Thursday 26th February: European Open Briefing

Global Markets:

- Asian stock markets: Nikkei up 0.80 %, Shanghai Composite gained 1.15 %, Hang Seng rose 0.05 %, ASX declined 0.60 %

- Commodities: Gold at $1209.70 (+0.70 %), Silver at $16.62 (+0.90 %), WTI Oil at $50.62 (-0.70 %), Brent Oil at $61.35 (-0.95 %)

- Rates: US 10 year yield at 1.957, UK 10 year yield at 1.719, German 10 year yield at 0.325

News & Data:

- Australia Private New Capital Expenditure -2.2 %, Expected: -1.9 %, Previous: 0.6 %

- Australia Building Capital Expenditure -2.6 %, Expected: -2.5 %, Previous: -0.9 %

- Australia Machinery Capital Expenditure -1.3 %, Expected: -2.0 %, Previous: 3.7 %

- New Zealand Trade Balance NZ$56mln m/m, Expected: -NZ$183mln, Previous: -NZ$1.15bln

- New Zealand Trade Balance -NZ$ 1.4bln y/y, Expected: -NZ$1.65bln, Previous: -NZ$1.15bln

- New Zealand Imports NZ$3.64bln, Expected: NZ$3.93bln, Previous: NZ$4.58bln

- New Zealand Exports NZ$3.70bln, Expected: NZ$3.71bln, Previous NZ$4.42bln

- S&P Trimmed GDP Growth Forecast For China To 6.9% This Year

- S&P Cut Japan 2015 Growth Forecast To 0.7%

- Hong Kong FinSec Tsang: No Need & No Intention To Change HKD Peg – RTHK

- New Zealand FinMin English: Australia & China Present Risks To NZ Economy – Bloomberg

- New Zealand FinMin English: Domestic Labour Market Exceeding Expectation

- New Zealand FinMin English: NZ Households Benefit From Low Inflation

- Commodities Slump To Deliver AUD 110 Bln Hit To Export Earnings – ANZ

- BOJ’s Kuroda: Cheaper oil to put upward pressure on CPI longer term, need to hit price target soonest to change expectations

- BOJ’s Kuroda: Too early to talk about exit strategy, BOJ still half way to price target

- BOJ’s Kuroda: No set ceiling for BOJ easing, various options possible for the BOJ

- BOJ’s Kuroda: BOJ easing isn’t planned to continue until specific date, easing will continue until price stabiity achieved

- BOJ’s Kuroda: BOJ board sees CPI reaching 2% before end of FY2016

Markets Update:

Asian stock indices are mostly higher this morning and commodities recovered a bit overnight. WTI Oil is back above $50, while Gold and Silver both posted a double bottom at $1190 and $16.10 respectively. Silver may run into decent resistance in the $16.70-80 area, while the next level to keep an eye on in Gold is $1215.

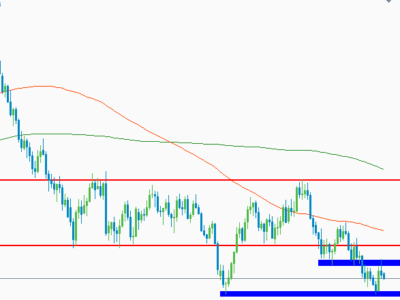

In FX, USD is still offered across the board. NZD received a boost by the better than expected NZ trade balance data and briefly traded above the 0.7570 resistance level. Momentum waned quickly and the pair is currently consolidating near the level. Meanwhile, AUD/USD declined on weaker than expected Private CapEx data, reaching a low of 0.7834 overnight. Short-term techs are still fairly bullish as long as the pair remains above 0.78.

EUR/USD still very quiet, with the intraday ranges getting smaller. 1.1320 seen as intraday support, while decent offers are expected in front of the 1.14 level. GBP/USD had a decent bounce off the former resistance level at 1.5470 yesterday, which signals that further gains are ahead. Next resistance is seen at 1.5620, which is the December 31st high.

Looking at the econ calendar, there is a busy day ahead of us. In the EU session, the focus will be on German employment data and UK GDP. In the US session, we will get US and Canadian inflation numbers. See the calendar below for further details.

Upcoming Events:

- 07:00 GMT – German Consumer Climate (9.5)

- 07:45 GMT – French Consumer Confidence (91.0)

- 08:00 GMT – Spanish GDP (0.7 % q/q, 2.0 % y/y)

- 08:55 GMT – German Unemployment Change (-10k)

- 08:55 GMT – German Unemployment Rate (6.5 %)

- 09:30 GMT – UK GDP (0.5 % q/q, 2.7 % y/y)

- 13:30 GMT – US CPI (-0.6 % m/m, -0.1 % y/y)

- 13:30 GMT – US Core CPI (0.1 % m/m, 1.6 % y/y)

- 13:30 GMT – US Durable Goods Orders (1.9 % m/m)

- 13:30 GMT – US Initial Jobless Claims

- 13:30 GMT – Canadian CPI (1.0 % y/y)

- 13:30 GMT – Canadian Core CPI (2.0 % y/y)

- 14:00 GMT – US House Price Index

- 23:30 GMT – Japan National CPI

- 23:30 GMT – Japan National Core CPI (2.2 % y/y)

- 23:30 GMT – Japan Unemployment Rate (3.4 %)

- 23:50 GMT – Japan Industrial Production (2.7 % m/m)

- 23:50 GMT – Japan Retail Sales (-1.3 % y/y)

The post Thursday 26th February: European Open Briefing appeared first on .