US service sector expanded in February but job sector shrunk: ISM

The highly anticipated US non-farm payrolls report is due later in the day. This is one of the most important economic data that is closely watched by the markets and by Federal Reserve policy makers. A strong NFP number will increase the prospects of interest rates being lifted again this year.

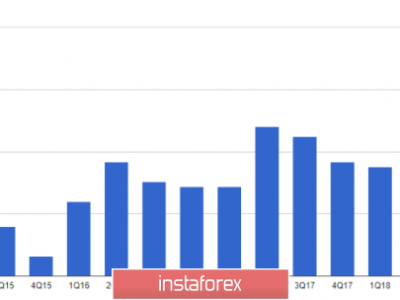

Economists forecast the US economy to have added 195,000 jobs in February, up from 151,000 the previous month, and for the unemployment rate to hold steady at 4.9 per cent.

However, some data out of the US yesterday dampened expectations the Fed would hike interest rates soon. The ISM non-manufacturing PMI indicated that the vast US services sector continued expanding in February. However, a soft employment component of the ISM report shrunk for the first time in two years. Here are some views from economists about the latest data on the US economy:

Jesse Hurwitz at Barclays says “modest growth in service sector activity remains the primary growth engine for the US economy,” cautioning, however, that the employment figure “highlights some downside risk heading into tomorrow’s February employment report”.

Joshua Shapiro at MFR notes the data over the past two months are “consistent with the weaker pace of economic growth seen recently, but any further declines would certainly be worrisome”. He added the contraction in the employment component, “may be sending a significant signal concerning a slower pace of payroll employment growth”.

The post US service sector expanded in February but job sector shrunk: ISM appeared first on FXTM Blog.

Source:: US service sector expanded in February but job sector shrunk: ISM