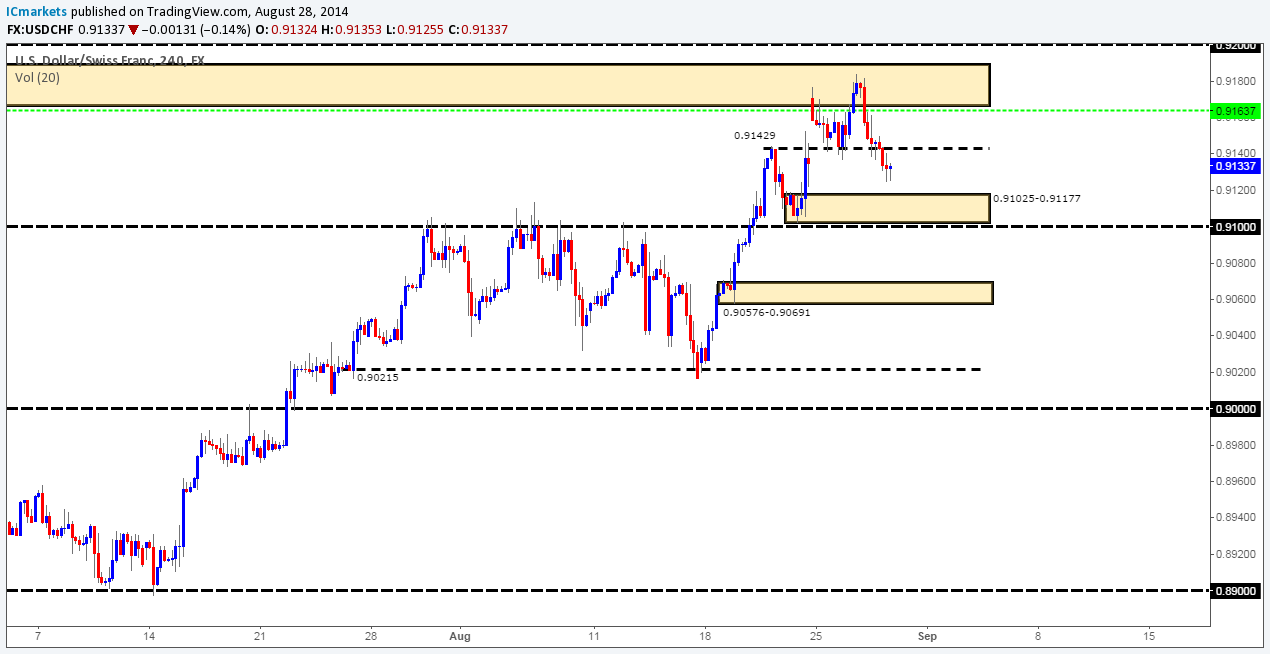

$USDCHF Daily Technical Outlook and Review – Friday 29th August

The higher-timeframe picture resembles the following:

- Weekly TF: A close above the weekly decision-point level at 0.90927 has been seen (keep an eye on a possible retest of this level as support). Any sellers around this area have now very likely been stopped out, and on this timeframe the path north appears to be clear up to around the weekly supply area at 0.94546-0.93081.

- Daily TF: Price has broken above the daily supply area at 0.91556-0.90985. Looking to the left of current price, there is nothing but ‘wicky’ price action indicating supply consumption i.e. no sellers left up to around the daily supply area at 0.94546-0.93448, however before this happens we must be prepared for a decline in value down to at least the daily S/D flip area at 0.90372-0.90042.

Our short position (0.91637) taken just under the 4hr supply area at 0.91892-0.91668 is looking in relatively good shape at the moment, since price has now broken the minor 4hr R/S flip level at 0.91429 below, we can very likely expect the 4hr demand area to be hit at 0.91025-0.91177 sometime soon (which is where our second take-profit target is located). However, before this target is hit, we are prepared to take some heat on the trade, as price could very likely rally from here, and retest the aforementioned minor 4hr R/S flip level, or with a push, even back up to the aforementioned 4hr supply area.

Once, or indeed if price declines from here, and breaks the 4hr demand area at 0.91025-0.91177, there appears to be very little stopping price from dropping down to the next fresh 4hr demand area at 0.90576-0.90691, which will be where our third and final take-profit target will be set.

Pending/P.A confirmation levels:

- No pending buy orders (Green line) are seen in the current market environment.

- No P.A confirmation buy levels (Red line) are seen in the current market environment.

- No P.A confirmation sell levels (Red line) are seen in the current market environment.

- The pending sell order (Green line) set just below 4hr supply (0.91892-0.91668) at 0.91637 is now active. Our first take-profit target has been hit at 0.91429, so do keep an eye on our second take-profit level set at 0.91177.

Quick Recap:

A break below the minor 4hr R/S flip level at 0.91429 has been seen, price seems to be stalling before our second take-profit target at 0.91177, so we have to be prepared to take some heat on the trade, as price could very likely rally from here, and retest the aforementioned minor 4hr R/S flip level, or with a push, even back up to the 4hr supply area at 0.91892-0.91668 before our second target is hit..

- Areas to watch for buy orders: P.O: No pending buy orders are seen in the current market environment. P.A.C: No P.A confirmation buy levels are seen in the current market environment.

- Areas to watch for sell orders: P.O:0.91637(Active) SL: 0.91941 TP: [1] 0.91429 [2] 0.91177 [3] 0.90726 P.A.C: No P.A confirmation sell levels are seen in the current market environment.