Tuesday 15th July: Daily Technical Outlook and Review.

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming an opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

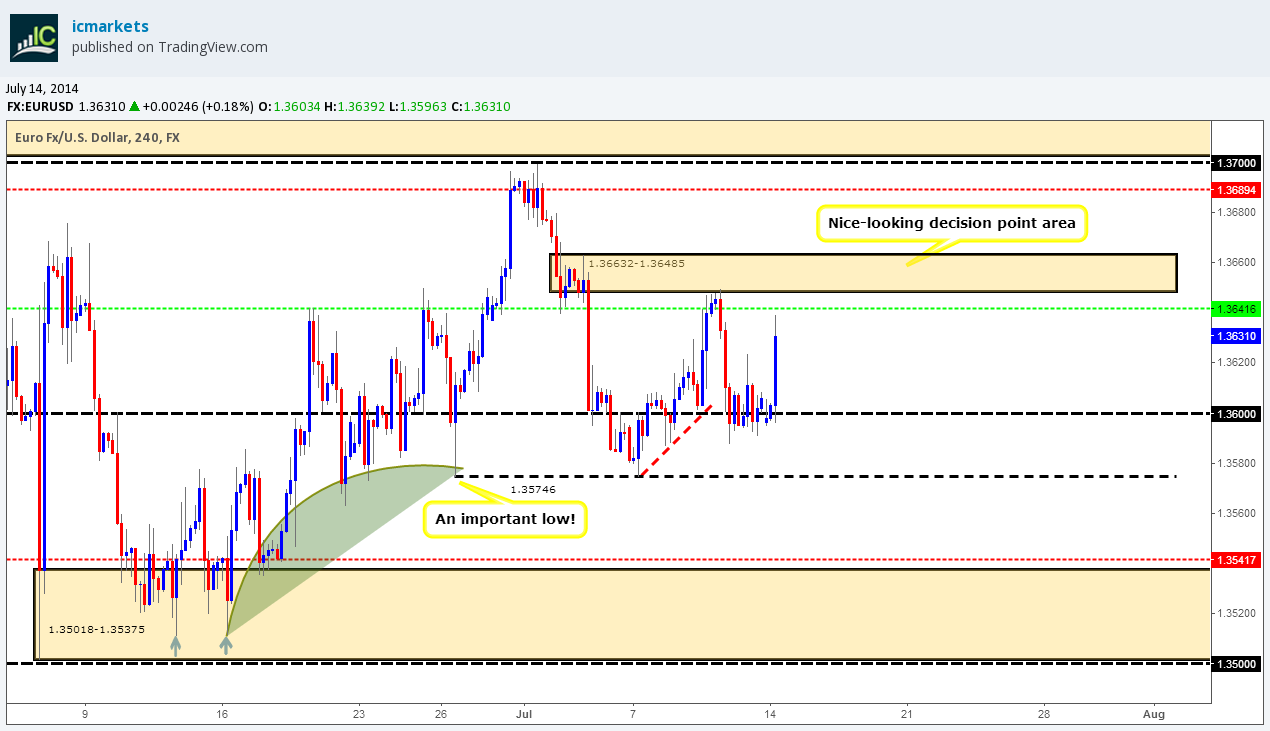

EUR/USD:

4hr TF.

The higher picture resembles the following:

- Buyers and sellers still remain trading within weekly demand at 1.34760-1.36314.

- Trading remains capped between daily supply at 1.37297-1.36879 and daily demand below at 1.34760-1.35265.

Price opened lower at 1.35965 with the buyers seen taking complete control, with very little seen stopping them until around the 4hr decision-point supply area at 1.36632-1.36485 where sellers will likely show an appearance.

Last week we saw a break of the low 1.36013 which likely cleared a path down to at least the low 1.35746. So why the sudden burst of buying power, and not a drop straight down to the low? In the last analysis it was reported that for pro money to get price down to the low 1.35746, they would likely need liquidity, and where better than the decision-point supply area above (levels above).

A lot of traders have no doubt jumped on this sudden burst of buying power on the lower timeframes thinking it is going to the moon, but you can normally be rest assured pro money is busy selling whilst they are buying as they need to move huge amounts of capital and cannot merely click buy and sell like you and I can.

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- P.A confirmation buy orders (Red line) are seen just above demand (1.35018-1.35375) at 1.35417. The reason behind us placing a P.A confirmation buy order here, rather than a pending buy order is because the aforementioned demand area appears weak as deep spikes have been seen recently (marked with two arrows).

- Pending sell orders (Green line) are seen just below the decision-point supply area (1.36632-1.36485) at 1.36416. The reasoning behind placing a pending sell order here is due to the simple fact we have seen buyers consumed lower around the lows 1.36013, thus making it a low-risk high-probability trade.

- P.A confirmation sell orders (Red line) are seen just below supply (1.37224-1.37028) at 1.36894. A P.A.C order was selected here due to the reaction seen at the aforementioned supply area proving its validity. However, pro money may well decide to push price higher into this supply area if/when price returns to it, thus making it a risky trade for a stop above the high 1.36995 which could be very easily be stopped out if a pending sell order was set, hence the need to wait for confirmation.

Quick Recap:

The buyers were on full steam ever since the market opened at 1.35965 with little interest being shown by the sellers at the moment. Our pending sell order set 1.36416 will likely get filled very soon, following this price will likely drop back down to around the low 1.35746 as there is very little in its way.

- Areas to watch for buy orders: P.O: No pending buy orders are seen in the current market environment. P.A.C: 1.35417 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 1.36416 (SL: 1.36584 TP: Dependent on price action approach).P.A.C: 1.36894 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

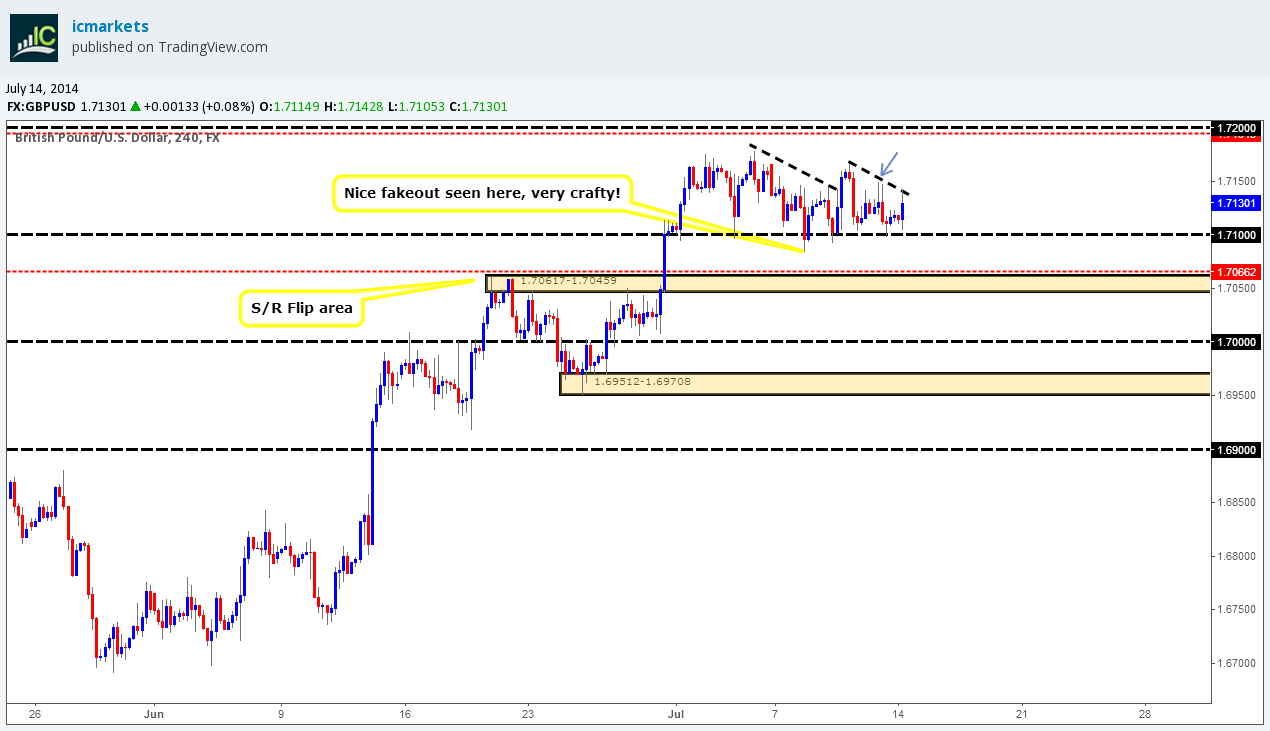

GBP/USD:

4hr TF.

The higher picture resembles the following:

- Buyers are still seen deep within weekly supply territory at 1.76297-1.67702, with a little interest being shown by the sellers at the moment.

- The daily timeframe still shows price is currently trading in no man’s land between daily supply above at 1.76297-1.73024 and daily S/R flip level seen below at 1.69712.

The market opened at 1.71171, consolidated for a little while, then made an attempt to touch the round number 1.71000 before advancing. This was a little surprising as we expected price to break the aforementioned round number level down to around the 4hr S/R flip level at 1.70617-1.70459, instead a small bullish reaction was seen.

It is not over yet, notice the price symmetry forming? The second small downtrend line is not to show a trend forming, it is to show how pro money are likely consuming supply as price was declining, if we see a successful break above the high marked with an arrow at 1.71497 we can likely expect that the path is now once again clear to at least the round number above at 1.72000. Will pro money still drop price down to the 4hr S/R flip level (levels above) before rallying to the round number just mentioned? We believe it is still very likely as there is a high possibility they will need liquidity before moving price that far.

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- P.A confirmation buy orders (Red line) are seen just above demand (1.70617-1.70459) at 1.70662. A reaction north is likely to be seen here as there is no doubt unfilled buy orders left around this area when pro money made the ‘decision’ to push higher. However deep spikes can occur around flip areas (levels above) such as these, hence the need to wait for confirmation.

- No pending sell orders (Green line) are seen in the current market environment.

- P.A confirmation sell orders (Red line) are seen just below the round number 1.72000 at 1.71943. We have placed a P.A confirmation sell order here simply because these psychological levels are prone to deep tests/spikes, so sometimes it is better to wait for that all important confirmation.

Quick Recap:

An attempt to trade to the round number was seen a little while after the market opened at 1.71171, with the buyers then seen taking control for the time being. If we see a break above the high marked with an arrow at 1.71497 the path north is once again clear, however, do not totally dismiss the notion that price may still drop down to the 4hr S/R flip area at 1.70617-1.70459 before higher prices are seen.

- Areas to watch for buy orders: P.O: No pending buy orders seen in the current market environment. P.A.C: 1.70662 (likely to be set at 1.70423 TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: No pending sell orders seen in the current market environment. P.A.C: 1.71943 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

AUD/USD:

Daily TF.

The daily timeframe still remains capped between the low 0.93208 and daily supply above at 0.95425-0.94852 with a break of either side yet to be seen. Once a positive break does happen, we will likely have more information regarding possible future direction.

4hr TF.

The market opened at 0.93758 with the buyers seen taking full control pushing price back up to the round number 0.94000 which is where the sellers are currently showing an appearance.

Something that was not mentioned in in the last analysis which should have been, is that price has consumed some of the buyers around the minor low 0.93765 meaning that the path is likely clear down to the 4hr demand area below at 0.93208-0.93417, as there does not seem to be any obvious trouble spots (demand) to stop price in between the minor low (level above) and the aforementioned 4hr demand area, so effectively we should see much lower prices very soon.

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- P.A confirmation buy orders (Red line) are seen just above the decision point level (0.92566-0.92736) at 0.92775. The reason for placing a P.A confirmation buy order here rather than pending buy order is simply because we were trading just above a daily demand ‘buy zone’ at 0.92046-0.92354, meaning pro money could very well just ignore this level completely and trade deeper into the aforementioned daily demand area, so, confirmation is the order of the day!

- Pending sell orders (Green line) are seen just below supply (0.95425-0.95096) at 0.95052. A pending sell order is placed here due to this being an area where pro money was interested in before; see how close price came to the supply area? (Levels above), this indicates possible strong supply (selling pressure), so the next time price visits we can expect some sort of reaction.

- The pending sell order (Green line) set just below the decision point level (0.94408) at 0.94382 is now active. Our first take-profit target has been hit at 0.93678, so do keep an eye on our second target seen within 4hr demand below (0.93208-0.93417) at 0.93360.

Quick Recap:

The market opened at 0.93758 with the buyers seen taking full control up to the round number 0.94000 which is where the sellers begun showing interest. We still favor price dropping from here down to at least the 4hr demand area at 0.93208-0.93417 as there does not seem to be any obvious trouble spots (demand) to stop price in between the minor low (level above) and the aforementioned 4hr demand area which is where our second take profit target is set within at 0.93360.

- Areas to watch for buy orders: P.O: No pending buy orders seen in the current market environment. P.A.C: 0.92775 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 0.95052 (SL: 0.95467 TP: Depending on price approach)0.94382 (Active-1st target hit) (SL: 0.94677 TP: [1] 0.93678 [2] 0.93360 [3] 0.93000. P.A.C: No P.A confirmation sell orders seen in the current market environment.

USD/JPY:

4hr TF.

The higher picture resembles the following:

- The weekly timeframe shows price is trading around a long-term S/R flip level support at 101.206 with a positive close below yet to be seen.

- Buyers and sellers on the daily timeframe are currently trading within a range with resistance being seen above at 102.713 and daily demand seen below at 100.747-100.967.

The market opened higher at 101.363 with the buyers seen taking full control at the moment. It was reported in the last analysis that price would likely react at the prior (supply) decision point area at 101.400-101.465, a minor bearish reaction was indeed seen, however not quite with the intensity we expected.

Taking the above into consideration we still do believe price is likely going to drop down to the round number 101.000 area sometime this week. However before this happens a rally higher to a decision-point level (resistance) at 101.754 may be seen. The reasoning behind this is pro money will likely want to fool as many traders as humanely possible that a new uptrend is beginning and it is going to take off heading right up to the moon, this way they can use all of those buy orders as liquidity to drop price (use the buy orders to sell into), meanwhile using the same traders’ stops, which are sell orders to begin putting buy orders into the market in small chunks, the reason it would have to be in small chunks is to disguise their real intentions without moving price too much.

Therefore, still be prepared for a price decline, but also remain vigilant to the fact that we may see a rally higher to the 101.754 area beforehand.

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen just above the round number 101.000 at 101.020. The reason for setting a pending buy order here is because we are currently trading around weekly and Daily demand areas (101.206…100.747-100.967). We would not normally set a pending order around psychological levels such as these, but since we are in a great higher-timeframe location it is worth the risk.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- Pending sell orders (Green line) are seen just below supply (103.294-102.983) at 102.953. A pending sell order was set here due to this being an area where likely unfilled sell orders are.

- New pending sell orders (Green line) are seen just below a decision-point level (resistance, 101.754) at 101.696. The reasoning behind setting a pending sell order here rather than a P.A confirmation sell order is for the simple fact this area is expected to see a nice reaction due to this being the overall area where pro money sellers dropped price lower engulfing multiple lows (101.400/101.227) in the process.

- P.A confirmation sell orders (Red line) are seen just below supply (102-191-102.104) at 102.074. A P.A confirmation order was used here purely for the simple fact we are trading around a higher-timeframe weekly support level at 101.206 meaning we may see a small reaction, but nothing to write home about, hence the need for confirmation!

Quick Recap:

We still fully expect a price decline sometime soon even though we have seen a break of the decision-point area (supply) at 101.400-101.465. We have to be prepared for the possibility of price now rallying to the decision-point level, now resistance at 101.754 before a drop down to the round number 101.000 area is seen.

- Areas to watch for buy orders: P.O: 101.020 (SL: 100.786 TP: Dependent on price approach).P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 102.953 (SL: 103.317 TP: Dependent on price approach) 101.696 (SL: 101.862 TP: Dependent on price approach) P.A.C:102.074 (SL: 102.214 TP: Dependent on approaching price action after the level has been confirmed).

EURGBP:

Daily TF.

The buyers, at the time of writing really seem to be pushing hard into this minor S/R flip level at 0.79581 with little to no interest being seen by the sellers.

4hr TF.

The market opened at 0.79393 with the buyers wasting no time in pushing price back up to the 4hr S/R flip level at 0.79679 where a small bearish reaction is currently being seen.

We still expect lower prices from here to at least the low seen at 0.79139, as the path south is relatively clear of any obvious demand (trouble) areas.

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen just above demand (0.78862-0.79048) at 0.79076. A pending buy order is placed here due to the aforementioned 4hr demand area’s location in the higher timeframes (Within the compressed green arc from weekly demand: 0.76931-0.78623… Seen on Monday 7th July analysis), and daily demand at 0.78862-0.79206.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- The pending sell order (Green line) set just below the S/R flip level (0.79679) at 0.79641 is now active. Our first target has been hit at 0.79388, so do keep an eye on our second target below at 0.79139.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

Our pending sell order set just below the S/R flip level (0.79679) at 0.79641 is still active, and our first profits are locked in. We still do expect price to decline from here, as there is very little in the way of ‘active’ demand before the low 0.79139.

- Areas to watch for buy orders: P.O: 0.79076 (SL: 0.78846 TP: Dependent on price approach)P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 0.79641 (Active – 1ST target hit) (SL: 0.79747 TP: [1] 0.79388 [2] 0.79139). P.A.C: No P.A confirmation sell orders are seen in the current market environment.

USD/CAD:

4hr TF.

The higher picture resembles the following:

- Price is currently seen trading out of weekly demand at 1.05715-1.07008.

- Much like the weekly timeframe above, the daily timeframe shows price is currently trading out of daily demand at 1.05874-1.06680 into a daily decision-point area at 1.07508-1.07293.

Price is currently reacting beautifully off of a small 4hr supply area at 1.07508-1.07434 with the first trouble area for the sellers being seen below at the round number 1.07000.

Price could very well drop to the aforementioned round number and continue on rallying higher, if this is the case, we should definitely be prepared for a deep spike through the round number level as pro money will no doubt want to test this area for buying strength, thus stopping out countless traders attempting to go long, and breakout sellers trying to sell in the process.

Should a break be seen of the round number, we can likely expect a reaction at an ignored supply area at 1.06749-1.06578, as there is still more than likely some unfilled buy orders left around this area.

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- P.A confirmation buy orders (Red line) are seen just above the round number 1.07000 at 1.07047. The reason a P.A confirmation order was set here was simply because we expect a retracement down to this level very soon before price continues on higher, a pending buy order would be too risky as (on this timeframe) there is no logical area for a stop loss order to be placed.

- The pending sell order (Green line) set just below a small supply area (1.07508-1.07434) at 1.07386 is now active; keep an eye out for our first take-profit level set at 1.07000.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

Our short-term bias on this pair is short, our pending sell order set just below 4hr supply (1.07508-1.07434) at 1.07386 has been filled, and we see the first trouble area down below at the round number 1.07000 which is where we will take partial profits. A break of this level is also likely with the next 4hr demand area being seen below at 1.06749-1.06578 which is where our second and final take-profit target is set.

- Areas to watch for buy orders: P.O: There are no pending buy orders seen within the current market environment. P.A.C: 1.07047 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 1.07386 (Active) (SL: 1.07541 TP: [1] 1.07000 [2] 1.06749)P.A.C: There are no P.A confirmation sell orders seen within the current market environment.

USD/CHF:

4hr TF.

The higher picture resembles the following:

- The weekly timeframe is showing price consolidating just above weekly demand at 0.85664-0.88124

- Daily supply at 0.90372-0.90042 has seen a lot of action over the past few weeks with no break north seen yet. Price is currently capped between the daily supply level just mentioned, and the daily S/R flip level below at 0.88608.

In our opinion there is not much to go on at the moment in the higher timeframes, so this pair remains difficult at best! The market opened up at 0.89242 with a pathetic push up seen from the buyers making a high of 0.89310. It was not long after that, the sellers showed the buyers who were boss as they slammed price down straight into the round number 0.89000 where the buyers have begun to show interest. No doubt this spike below the aforementioned round number stopped out millions of both traders attempting to go long there with too tight of a stop, and breakout sellers attempting to catch a possible break, think of all that liquidity for pro money!

If the buyers can push price above the high marked with an arrow at 0.89310, we may be in business! The area around this high could well be the last remaining supply area between the high above at 0.89557, again this is a snippet taken from the last analysis regarding what the purple trend line represents: Take a quick a look at the small purple trend line, this is not to resemble a trend as such, it is more to show how pro money have likely consumed supply/sellers as price was dropping possibly clearing the path for a nice advance back up to the high 0.89557.

Pending/P.A confirmation orders:

- The Pending buy order (Green line) set just above the round number 0.89000 at 0.89042 is now active, so do keep an eye out for our first take-profit target set at 0.89243.

- P.A confirmation buy orders (Red line) are seen just above the low 0.88546 at 0.88586. The reason that a P.A confirmation buy order was set here rather than a pending buy order was simply because there is no logical area for a stop loss, and the low (level above) will be likely prone to deep tests, or worse, a positive break below, hence the need to wait for confirmation.

- Pending sell orders (Green line) are seen just below the highs 0.89557 at 0.89514. The reasoning behind setting a pending sell order here is simply because the sellers proved to us that this level is worthy by consuming the buyers around the low 0.89245, thus permitting us to set this type of order.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

Our pending buy order set at 0.89042 has been filled recently and is currently trading in the green! Our first take-profit target is set at 0.89243 which remains an important area. If this area gets consumed north we could very well be looking at higher prices right up to the area around the high at 0.89557.

- Areas to watch for buy orders: P.O: 0.89042 (Active) (SL: 0.88886 TP: [1] 0.89243 [2] 0.89514).P.A.C: 0.88586 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 0.89514 (SL 0.89624 TP: Dependent on price approach).P.A.C There are currently no P.A confirmation sell orders seen in the current market environment.