USD/JPY stages a recovery, oil remains weak

Market sentiment improved slightly on Thursday after a tumultuous trading day that saw a number of global stock markets enter bear markets. Asian equities were staging a tentative recovery on Thursday.

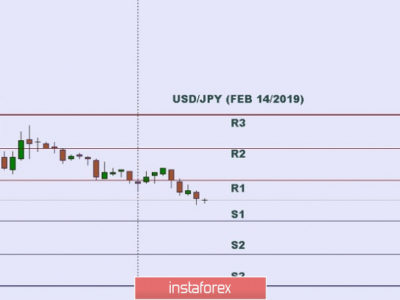

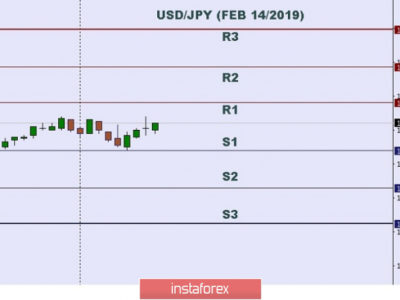

As a result there were flows out of safe haven assets. That saw the Japanese yen as the worst-performing currency in the region, weakening 0.3 per cent to Y117.34. The yen reached a fresh one-year high of Y115.98 during Wednesday’s volatility, though.

Also weaker was gold, down 0.1 per cent at $1,100.37 an ounce, and benchmark Japanese government 10-year bonds, where yields (which move opposite to price) were 0.5 basis points higher at 0.222 per cent.

Brent crude oil, the international benchmark, was up 0.9 per cent today to $28.14 following a 3.1 per cent drop on Wednesday.

WTI, the US benchmark, climbed 1 per cent this morning to $28.62 a barrel. On Wednesday WTI traded below $27 a barrel for the first time since September 24, 2003.

The euro traded below $1.09 in Asia today, as focus turns to the European Central Bank policy meeting later in the day.

The post USD/JPY stages a recovery, oil remains weak appeared first on FXTM Blog.