Trading Plan for EUR/USD and GBP/USD pairs on 07/25/2019

The single European currency continued to decline quite expectedly, although it is extremely sluggish. Of course, this is due to weak preliminary data on business activity indices, which showed a decrease in the business activity index in the services sector from 53.6 to 53.3 and in the manufacturing sector from 47.6 to 46.4. By the way, it turned out to be somewhat worse than forecast since the production index should have remained unchanged. As a result, the composite index of business activity fell from 52.2 to 51.5. In theory, the single European currency was supposed to decline somewhat more actively, but the American statistics, which also turned out to be somewhat worse than forecasts, prevented such an exciting process. Although preliminary data on the business activity index in the service sector showed an increase from 51.5 to 52.2 and not to 51.7, the production index did not rise from 50.6 to 51.0 but decreased to 50.0. The consequence of all these was the growth of the composite index of business activity from 51.5 to 51.6, while an increase was expected to 52.1. In many ways, the disappointment over the American statistics explains yesterday’s growth of the pound. Overall, It is also worth noting that American statistics were not so disappointing as sales of new homes increased by 7.0%. Against the background of a weaker than expected growth of the composite index of business activity, as well as a reduction in the production index to a border value of 50.0 points, below such values indicate a crisis in this sector of the economy. Thus, investors looked cautiously at the dollar.

Today, the United States will be pleased with the data on orders for durable goods, which may increase by 0.7% and this is after a decline of 1.3% in the previous month.

However, this news is elementary. No one will notice since at the same time, the press conference of Mario Draghi will begin, which will be dedicated to the results of the next meeting of the Board of the European Central Bank. The piquancy of the situation lies in the fact that for several days in a row rumors have been actively circulating that the European regulator may cut the deposit rate. Naturally, such rumors cause some concern to market participants, which, of course, adversely affects the rate of the single European currency. However, the irony is that the European Central Bank will almost certainly leave the parameters of monetary policy unchanged, which will lead to a decrease in tension and will also be perceived as positive news. As a result, the single European currency immediately begins to grow. Of course, only if the office of Mario Draghi leaves everything as it is.

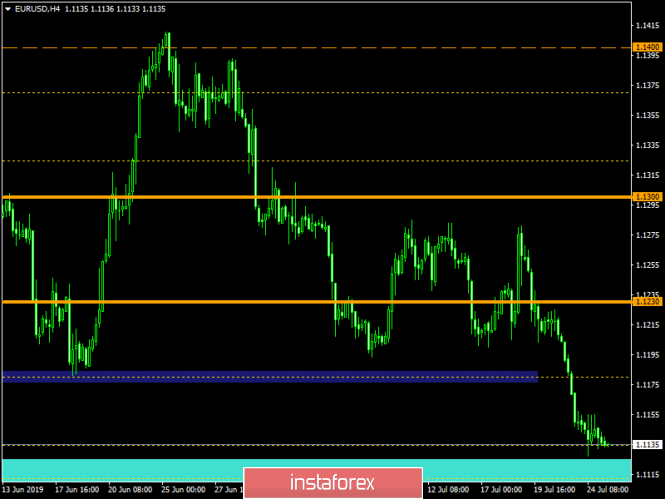

After a rapid downward rally, the Euro/Dollar currency pair has come closer to the key range of 1.1100, where it felt the support and slowed down as a fact. We can assume a temporary fluctuation within the current values, after which we analyze the information background of the ECB that will set the right direction and we cannot miss the possible jumps.

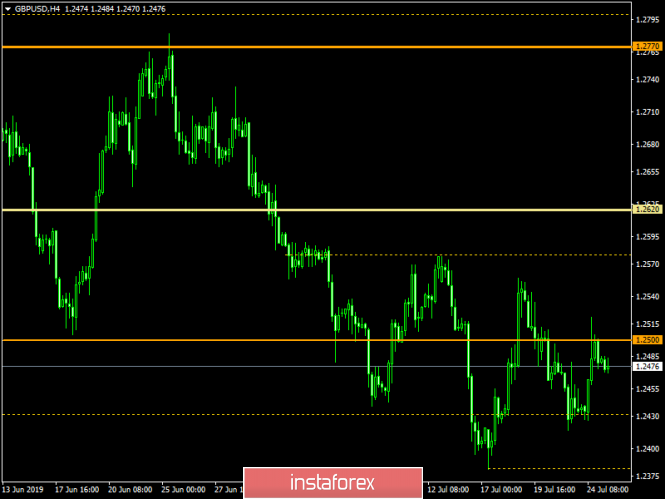

The Pound/Dollar currency pair has once again found a foothold in the previously broken level of 1.2430, where it slowed down against the general informational background and bounced off to the area of the periodic value of 1.2500. It is likely that there will be a temporary fluctuation in the range of 1.2465/1.2500, where analysis of fixation points is made for placing further trade order.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Trading Plan for EUR / USD and GBP / USD pairs on 07/25/2019