USD/JPY. Yen under attack: market rumors allow you to build up long positions

The yen completely ignored today’s release of inflation data in Japan. However, the published figures fully coincided with the forecasts, therefore, traders did not have any reasons for increased volatility. The general consumer price index came out at the level of 0.4% – the March indicator coincided with forecasts and the February value. Core inflation, excluding prices for fresh food, continued its downward trend, falling to 0.4% (this indicator was at around 0.8% in January, while it was around 0.6% in February). The CPI, excluding food and energy prices, also repeated the February increase to 0.6%, meeting the expectations of most analysts.

It is worth noting here that Japanese inflation has shown a downward trajectory since the beginning of the year, that is, even before the height of the coronavirus epidemic. After the sales tax was raised in Japan, consumer spending immediately collapsed by three percent. Investments in business also significantly decreased. Likewise, exports showed weak dynamics. The coronavirus factor joined all the problems of an economic nature in the first quarter of this year. Therefore, according to most experts, the Japanese economy will also demonstrate negative dynamics in the period from January to March, indicating the reality of a technical recession.

The Bank of Japan will hold its next meeting next Tuesday, April 28. Members of the central bank will certainly appreciate the dynamics of March inflation. But the data on the growth of the country’s economy for the first quarter of this year will be published a little later. Therefore, regulator members will be forced to operate with indirect indicators, preliminary calculations by economists and outdated indicators of the final quarter of 2019.

I recall that Japan’s GDP in the fourth quarter of 2019 fell at the highest rate over the past six years – it reached -6.3% compared to the same period in 2018. The key indicator fell into the negative area for the first time since the third quarter of the year before last. It is worth emphasizing that the Japanese economy showed a negative result even before the global lockdown and the crisis associated with the spread of coronavirus.

All of the above suggests that the April meeting will not be “passing”. In particular, yesterday there was information going around the market that the Bank of Japan will decide on unlimited purchases of government bonds. In addition, the regulator will also discuss the possibility of a sharp increase in the volume of commercial securities and corporate bonds it purchases. After this information was published in the Japanese press, the yen impulsively fell in price throughout the market – for example, the USD/JPY pair jumped by more than 60 points in just an hour, again being designated in the 108th figure. But it quickly returned to its usual range – first, the information is unofficial (in other words, it is just a rumor), and secondly, it is not the first time for the Bank of Japan to announce its intention to significantly soften the parameters of monetary policy, but these threats are just threats.

However, in my opinion, the Japanese regulator will still move from words to deeds at the April meeting. Haruhiko Kuroda said during the March meeting that the central bank did not follow the general trend of reducing rates, “because the level of uncertainty remains high.” However, he added that the regulator “will not hesitate” to make this decision at one of its next meetings if the situation worsens. It is worth noting that the number of infected people in Japan did not exceed thousands during the last central bank meeting (mid-March), but now this number has increased to 12,300 today. Due to the increase in the number of cases of coronavirus infection, the country’s authorities on April 16 imposed a state of emergency across the country – it will last until at least May 6. At the same time, Prime Minister Shinzo Abe unveiled a $1 trillion package of measures to support the economy. It was also decided to sell a record number of additional bonds worth more than 18 trillion yen to finance the anti-crisis package. At the same time, according to analysts, the country’s economy will show a significant downward trend for at least the first two quarters of this year. In particular, in their latest report, Moody’s experts indicated that they expect Japan’s GDP growth to decline by 2.4% in 2020.

In my opinion, against the backdrop of such events, the Bank of Japan will not be able to stay away. The Japanese regulator expanded the range back in July 2018, or rather, the limits of long-term interest rates – this allows the regulator to go deeper into the negative area at any meeting. However, the central bank has additional levers of influence in its arsenal, in addition to lowering the interest rate.This is about increasing the volume of purchases of Japanese government bonds and raising the monetary base – and judging by preliminary rumors, the regulator will at least decide on an unlimited purchase of government bonds. In addition, many experts are confident that the Japanese central bank will decide on a further review to lower forecasts for the economy and inflation.

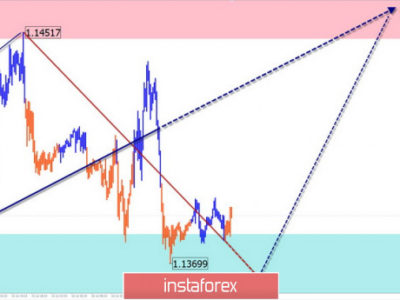

Thus, given the voiced disposition, from current positions you can consider long positions to the nearest, most powerful resistance level of 109.00 – this price target coincides with the upper line of the Bollinger Bands indicator on the daily chart. This week, the USD/JPY pair is unlikely to reach this level, but if we talk about the medium term then the upward movement is still prioritized – especially in light of rumors about the possible outcome of the April meeting of the Bank of Japan.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: USD/JPY. Yen under attack: market rumors allow you to build up long positions