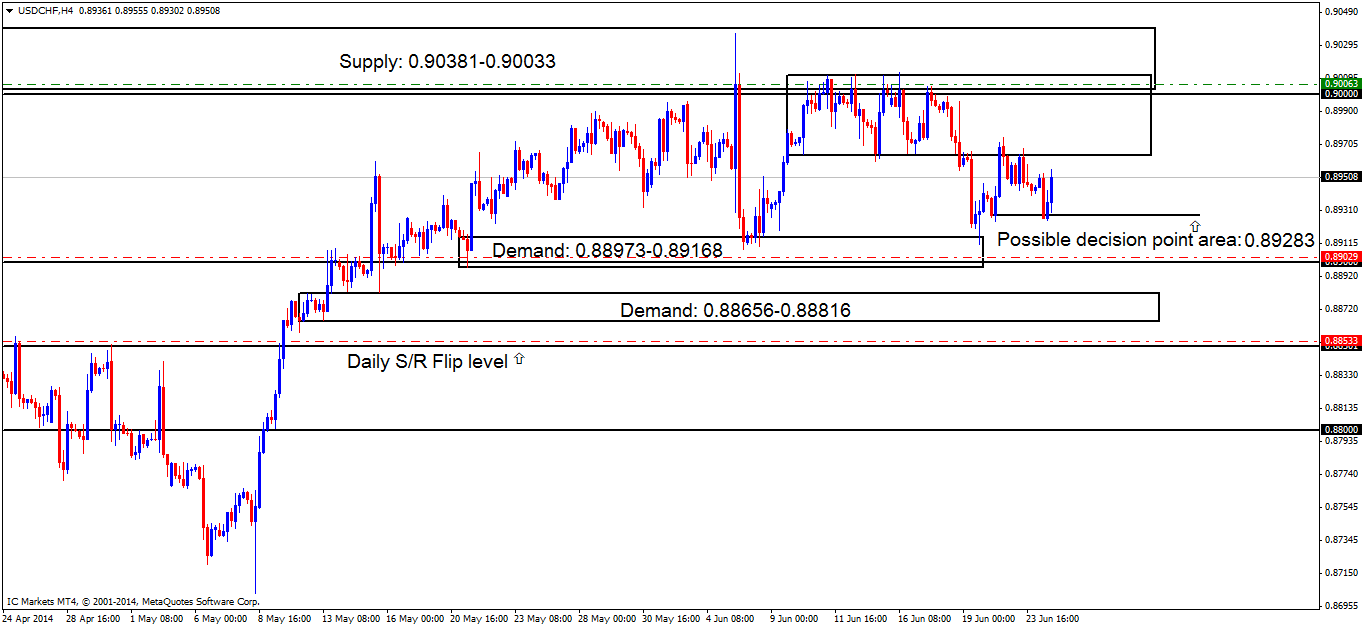

USDCHF Daily Technical Outlook and Review 25th June

The sellers sold heavily into the ‘possible’ decision point area at 0.89283, only to have the buyers switch direction nearly to the pip off of this level. This decision point area was only a possibility because of the way price was behaving; the small consolidating price action seen just above could have proved to be a serious trouble area if we attempted to go long, but in this case it was proved to be wrong!

Price now remains capped between demand at 0.89283 and the lower limit of the mini range (resistance) at 0.89643.

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- P.A confirmation buy orders (Red line) are seen just above the daily S/R flip level (0.88501) at 0.88533. This level needs to see some confirming price action before any entry is placed in the market, due to their being no logical area for a stop loss order.

- Near-term P.A confirmation buy orders (Red line) are seen within demand (0.88973-0.89168) at 0.89029, just above the round number 0.89000, as price may retrace to demand to collect unfilled orders deeper within this area.

- The pending sell order (Green line) visible at the base of supply (0.90381-0.90033) just above the round number 0.90000 at 0.90063 still remains active. The first target has been hit at 0.89168, we are allowing our final position to run, giving price room to move and hopefully hit our final target at 0.88501.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

The ‘unsure’ decision point area at 0.89283 proved to be a nice area for a reaction, however, we currently have small position left in the market from our sell entry up at 0.90063, so a break south of the aforementioned decision point area is ideally what we want to see happen next. Price will likely see a rally towards the lower limit of the mini range above at 0.89643, before any lower prices are seen, hopefully breaking the decision point area in the process.

- Areas to watch for buy orders: P.O: There are no pending buy orders seen in the current market environment. P.A.C: 0.88533 (SL: Dependent on approaching price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed) 0.89029 (SL: likely to be set at 0.88784 TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: (Active – 1st target hit) 0.90063 (SL: 0.90412 TP: [1] 0.89168[2] 0.88501) P.A.C: There are currently no P.A confirmation sell orders seen in the current market environment).

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Source: IC Markets Trading Desk