Trading recommendations for the currency pair GBP/USD – placement of trading orders July 9, 2019

Over the past trading day, the currency pair pound / dollar showed an extremely low volatility of 39 points, forming a temporary stagnation in the area of an important price level. From the point of view of technical analysis, we see that, having come close to the historical level of 1.2500, the quotation felt under a periodic support, slowing down the movement, but still maintaining a bearish interest. The fact that, with such a strong support and Friday rally, the quotation did not manage to go to the correction stage, tells us that the fervor of the bears still exists and the level of 1.2500, which held us for a long time, can still fall under the pressure of short positions. Considering the trading chart in general terms, we see that the main downward trend is now fixated on the pivot point 1,2500, from which we saw a V-shaped oscillation. Thus, traders carefully monitor the behavior of quotes, as there are prerequisites for a breakdown and further decline.

The information and news background had practically no significant statistical data. The only thing that could be identified was consumer lending in the United States, where there is a reduction from 17.46 B to 17.09 B, but this news is somehow not really affected the market. Most likely, the market is in anticipation of something bigger, and this is more waiting for us from the middle of the week. The information background is no different from the previous days, the pre-election race of Britain, in principle, already has a winner in the person of Boris Johnson, he, in turn, is trying to prove to everyone that the country’s withdrawal from the EU is already a fact and all this will happen on October 31, be this even a way out without a deal. Naturally, there are no specifics, thus we are waiting for the official appointment of Johnson with the next steps.

Today, in terms of the economic calendar, we have the speech of Fed Chairman Jerome Powell regarding the stress tests of the banking system, but we should not expect anything drastic from this event, since the refinancing rate will be discussed on other days. According to statistics, we are waiting for data on open vacancies in the United States, as well as waiting for growth from 7.449 to 7.470 today.

Further development

Analyzing the current trading chart, we see that the quotation is actively trying to continue to decline, but the level of 1.2500 and the accumulation of stop orders still keep the bears, but for how long? It is likely to assume that in the case of strengthening of short positions and price fixing lower than 1.2475, we will be dragged towards 1.2450-1.2430, where traders will analyze the behavior of sellers and fixation points when laying further trading volumes. Wait for a correction? Theoretically, traders consider it, but perhaps a little lower. Now, there is an excessive amount of short positions.

Based on the available information, it is possible to decompose a number of variations, let’s consider them:

– Positions to buy will be considered in case of a slowdown in the area of 1.2450-1.2430.

– Positions for sale are saved as a deal.

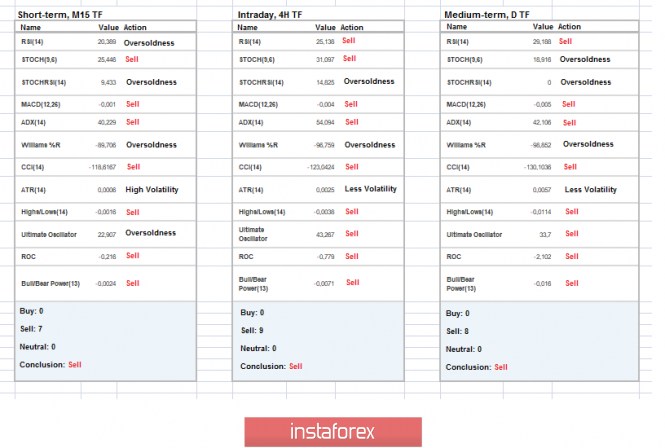

Indicator Analysis

Analyzing a different sector of timeframes (TF), we see that the indicators in the short term, after a slight slowdown in the form of the neutral phase, have switched to the descent mode. Meanwhile, intraday and mid-term perspectives maintain a downward interest against the background of a general decline.

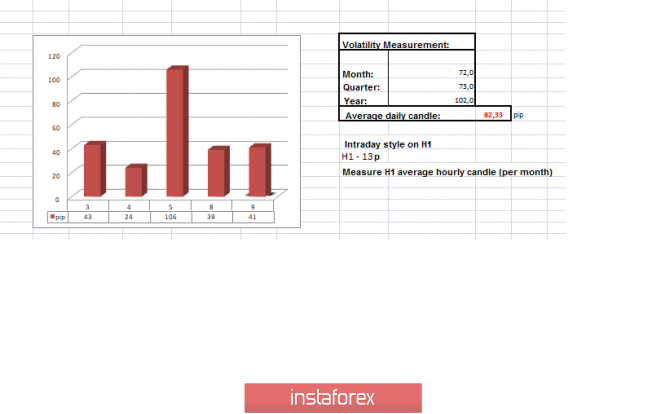

Weekly volatility / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, based on monthly / quarterly / year.

(July 9 was based on the time of publication of the article)

The current time volatility is 41 points. Probably guess. that in the case of the inertial course, volatility can still grow, but so far within the framework of the average daily indicator.

Key levels

Zones of resistance: 1.2500; 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) *; 1.2920 *; 1.3000 **; 1.3180 *; 1,3300

Support areas: 1.2430 *; 1.2350 **; 1.2100 **; 1.2000.

* Periodic level

** Range Level

*** The article is based on the principle of conducting a transaction, with daily adjustment

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Trading recommendations for the currency pair GBPUSD – placement of trading orders (July 9)