$USDCAD Daily Technical Outlook and Review – Friday 29th August

The higher-timeframe picture resembles the following:

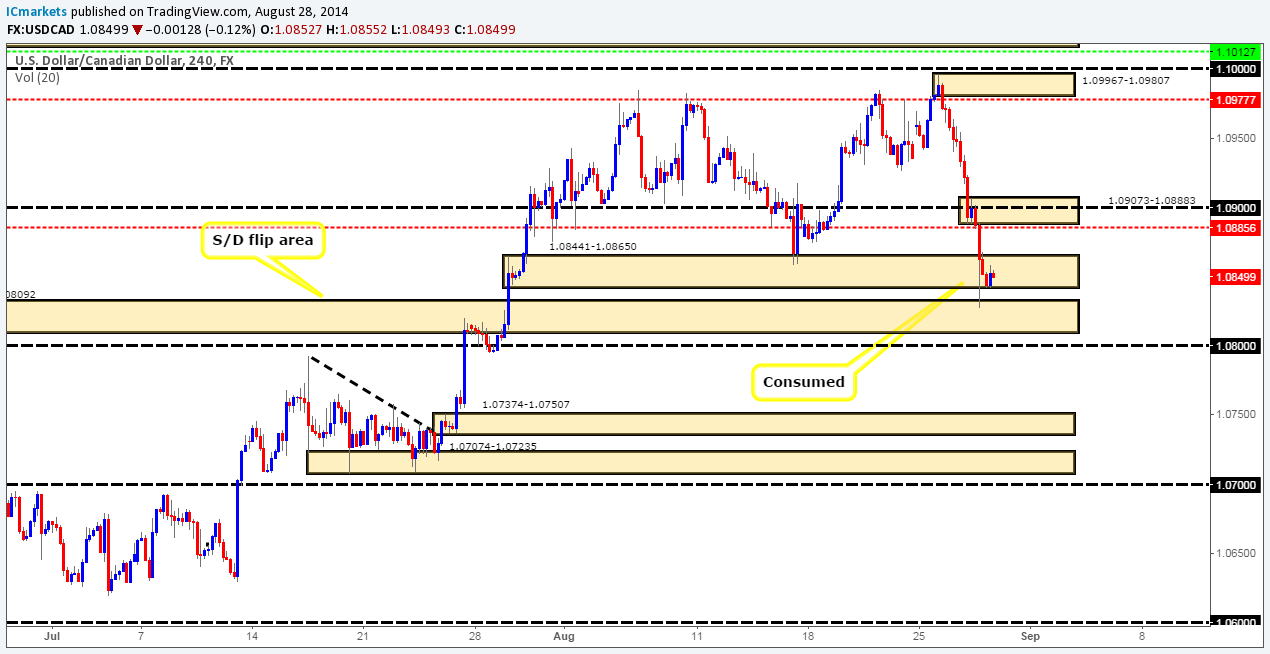

- Weekly TF: A push higher into a small weekly supply area at 1.10522-1.09996 has been seen, and at the time of writing, serious sellers appear to have come into the market.

- Daily TF: Price has been sold very heavily straight into a daily S/R flip level at 1.08277, where the buyers are beginning to show interest, and consequently capping price between the aforementioned daily S/R flip level, and a newly-formed daily supply above at 1.09967-1.09401.

It was reported in the last analysis after the break below of the round number 1.09, that we may see a retest of this level as resistance. This did happen, but trading on the 4hr timeframe, this was very difficult to catch, other than setting a pending sell order, but we try to avoid setting pending orders around round numbers, we prefer to wait for some confirmation before entering.

The 4hr demand area at 1.08441-1.08650 saw a vicious spike through it straight into an important S/D flip area at 1.08324-1.08092, no doubt stopping out any poor soul trying to fade the 4hr demand area!

Considering we are trading out of a heavy-weight weekly supply area (levels above), and currently trading around a daily S/R flip level (level above), we naturally expect to see lower prices still (higher timeframes usually overrule). However, before this happens, we must be prepared for a rally in price, as there are no doubt active buyers around the daily S/R flip level area to consume first. We will be watching the following areas for bearish price action: 4hr supply (1.09073-1.08883) where we have set a P.A confirmation sell level just below at 1.08856, 4hr supply (within daily supply at 1.09967-1.09401) at 1.09967-1.09807 where we have another P.A confirmation level set just below at 1.09777, and finally a fantastic-looking 4hr supply area above at 1.10388-1.10163 (pending sell order set below at 1.10127).

Pending/P.A confirmation levels:

- No pending buy orders (Green line) are seen in the current market environment.

- No P.A confirmation buy levels (Red line) are seen in the current market environment.

- Pending sell orders (Green line) are seen just below a 4hr supply area (1.10388-1.10163) at 1.10127. This area remains fresh, and likely contains unfilled sell orders indicating a bounce south at the very least will be seen if/when price reaches this area.

- New P.A confirmation sell levels (Red line) are seen just below 4hr supply (1.09073-1.08883) at 1.08856. The reasoning behind not setting a pending sell order here was simply because price could rally all the way back up to (in our opinion) a beautifully located 4hr supply area at 1.10388-1.10163.

- New P.A confirmation sell levels (Red line) are seen just below 4hr supply (1.09967-1.09807) at 1.09777. The reasoning behind not setting a pending sell order here was simply because price could rally all the way back up to (in our opinion) a beautifully located 4hr supply area at 1.10388-1.10163.

Quick Recap:

We still expect lower prices considering we are trading out of a heavy-weight weekly supply area at 1.10522-1.09996. However, before lower prices are seen, we need to prepare ourselves for a rally higher due to their likely being active buyers around the daily S/R flip level at 1.08277. We will be watching the following areas for bearish price action: 4hr supply (1.09073-1.08883) where we have set a P.A confirmation sell level just below at 1.08856, 4hr supply (within daily supply at 1.09967-1.09401) at 1.09967-1.09807 where we have another P.A confirmation level set just below at 1.09777, and finally a fantastic-looking 4hr supply area above at 1.10388-1.10163 (pending sell order set below at 1.10127).

- Areas to watch for buy orders:P.O: No pending buy orders are seen in the current market environment. P.A.C:No P.A confirmation buy levels seen in the current market environment.

- Areas to watch for sell orders: P.O: 1.10127 (SL: 1.10440 TP: Dependent on how price approaches) P.A.C: 1.08856 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed) 1.09777 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).