USDCAD Daily Technical Outlook and Review 25th June

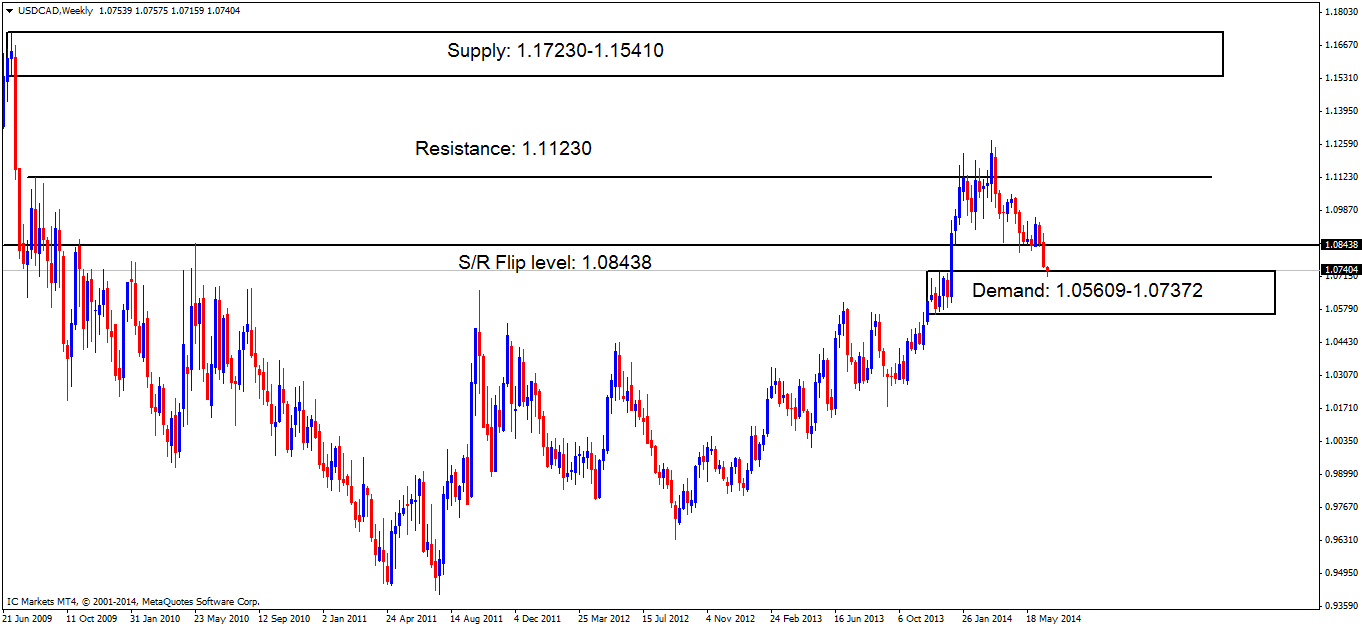

Active buyers on the weekly are seen around the base of demand at 1.05609-1.07372; look at that tidy tail forming!

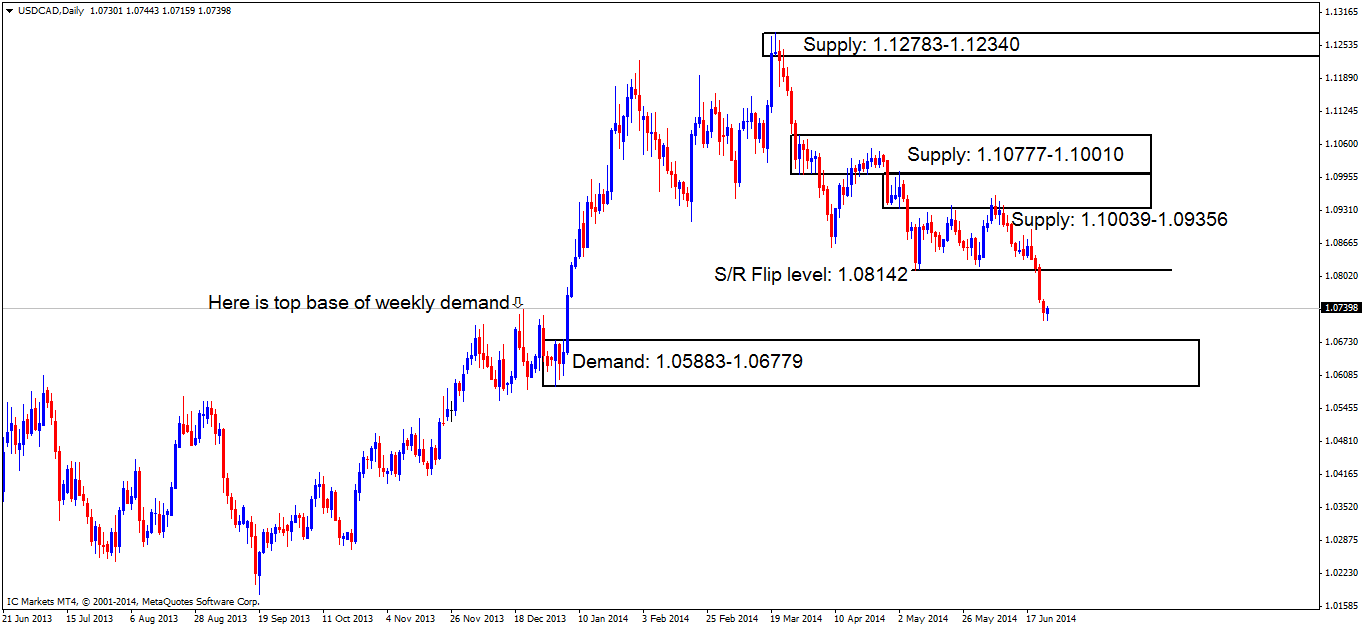

Daily TF.

The buying currently seen on the daily timeframe does not possess the energy it should have when trading out of a weekly demand area (levels above), so do be prepared for sellers to take over and push price to the downside to daily demand at 1.05883-1.06779.

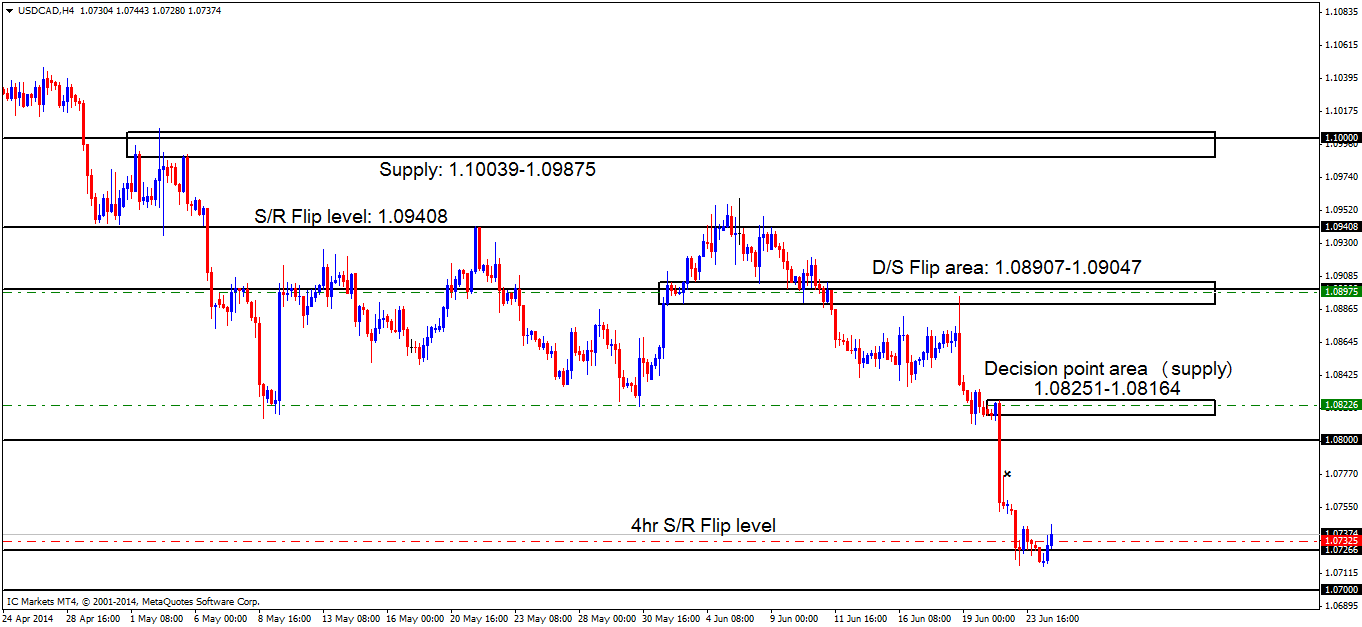

4hr TF.

Price appears to be consolidating around the 4hr S/R flip level at 1.07266, with no direction being shown yet.

Much the same as the last analysis:

At the time of writing price is capped between the 4hr S/R flip level just mentioned above and the round number 1.08000 acting as temporary resistance for now. A break below the S/R flip level could see price testing the round number 1.07000, conversely, a break above the round number 1.08000 (temporary resistance) could force price to test the decision point area (supply) at 1.08226.

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- The P.A confirmation buy order (Red line) set just above the S/R flip level (1.07266) at 1.07325 is now active. Buyers will need to confirm this level by consuming the sellers around the high 1.07759 marked with an x, a pending buy order can then be set, awaiting a possible retracement.

- Pending sell orders (Green line) are seen at 1.08975, within supply (1.08907-1.09047) just below the round number 1.09000. A pending sell order is permitted to be set here since the sellers confirmed this area from the previous confirmation sell order that was originally set at 1.08876 by consuming the majority of the buyers situated in and around (which was) demand at 1.08142-1.08330 (Seen on Thursday 19th June daily analysis).

- Pending sell orders (Green line) are seen within the decision point supply area (1.08251-1.08164) at 1.08226. Pending orders are valid here due this likely being the work of pro money, the momentum out of the zone is only caused by traders with big accounts, and when pro money move the market, all of their orders here were unlikely to have been filled, hence a pending order being logical here.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

Patience is definitely required here at the S/R flip level (1.07266) as price is currently consolidating around our buy confirmation order at 1.07325. A positive break below this level could see the round number 1.07000 being tested as explained in the last analysis. It is very difficult to give an likely analysis of this pair since price could very well do one of two things: 1. Price will react hard from weekly demand (1.05609-1.07372) thus confirming our P.A confirmation buy order mentioned above, or, 2. Price will drop hard towards daily demand at 1.05883-1.06779, and then see a bullish reaction, the beautiful thing about this though is that price would never leave the confines of the weekly demand area (levels above), as all it would look like on the weekly timeframe is a deep test of demand. We currently favor option number two as pro money love to get the cheapest prices in areas of interest.

- Areas to watch for buy orders: P.O: There are no pending buy orders seen within the current market environment. P.A.C: 1.07325 (Active-awaiting confirmation) SL: likely to be set at 1.07152 TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O:1.08975 (SL: 1.09059 TP: 1.08330 [May change if any new developments in the market are seen]) 1.08226 (SL: 1.08357 TP: Dependent on approaching price action) P.A.C: There are no P.A confirmation sell orders seen within the current market environment.

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Source: IC Markets Trading Desk