Trading USDCAD After the FOMC Meeting | Trade Example

Trading USDCAD After the FOMC Meeting

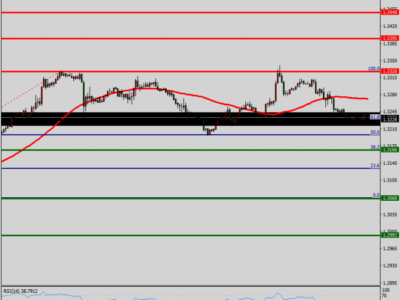

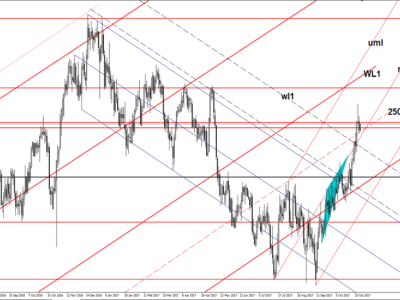

Welcome to a trade example. In this video we’ll be looking at a short position that was taken on USDCAD after the FOMC meeting on the 16th of March 2016. To understand the rationale behind this trade we need to look at what oil was doing at the time, so we’re going to firstly view West Texas Intermediate. This is on the hourly chart and the red vertical line is precisely the hour when we went short on USDCAD. As you can see in the video we are in an uptrend here, WTI rallied five dollars during this period and there was a strong fundamental reason behind this. So we went to our news feed to find out what happened.

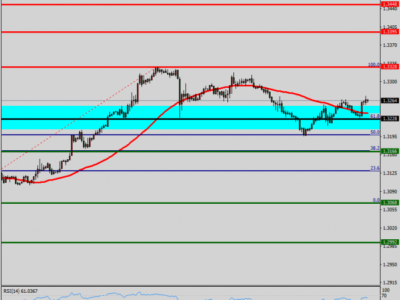

On the 14th of March a lot of news was coming out about a potential meeting between OPEC and non-OPEC nations to potentially freeze output levels, the news feed stated that “OPEC Gulf delegate states that the meeting between OPEC and non-OPEC nations is likely to take place in April”. Now this was big news because we had a lot of chatter, speculation, and unconfirmed reports heading into the headline and this was the first solid confirmation that we’d had that there will be a meeting in April. This of course sees speculators get long in oil, so knowing that this was the case, the ideal trade would be to go short USDCAD if the Fed came out much more dovish than expected at their March meeting.

On March 16, as we can see on the news feed, the Fed lowered their median forecast to two hikes in 2016 from their previous expectations of four hikes, and below market expectations of a decrease to only three hikes. The Fed was overall very dovish at their March meeting, along with the Fed lowering their median forecast, Fed Chair Yellen was quite skeptical of the rise in core inflation; hence we saw a big sell-off on the US dollar.

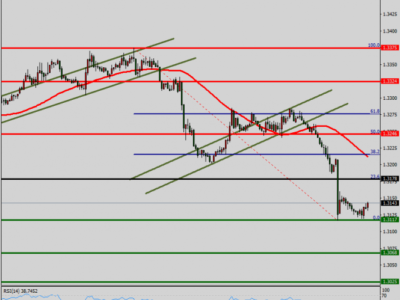

With oil prices supporting CAD and a dovish Fed weighing on USD, USDCAD dropped off exactly as expected. I closed the first position for 213 pips and the second position for 190 pips, overall I took 6700 for the first trade, and close to 6,000 on the second trade. This has been a quick example of how we traded out of FOMC here at SMILe and Jarratt Davis.

To get daily market insights from Jarratt Davis delivered to your inbox simply enter your name and email below:

The post Trading USDCAD After the FOMC Meeting | Trade Example appeared first on Jarratt Davis.

Source:: Trading USDCAD After the FOMC Meeting | Trade Example