Trading recommendations for the currency pair GBP/USD – placement of trading orders July 8, 2019

By the end of the last trading week, the currency pair Pound / Dollar showed a high volatility of 106 points, as a result of drawing impulsed candlesticks and reaching an important price level. From the point of view of technical analysis, we see that a two-day stagnation (July 3-4) led to a regrouping of trading forces, drawing an impulse to the level of 1.2500, which kept the quote for a long time. Considering the graph in general terms, we see that the main downward movement remains in the market, but the last clock frequency showed us a V-shaped oscillation of 1.2500-1.2770. Thereby, traders keep these values in their head.

The information and news background had statistics on the American labor market, where they published data on Non-farm in June, and the report certainly surprised investors after the failed data for May. According to the new data, the change in the number of people employed in the non-agricultural sector in June has increased from 72K to 224K. Positive statistics played into the hands of the dollar, and we saw growth on all fronts. We return to the information background, according to tradition, a few words about the long-playing Brexit. The main candidate for the post of British Prime Minister Boris Johnson said that the country would leave the EU on October 31, regardless of whether an agreement is reached or not. Johnson stressed that he is not bluffing, and a way out without an agreement is possible, and this is not as scary as it seems. What to say – we will continue to observe.

Today, in terms of the economic calendar, we do not have any statistics on the United States and Britain.

Further development

Analyzing the current trading schedule, we see that after the Friday rally there is a characteristic rollback, which is normal after such fluctuations and reaching the key level. It is likely to assume that we will see a temporary bumpiness of 1.2500 / 1.2550, where traders carefully analyze the further behavior of the quote.

Based on the available information, it is possible to decompose a number of variations, let’s consider them:

– Positions for the purchase will be considered in the case of price fixing higher than 1.2550.

– Positions for sale are considered in the case of price fixing lower than 1.2500.

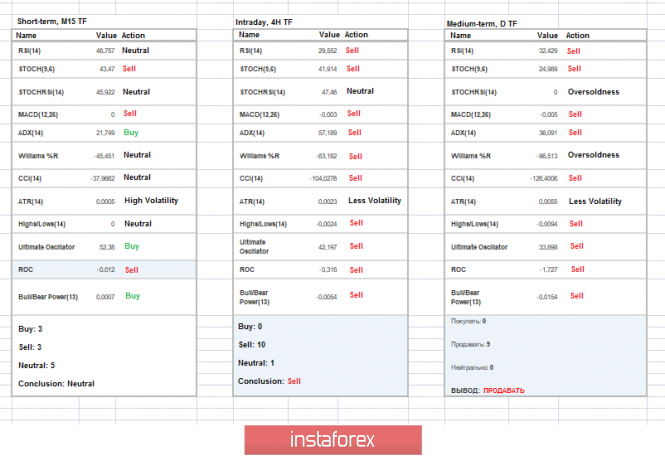

Indicator Analysis

Analyzing a different sector of timeframes (TF), we see that indicators in the short term have taken a neutral position due to stagnation. Meanwhile, intraday and mid-term perspectives maintain a downward interest against the background of a general decline.

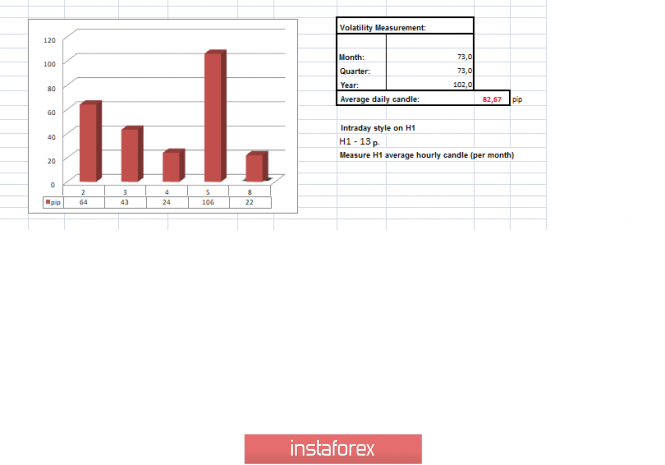

Weekly volatility / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, based on monthly / quarterly / year.

(July 8 was based on the time of publication of the article)

The current time volatility is 22 points. It is likely to assume that in the case of a two-digit bump, volatility will be concentrated within the daily average.

Key levels

Zones of resistance: 1.2620; ; 1.2770 **; 1.2880 (1.2865-1.2880) *; 1.2920 * 1.3000 **; 1.3180 *; 1,3300

Support areas: 1.2500; 1.2350 **.

* Periodic level

** Range Level

*** The article is based on the principle of conducting a transaction, with daily adjustment

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Trading recommendations for the currency pair GBPUSD – placement of trading orders (July 8)