Trading Outlook – USD/CAD

Click here to learn how to use my trade calls!

Originally updated: 07:00

Trading Bias: LONG

Currency pair: USD/CAD

Current Sentiment: Bullish

In today’s trading session we will be focussing on buying opportunities on the USD/CAD.

Fundamentals:

As per my weekly risk events video today I will be focussing on the USD/CAD pair, at 3pm we have Fed Chair Yellen Testifying to the Senate Banking Committee – she is expected to be hawkish, which will support the USD. Recently we’ve had a FOMC minutes that was taken as dovish by the market as several members were concerned about raising rates too early, bearing in mind this minutes was a reflection of the outlook shared amongst members in January, since then we’ve had some exemplary labour market data which is the Feds main focal point when considering a rate hike.

Then at 7pm we have commentary from the Bank of Canada’s Gov Poloz, the BoC have recently cut rates and advised they are prepared to do so again if conditions don’t begin to improve. Since that commentary we’ve had some abysmal Canadian data so we can only expect Gov Poloz to be dovish going into the event. Look to pair these currencies (USD & CAD) pending news flow from the events – looking ahead on the calendar on Thursday the 26th we have further US and Canadian data, although these data points have the potential to support this trade my advice would be to close the positions prior to further market moving news.

(Bear in mind oil prices – if oil prices rally expect the CAD to go with them nullifying this trade given the CAD’s status as a commodity linked currency).

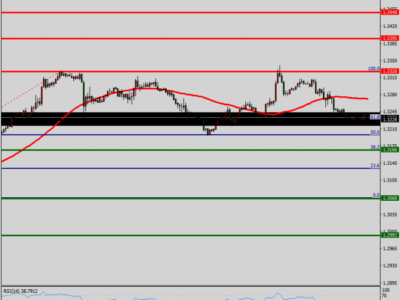

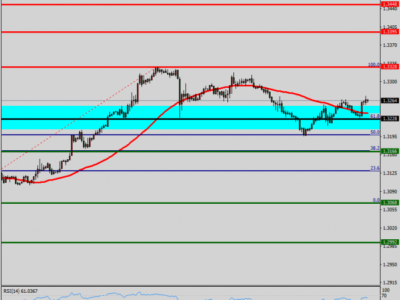

Technicals:

We expect this pair to rally during today’s session.

There is strong support at 1.25570 – 1.25720which could provide trading opportunities should the price pull back. Look for the price to bounce off this level if it retraces back to it.

Remember to be aware of intra-day news as this can very often change the sentiment which makes our trade weaker. Look for any news that could be negativefor this pair, which would change the sentiment to bearish.

Other Market Moving News:

Relatively quiet overnight session with the antipodean currencies being the main laggards prompted by a drop in New Zealand inflation expectations which in turn weighed on the AUD.

Absolutely stacked day on the calendar today with the release of German GDP, Eurozone CPI, as well UK inflation report hearings whilst later in the session we have commentary from RBNZ’s Wheeler, also the Eurogroup is to receive Greek letter of reforms.

To get daily market insights from Jarratt Davis delivered to your inbox simply enter your name and email below:

The post Trading Outlook – USD/CAD appeared first on Jarratt Davis.

Source:: Trading Outlook – USD/CAD