USDJPY Daily Technical Outlook and Review. Wednesday 18th June

4 hour timeframe.

As reported in the last analysis:

The higher timeframes is currently showing price trading around demand (Weekly: 101.254, Daily: 101.532-100.787), so higher prices are naturally expected sometime this week.

No decline into demand seen at 101.427-101.660 was seen yesterday, as reported may happen in the last analysis. The buyers are seen in control at the moment, currently battling it out with sellers around the minor S/R flip level 102.117. If the buyers manage a positive close above this flip level, the path is relatively clear for buyers to push up to the final target for our long position (101.679) seen at 102.367, where we respectively have a pending sell order allocated waiting to be filled.

- Pending buy orders (Green line) are seen just above demand (101.427-101.660) at 101.679 is now active. The first target has been hit at 102.000.

- No P.A confirmation buy orders (red line) are seen in the current market environment.

- Pending sell orders (Green line) are visible at 102.980, deep within supply (103.055-102.742), this area may well appear to be weak now, but the way price reacted at the circled area within supply indicates pro money activity, meaning sell orders may be left unfilled there, so a pending order is permitted.

- Near-term pending sell orders (Green line) are seen at 102.367. A pending order is valid here since this is the area where pro money made the ‘decision’ to take prices lower into demand (101.427-101.660), unfilled sell orders were likely left there in the process.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

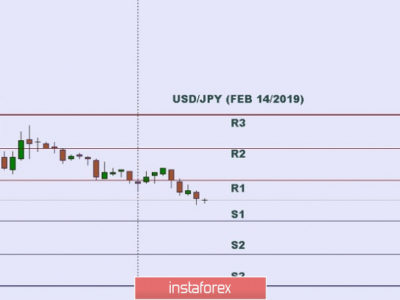

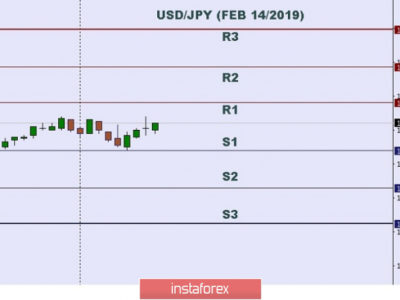

USDJPY 4Hr Chart (click to enlarge)

- Areas to watch for buy orders: P.O: (Active – 1st target hit) 101.679 (SL: 101.404 TP: [1] 102.000 [2] 102.367 [but may be subject to change]) P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 102.980 (SL: 103.108 TP: 102.117, but may well change if the market sees any new developments) 102.367 (SL: 102.458 TP: Dependent on how price action approaches this area). P.A.C: No P.A confirmation sell orders are seen in the current market environment.

- Most likely scenario: Price will likely decline a little, if a positive close above the minor S/R flip level is seen, possibly to around the round number 102.000, before the final advance commences to at least 102.367.

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Source: IC Markets Trading Desk