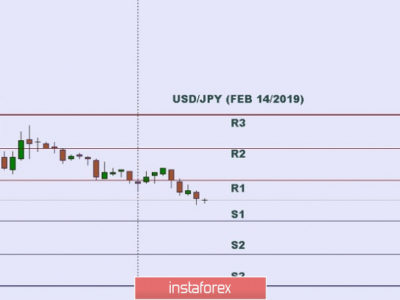

USD/JPY better bid after Japanese CPI data

USD/JPY was steadier in the Asian session after a Thursday’s big tumble to 118.33. In the US session the pair was back up as US yields rebounded on more hawkish talk from Fed officials and decent data on US jobless claims and services PMI. In Asia it traded between 119.06-41. Today’s US GDP data come into focus. Fourth quarter final GDP will be released. EUR/JPY got a modest lift from 129.55 to 129.85. GBP/JPY edged up from 176.76 to 177.31 despite a money center bank’s recommendation to go short.

EUR/USD did little in Asia, hovering around yesterday’s lows. EUR/USD eased down from 1.1052 in London to 1.0857 in New York. The bounce in US yields helped and short-covering flows look to have abated. In Asia the pair traded between 1.0865-96. EUR/GBP traded from 0.7384 to 0.7321 yesterday where it consolidated between 0.7320-30 in Asia. EUR/CHF traded 1.0475-94, just above yesterday’s 1.0466 low. Comments from an SNB official suggested the central bank will continue to intervene as it sees necessary.

GBP/USD traded between 1.4842-67 in Asia.

USD/CHF traded between 0.9525-46.

AUD/USD opened in Asia at 0.7826 and eased down from 0.7835 to 0.7791 in quiet trading. It later edged back above 0.7800.

NZD/USD closed in New York at 0.7600 and traded in Asia between 0.7568-0.7608 and affected by moves in AUD/USD.

The post USD/JPY better bid after Japanese CPI data appeared first on Forex Circles.