UK Employment Figures – UK Inflation Report – Forex Trading Tips

Click here to learn how to use my trade calls!

Originally updated: 08:00

Trading Bias: Neutral

Currency Pair: –

Today we have two major events: UK Employment figures and UK Inflation Report. These events will cause volatility on GBP and we will look to enter based on the details.

Current Sentiment:

Yesterday’s session saw UK Manufacturing Production come out better than expected. This gave impetus to pound’s already bullish sentiment. Cable rallied over 150 pips on the day.

Yesterday we also saw the release of the Australian Federal Budget which was received well by the market despite it showing very high household debt-to-income ratios (above pre-GFC levels). The AUD still provides a much higher yield than most currencies. Thus, it remains attractive for investors. This also applies to NZD.

Overnight the RBNZ provided their Financial Stability Report which contained few surprises and was not overly negative. It did however reveal plans to tackle the over-heating property market by placing curbs on lending. This could be perceived as a prelude to rate cuts. Kiwi spiked lower then rallied 90 pips in the following hours. This report has provided little in the way of tradeable insights.

Fundamentals:

The USD remains the strongest currency in the longer term. However the medium-term direction depends on data. Last week’s NFP number abated the bearish sentiment on the currency to a degree. We await today’s Retail Sales figures for potential direction.

The EUR remains fundamentally weak and the Greek debt issue is ongoing. The Euro can easily get a boost on any new USD weakness. This was witnessed a fortnight ago. As speculation mounts of a Greek debt default we can expect Euro to be pressured against fundamentally bullish currencies. Any major sell off in German bunds may precipitate euro strength.

GBP has regained its place as one of the strongest currencies now that the Conservative government remains in power. A degree of uncertainty has been erased. Today’s Inflation Report should provide solid direction.

AUD is relatively neutral now there is no speculation of rate cuts in the near term. China’s rate cut shows that the PBOC are acknowledging the slowdown in the economy. That has the potential to weigh on AUD if demand for commodities decrease further. The recent move higher in the iron ore price is positive for the Aussie dollar in the near term. AUD also enjoys a positive interest differential against all majors except NZD.

NZD has a greater chance of easing monetary policy since the poor employment figures were released. We will watch data to indicate the chance of a cut in the near-term. The OIS is now pricing a 46% chance of a June 10 cut. NAB says this is too soon.

CAD remains on the weaker side of neutral until we see more data or direction from the BOC. CAD will take most of its direction from any significant changes in the price of West Texas Intermediate crude oil.

JPY remains weak but the market will likely need a new bout of easing to sustain another fall. In the meantime, the sentiment on the JPY can turn bullish very quickly if there is uncertainty in the markets.

CHF is fundamentally a weaker currency given the SNB’s negative interest rates. However it is highly susceptible to volatility due to SNB potentially intervening to weaken the currency as it tends to strengthen on safe-haven demand. CHF often will take direction from the EUR with which its correlation over the last 50 trading days is 74%.

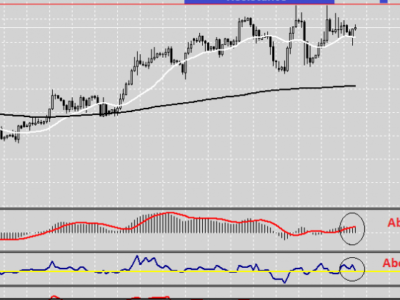

Technicals:

We await news flow to provide entries around strong support and resistance levels.

Other Market Moving News:

We have a busy line-up with national output data from France and Germany followed by UK Employment figures and UK Inflation Report, then a few hours later US Retail Sales. There is a good chance that trading opportunities will be presented today.

To get daily market insights from Jarratt Davis delivered to your inbox simply enter your name and email below:

The post UK Employment Figures – UK Inflation Report – Forex Trading Tips appeared first on Jarratt Davis.

Source:: UK Employment Figures – UK Inflation Report – Forex Trading Tips