Trading plan for EUR/USD and GBP/USD on 08/01/2019

Monetary authorities really know how to surprise what the Federal Reserve System demonstrated to us yesterday. For quite a long time, the dollar has steadily strengthened, and the market is clearly waiting for at least some reason for correction. The rebound was asking for itself. Investors viewed yesterday’s meeting of the Federal Commission on Open Market Operations as a starting point for weakening the dollar, as everyone understood that the regulator has no choice but to lower the refinancing rate. Taking into account the obviously difficult economic situation, aggravated by the trade conflict with China, the market was waiting for the Federal Reserve System to switch to a softer monetary policy, and yesterday’s reduction in the refinancing rate should have been only the first. We are waiting for one at the end of this year. The market needed only a go-ahead signal in the form of a statement or a hint that in December, the rate would be lowered again. However, Jerome Powell presented an unexpected surprise, saying that the economy as a whole is in good condition, and a careful easing of monetary policy should have a long-term beneficial effect, supporting economic growth at the current level. If you translate it into human language, this means that you should not expect any more reduction in the refinancing rate. And not only in the current year but rather, it is about the fact that at least until the middle of next year, the rate will not be touched. The market is preparing for something completely different, and it needed only a team to start selling portraits of late American presidents and a completely different team has followed. Investors are a little dazed and discouraged so they ran to buy these same portraits. Indeed, the result is extremely unexpected. So the Federal Reserve has again proved that it knows how to surprise. It is truly quite difficult to call it a pleasant surprise especially if you put yourself in the place of American business including the “happy” American industrialists. Donald Trump has already noted the next accusation of the Federal Reserve System of sabotage.

In this whole situation, European statistics looks quite mysterious, despite that it turned out to be better than predicted, the picture is no less bleak. So, in the UK, waiting for a slowdown in real estate ranges from 0.5% to 0.1%, while they slowed to 0.3%. A preliminary estimate of Europe’s GDP for the second quarter was supposed to show a slowdown in economic growth from 1.2% to 1.0%, but in fact, it turned out that it was only up to 1.1%. Only a preliminary estimate of European inflation coincided with forecasts, and it dropped from 1.3% to 1.1%. So it really looks more sad. Moreover, the ADP data on employment in the United States showed its growth by 156 thousand, against 112 thousand in the previous month. However, they predicted an increase of 150 thousand. So, even macroeconomic statistics favors the growth of the dollar.

Today, in the United States, data on applications for unemployment benefits was released. The total number of which should increase by 10 thousand. In particular, the number of initial applications for unemployment benefits may increase by 8 thousand, and repeated by another 2 thousand. Of course, on the threshold, for tomorrow’s publication of a report by the United States Department of Labor, the increase in the number of applications for unemployment benefits does not seem favorable. But yesterday’s employment data indicate that data on applications may be better than expected. But the main event of the day will be a meeting of the Board of the Bank of England, and in the light of the results of yesterday’s meeting of the Federal Commission on Open Market Operations, it begins to play in somewhat different colors. After all, if we proceed from the assumption that the Federal Reserve System is beginning to systematically soften monetary policy, the wait-and-see attitude of the Bank of England and the corresponding preservation of its refinancing rate, which is already unchanged, clearly benefits the pound. But, the alignment has changed a lot and investors should no longer count on a further reduction in the refinancing rate of the Federal Reserve System in the foreseeable future. So, the extremely cautious position of the Bank of England will again play against the pound.

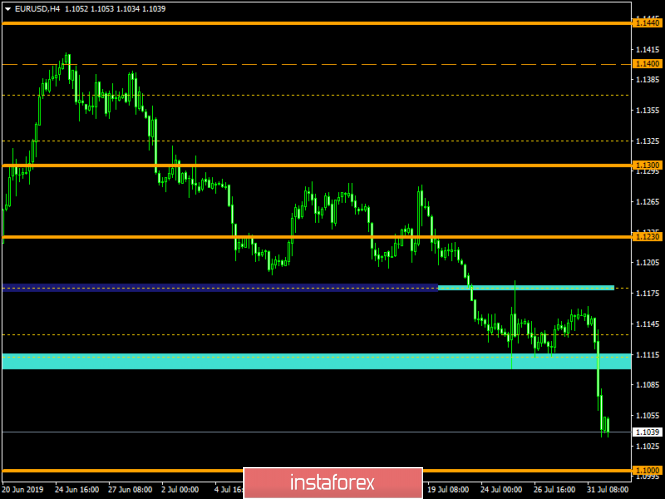

The euro / dollar currency pair has resumed a downward movement, leaving behind the impulse candles. The past information background gave the incentive to sellers, prolonging the ill-fated level of 1,1100. It is likely to assume that even if oversold is felt, the pressure of bearish positions prevails. Thus, we can see a further descent to the value of 1.1000.

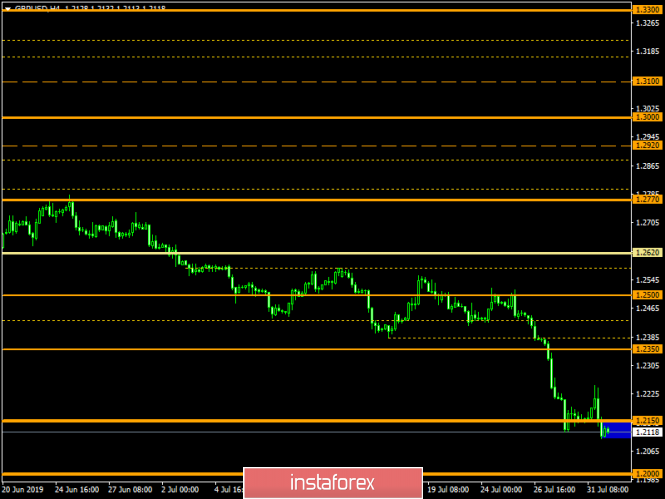

The pound / dollar currency pair, following its counterpart in the market, resumed its downward movement, forming new minima in the market. Probably, it is safe to assume a temporary chat, where in case of fixation lower than 1.2100, we will gradually be dragged towards the level of 1.2000.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Trading plan for EUR / USD and GBP / USD on 08/01/2019