep test below the round number 1.70000 would give pro money a load more sell orders to buy into (From the traders who are attempting to go long there – their stops, once hit would become sell orders). This deep test could be timed perfectly with the daily S/R flip level at 1.69712 sitting just below where there are very likely active pro money buy orders just waiting for this move. It will be definitely exciting to see how price action unfolds!

Again, hopefully we will see a bit more price movement in the next 24hrs!

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen just above the round number 1.70000 at 1.70058. A pending buy order has been placed here since a nice reaction will more than likely be seen at a big-figure level such as this. Our stop will be wide enough to cope with any deep tests, so we should see some profit from this trade if/when price reaches this level.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- No pending sell orders (Green line) are seen in the current market environment.

- P.A confirmation sell orders (Red line) are seen just below the round number 1.72000 at 1.71943. We have placed a P.A confirmation sell order here simply because these psychological levels are prone to deep tests/spikes, so sometimes it is better to wait for that all important confirmation.

Quick Recap:

Very much the same as the last analysis:

A drop down to the big-figure level at 1.70000 is highly likely to be seen soon. We have set a pending buy order just above at 1.70058, however our stop is set quite a way below at 1.69446, and this should hopefully keep us out of any trouble if pro money does indeed decide to perform a deep stop hunt here.

- Areas to watch for buy orders: P.O: 1.70058 (SL: 1.69446 TP: Dependent on price approach).P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: No pending sell orders are seen in the current market environment. P.A.C: 1.71943 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

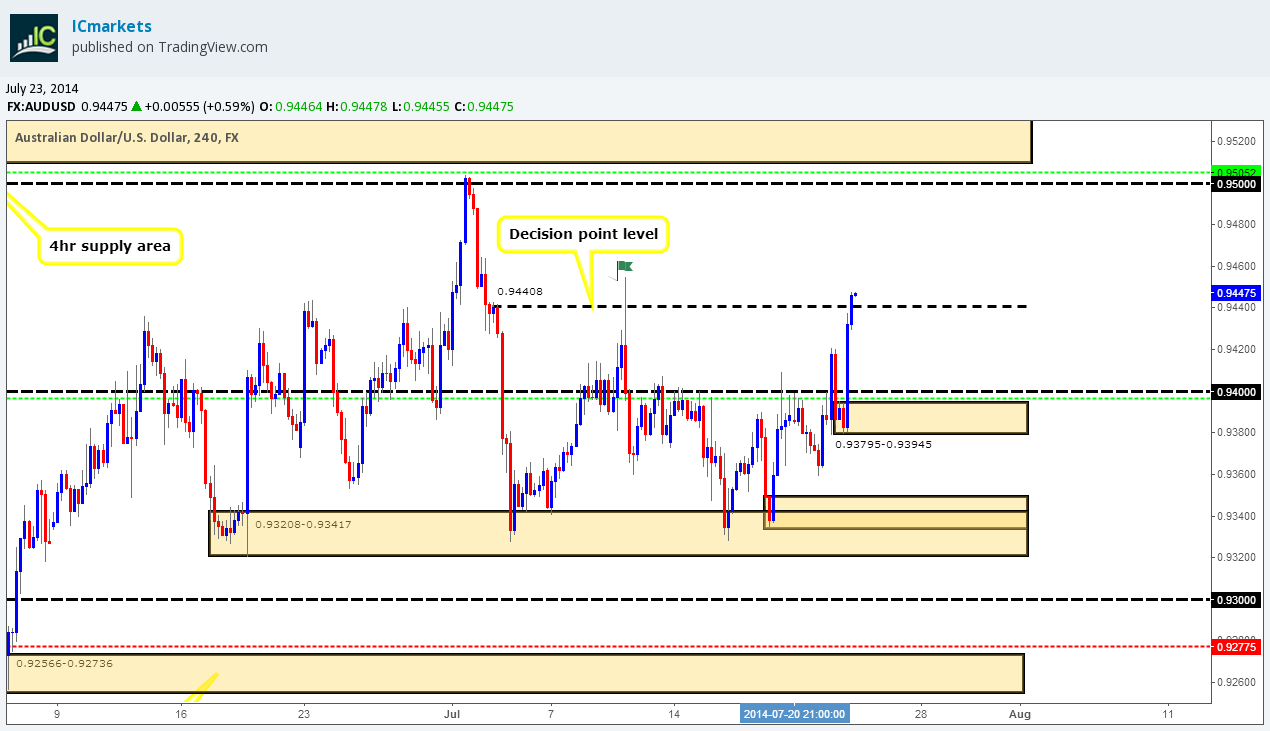

AUD/USD:

4hr TF.

The higher-timeframe picture resembles the following:

- The weekly timeframe is still depicting consolidating price action with the upper limits being seen at 0.94600 and the lower at 0.92046.

- Buyers and sellers have been trading within a small range on the daily timeframe, daily supply being seen above at 0.95425-0.94852 and a low below at 0.93208. Once we see a break of either of these areas, we will likely have more idea on possible short-term direction.

Following on from the last analysis, we thought price may drop down to at least the 0.93348-0.93500 area, but as we can see this just did not happen.

A quick ‘two-candle’ spike was sent north through the round number 0.94000, price then consolidated, and then shot north straight to the 4hr decision-point level at 0.94408 where price is currently seen trading at the moment. If we see the buyers positively close above the high marked with a green flag at 0.94550, we may look to trade the retest up to at least the round number 0.95000 or 4hr supply just above at 0.95425-0.95096. We will be watching price action very closely on this pair for the time being.

Pending/P.A confirmation orders:

- The pending buy order (Green line) set just above demand (0.93208-0.93417) at 0.93512 has been cancelled, for the time being price has rallied too far from the entry level.

- New pending buy orders (Green line) are seen just above a decision point area (0.93795-0.93945) at 0.93967. The reasoning behind setting a pending buy order here is simply because the aforementioned decision point area is where pro money buyers (on this timeframe) likely made the decision to push prices higher to the 4hr decision point level at 0.94408, with the possibility of unfilled buy orders still lurking there.

- P.A confirmation buy orders (Red line) are seen just above the decision point level (0.92566-0.92736) at 0.92775. The reason for placing a P.A confirmation buy order here rather than pending buy order is simply because we were trading just above a daily demand ‘buy zone’ at 0.92046-0.92354, meaning pro money could very well just ignore this level completely and trade deeper into the aforementioned daily demand area, so, confirmation is the order of the day!

- Pending sell orders (Green line) are seen just below supply (0.95425-0.95096) at 0.95052. A pending sell order is placed here due to this being an area where pro money was interested in before; see how close price came to the supply area? (Levels above), this indicates possible strong supply (selling pressure), so the next time price visits we can expect some sort of reaction.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

Unfortunately price did not reverse down to our 4hr decision-point area at 0.93348-0.93500 resulting in our pending buy order set just above at 0.93512 not being filled. Instead, price has seen an explosive bullish move up to the 4hr decision-point level at 0.94408, if price is able to close above the high marked with a green flag, we will definitely be looking to play the retest up to at least the round number above 0.95000.

- Areas to watch for buy orders: P.O: 0.93967 (SL: 0.93773 TP: Dependent on price approach).P.A.C: 0.92775 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 0.95052 (SL: 0.95467 TP: Depending on price approach)P.A.C: No P.A confirmation sell orders seen in the current market environment.

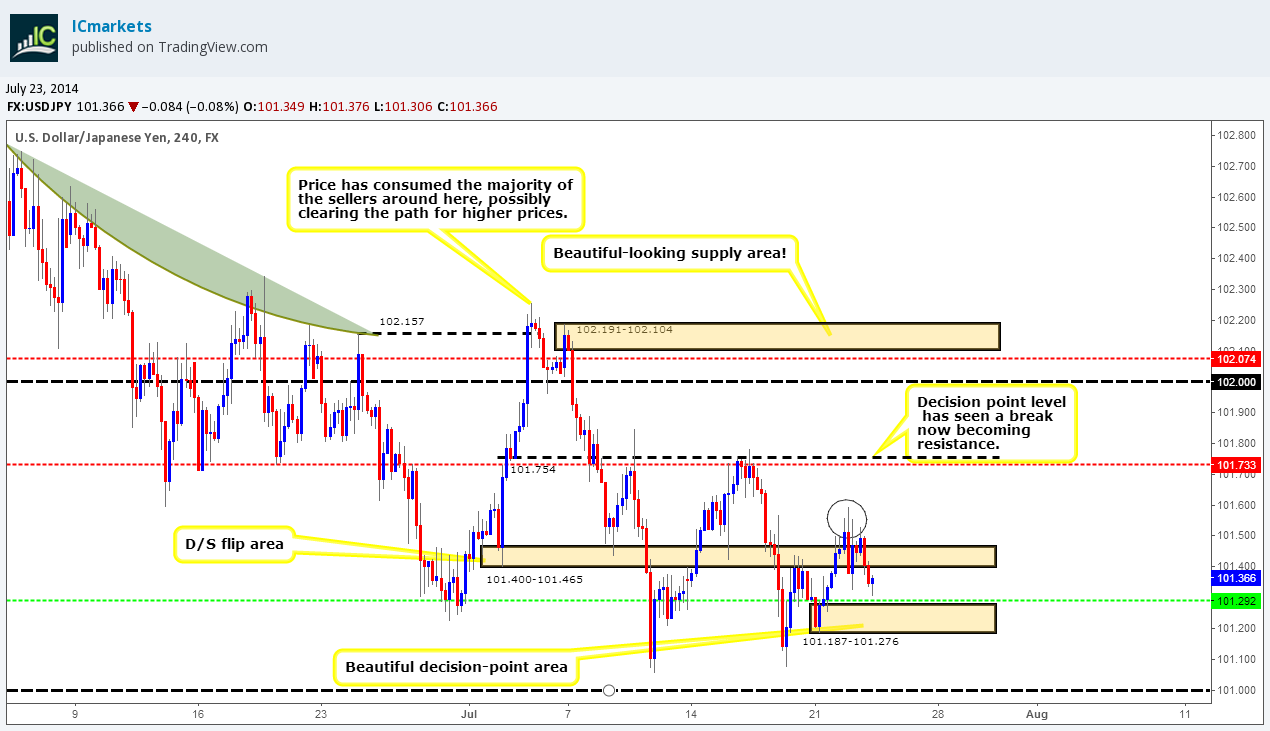

USD/JPY:

4hr TF.

The higher-timeframe picture resembles the following:

- The weekly chart shows buying pressure is being seen from the long-term weekly support at 101.206, a positive close below this level has yet to be seen.

- Buyers and sellers have been seen trading within a medium-term range now for about two months (Resistance: 102.713 Demand: 100.747-100.967) now. If we see a positive close below the aforementioned daily demand area, is this the end for the buyers? Not quite. A break below would likely see price trading down to daily demand at 99.562-100.247 where active buyers are quite possibly lurking. What would this look like on the weekly timeframe if we did indeed see a reaction at this daily demand (99.562-100.247)? Our guess is it would look like a carefully-planned fakeout, which would no doubt give pro money lots of liquidity in the process.

Pro money clearly did not have enough sell orders to buy into around the 101.516 area as price has seen a decline in value. Bullish price action is currently being seen just above a 4hr decision-point area at 101.187-101.276; we hope this is not the start of a rally as price missed our pending buy order at 101.292 by two pips!!!!

From the aforementioned 4hr decision-point area where price is trading at now, we believe price will rally higher up to at least a 4hr decision-point level at 101.754. Our reasoning behind this is because the price action in the circled area (101.516) likely consumed the sellers around the 4hr D/S flip area at 101.400-101.465, thus selling pressure should theoretically be weak around this zone allowing price to feely move up to the 4hr decision-point level at 101.754.

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen just above the decision-point area (101.187-101.276) at 101.292. The reason a pending buy order has been set here is because this remains an important area as this is the likely where pro money buyers made the ‘decision’ to push prices higher above the D/S flip area at 101.400-101.465, making this zone a magnet for a first-time reaction.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- Pending sell orders (Green line) are seen just below supply (103.294-102.983) at 102.953. A pending sell order was set here due to this being an area where likely unfilled sell orders are.

- P.A confirmation sell orders (Red line) are seen just below supply (102-191-102.104) at 102.074. A P.A confirmation sell order was used here purely for the simple fact we are trading around a higher-timeframe weekly support level at 101.206 meaning we may see a small reaction, but nothing to write home about, hence the need for confirmation!

- P.A confirmation sell orders (Red line) are seen just below the decision-point level (101.754) at 101.733. We have not chosen a pending sell order here for the simple reason, price could very well ignore this area, and continue on higher due to the amount of touches this level has seen in the past.

Quick Recap:

A recent decline in value has been seen as reported may happen if pro money had few sell orders available to buy into. Price is currently seen reacting bullishly around the 4hr decision-point area at 101.187-101.276, we hope this is not the start of a rally as our pending buy order set at 101.292 missed its fill by two pips! From here price is relatively clear to trade up to at least the 4hr decision-point level at 101.754.

- Areas to watch for buy orders: P.O: 101.292 (SL: 101.166 TP: Dependent on price approach)P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 102.953 (SL: 103.317 TP: Dependent on price approach)P.A.C: 102.074 (SL: likely will be set at 102.214 TP: Dependent on approaching price action after the level has been confirmed) 101.733 (SL: likely will be set at 101.859 TP: Dependent on approaching price action after the level has been confirmed).

EUR/GBP:

4hr TF.

The higher-timeframe picture resembles the following:

- The weekly chart shows the sellers have nearly reached the weekly demand area at 0.76931-0.78623. Any short orders currently in the market should now be carefully monitored.

- A break south has been seen below daily demand at 0.78862-0.79206, price should be relatively free now to hit the next daily demand area below at 0.78117-0.78533.

Following on from the last analysis, the round number 0.79000 proved to be weak, along with the 4hr demand area at 0.78862-0.79048 as price has closed below the both of these areas. We are trading ever so close to weekly demand now (see above) so any long-term shorts will need to be closely monitored around this area. Saying this though, price could, and we emphasize the word ‘could’ here, still drop down lower within the weekly demand area (see above for the levels) before seeing higher prices.

A small rally north has already been seen from the low 0.78729 to the round number 0.79000 where the sellers at the time of writing are beginning to show a little interest. If we see a close above the aforementioned round number, price will likely test the 4hr decision-point area at 0.79277-0.79170, from here a bearish reaction could well be seen, which could take prices down to as low as the 4hr demand area at 0.78602-0.78320 (seen lower on the chart), where we expect serious buyers to come into the market if price reaches this far.

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- Pending sell orders (Green line) are seen just below a supply area (0.79795-0.79684) at 0.79651. The reason for a pending sell order being set here, rather than a P.A confirmation sell order was because this area looks very hot for a first-time reaction. Notice how price faked above the S/R flip level at 0.79679 then dropped back down, there is very likely unfilled sell orders still lurking around this area, hence the need for a pending sell order.

- Pending sell orders (Green line) are seen just below a decision-point area (0.79277-0.79170) at 0.79143. The reasoning behind a pending sell order being set here is that pro money will likely require liquidity, so a push up to the aforementioned 4hr decision-point area may well be seen before lowers prices are.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

With price trading very near weekly demand at 0.76931-0.78623, higher prices are naturally expected. If a break above the round number 0.79000 is seen, price will likely test the 4hr decision-point area at 0.79277-0.79170 resulting in our pending sell order set at 0.79143 being filled in the process. The above will most probably happen before lower prices are seen.

- Areas to watch for buy orders: P.O: No pending buy orders are seen in the current market environment. P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 0.79651 (SL: 0.79828 TP: Dependent on price approach) 0.79143 (SL: 0.79313 TP: Dependent on price approach). P.A.C: No P.A confirmation sell orders are seen in the current market environment.

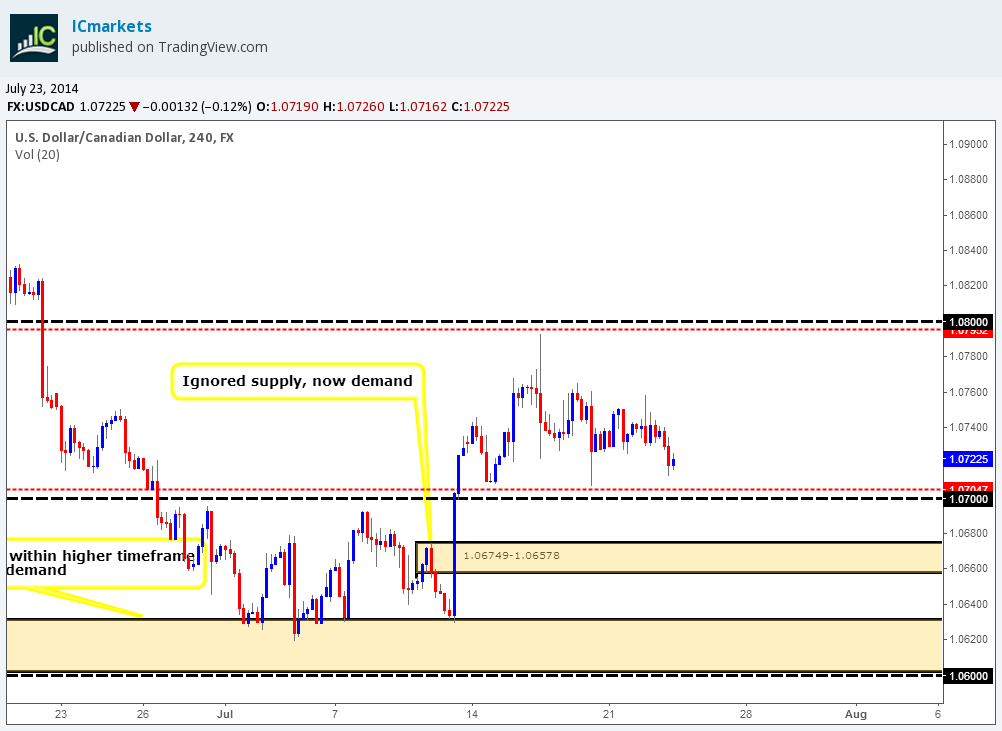

USD/CAD:

4hr TF.

The higher-timeframe picture resembles the following:

- At the time of writing, buyers and sellers are currently seen trading between weekly demand at 1.05715-1.07008, and weekly supply above at 1.09592-1.08133.

- The sellers are very likely all consumed on the daily timeframe around the daily decision-point area at 1.07508-1.07293. Price is now free to rally to at least the daily S/R flip level above at 1.08277, but do not forget pro money may require liquidity and reverse price back down to daily demand at 1.05874-1.06680 before much higher prices are seen.

Technically, not a lot has changed since the last analysis, except the sellers are seen heading for the round number 1.07000 at the moment.

Here is the analysis from yesterday, as it still remains valid:

At the time of writing, price action is seen trading between two round numbers, 1.08000 and 1.07000. Focus just for a moment on what the daily timeframe is telling us. We have broken above an important area (daily decision-point area at 1.07508-1.07293) meaning it is very possible we will hit the next important area, however before this, we may see a decline in price to daily demand below as pro money will no doubt require liquidity for the next move up (for all daily levels, see above). So with this in mind the round number 1.07000 will likely see a break before the round number 1.08000 above does.

Once, or indeed if a break below the aforementioned round number is seen, the most likely area for a bullish reaction is the ignored 4hr supply area, which is now demand at 1.06749-1.06578. However if there is not enough sell orders for pro money to buy into to fulfill their order book requirements around this area, they will no doubt keep selling back down to 4hr demand at 1.06041-1.06312 where they will likely manipulate price to collect more liquidity (sell orders). So, upon the break of the round number 1.07000 keep a watchful eye on the two areas just mentioned.

Hopefully in the next 24hrs we will see some developing price action to discuss regarding this pair.

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- P.A confirmation buy orders (Red line) are seen just above the round number 1.07000 at 1.07047. The reason a P.A confirmation buy order was set here is simply because a pending buy order would be too risky as (on this timeframe) there is no logical area for a stop loss order to be placed.

- No pending sell orders (Green line) are seen in the current market environment.

- P.A confirmation sell orders (Red line) are seen just below the round number 1.08000 at 1.07952. The reason a P.A confirmation sell order was set here is simply because a pending sell order would be too risky as (on this timeframe) there is no logical area for a stop loss order to be placed.

Quick Recap:

With the daily timeframe action suggesting price may see a decline to daily demand at 1.05874-1.06680; it is very likely the round number 1.07000 will be breached on the 4hr timeframe before the round number 1.08000 above does. Once/if a break lower is seen, we can likely expect to see buying pressure around the 4hr swap area at 1.06749-1.06578, if not, a bullish reaction will very likely happen around the 4hr demand area below at 1.06041-1.06312.

- Areas to watch for buy orders: P.O: No pending buy orders seen within the current market environment. P.A.C: 1.07047 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: No pending sell orders seen within the current market environment. P.A.C: 1.07952 SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

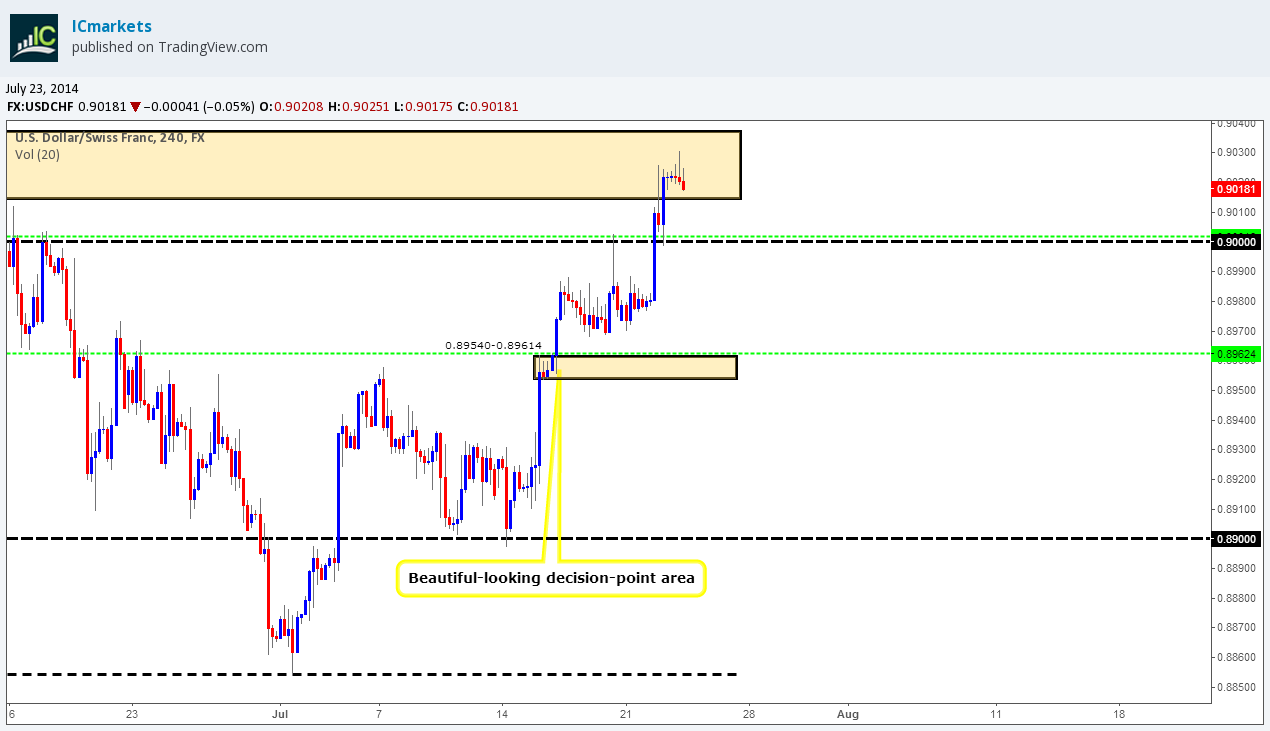

USD/CHF:

4hr TF.

The higher-timeframe picture resembles the following:

- Price is frustratingly consolidating above weekly demand at 0.85664-0.88124, and has been for several weeks now!

- Heavy buying into daily supply at 0.90372-0.90042 is currently being seen, if we see a break above this area, a likely push up to oncoming daily supply above at 0.91556-0.90985 will possibly happen.

Recent price action has seen price hit a 4hr supply area at 0.90372-0.90148 after breaking the round number 0.90000. Sellers then pushed price down to the round number, and from there a retest was seen, the buyers pushed price hard into the aforementioned 4hr supply area where once again selling action is being seen, take a look at all those wicks!

We must remember we are presently trading deep within daily supply at 0.90372-0.90042, so more selling could be seen soon, but judging by the beautiful reaction seen at the round number (level above), this level could be a fantastic area to buy from in the future.

Pending/P.A confirmation orders:

- New pending buy orders (Green line) are seen just above the round number 0.90000 at 0.90018. We would not normally set a pending buy order around a round number level such as this; however the first retest seen of this level gives us confidence to place an order such as this.

- Pending buy orders (Green line) are seen just above the decision-point level (0.89540-0.89614) at 0.89624. A pending buy order was placed here because this area remains an important decision-point area where the buyers ‘decided’ to trade above multiple highs, and the round number 0.90000.

- The P.A confirmation buy order (Red line) set just above the low 0.88546 at 0.88586 has now been cancelled, price rallied too far from the entry level.

- No pending sell orders (Green line) are seen in the current market environment.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

The daily timeframe shows price has traded a little deeper into daily supply at 0.90372-0.90042. The 4hr timeframe shows the round number 0.90000 was indeed a good place to go long from on the retest, as price rallied hard from here deeper into 4hr supply at 0.90372-0.90148. We have placed a pending buy order just above the round number 0.90000 at 0.90018 as price may very well come back for a second test.

- Areas to watch for buy orders: P.O: 0.89624 (SL: 0.89523 TP: Dependent on price approach) 0.90018 (SL: 0.89928 TP: Dependent on price approach). P.A.C: No P.A confirmation buy orders seen in the current market environment.

- Areas to watch for sell orders: P.O: No pending sell orders seen in the current market environment. P.A.C No P.A confirmation sell orders seen in the current market environment

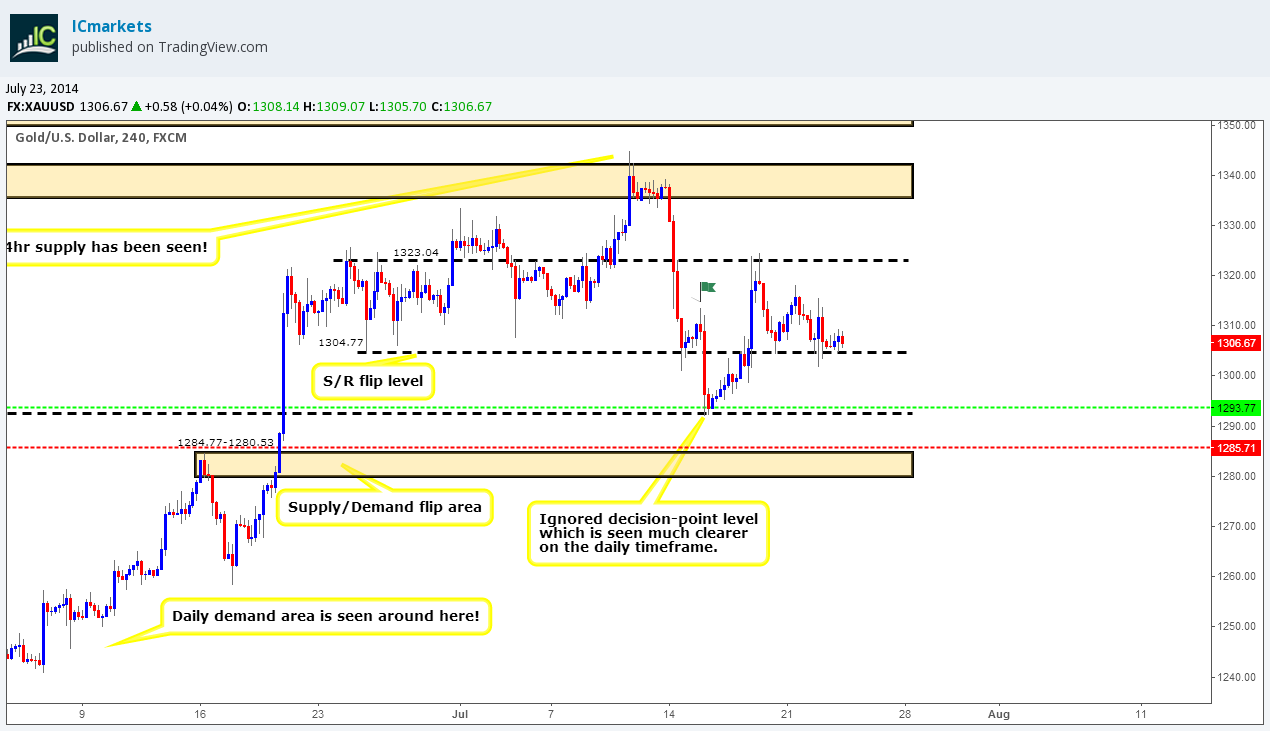

XAU/USD (GOLD)

4hr TF.

The higher-timeframe picture resembles the following:

- The weekly timeframe shows the sellers are beginning to show some interest around a (not-so-great) weekly supply area at 1391.97-1328.04. Price is currently capped between the aforementioned weekly supply area and a nice-looking weekly decision-point level at 1244.08.

- Buyers and sellers on the daily timeframe are seen trading between a beautiful-looking daily supply area at 1344.91-1333.55 and a daily ignored decision-point level at 1292.52.

Price has not changed much since the last analysis; a failed attempt by the sellers to close below the 4hr S/R flip level at 1304.77 was seen, as a result price action remains trading just above the 4hr S/R flip level.

Here is a snippet from the last analysis which still holds true:

If we see a break below the aforementioned 4hr S/R flip level we will very likely see price hitting the ignored decision-point level at 1292.52 (seen clearer on the daily timeframe) where it is very likely we will see a decent-sized bullish reaction, so do note this level down.

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen just above the ignored decision-point level at 1292.52 at 1293.77. A pending buy order is valid here since this level has been proven by the buyers who consumed the sellers around the high marked with a flag at 1313.66, making this area prime for a reaction when/if price reaches here.

- P.A confirmation buy orders (Red line) are seen just above the S/D flip area (1284.77-1280.53) at 1285.71. We have set a P.A confirmation buy order here simply because we could not find a logical area for the stop-loss order, so to avoid any deep spikes; we have decided to wait for confirmation.

- No pending sell orders (Green line) are seen in the current market environment.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

Price is still seen trading around the 4hr S/R flip level at 1304.77, the sellers have been seen making an attempt at trading lower, but failed miserably in their endeavor. A break below here however could very well see price trading down to an ignored decision-point level at 1292.52 (our pending buy order is set just above here at 1293.77) where active buyers are likely waiting.

- Areas to watch for buy orders: P.O: 1293.77 (SL: 1286.75 TP: Dependent on price approach).P.A.C: 1285.71 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: No pending sell orders seen in the current market environment. P.A.C: No P.A confirmation sell orders seen in the current market environment.