Wave analysis of EUR/USD and GBP/USD for June 13, 2019. British Parliament did not support Labor

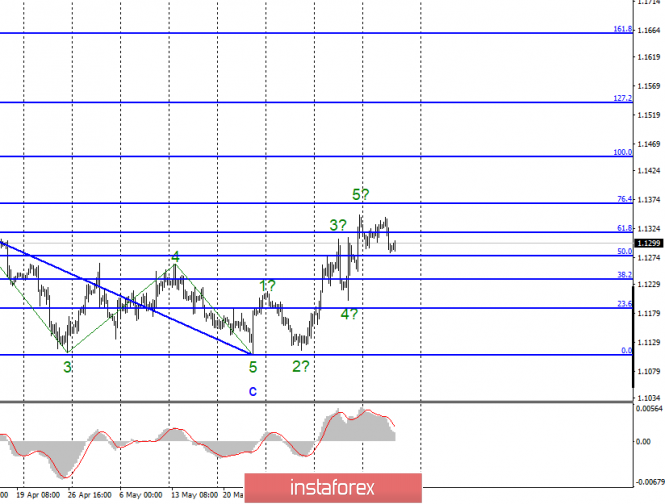

ER / USD

On June 12, Wednesday, trading ended for EUR / USD by 40 bp decline. Thus, the three-wave downward correctional structure, which I spoke about in recent days might have been completed, since the maximum of the supposed wave 5 has not been updated, and after it, three waves are already traced. Thus, although the correctional structure, if completed, is much shorter, the increase in the euro-dollar quotations of the instrument can resume from its current position. As a signal to confirm this hypothesis, I recommend waiting for a successful attempt to break the maximum of wave 5. For the pair, the news background remains more neutral than it is in favor of one of the currencies. Today, markets do not expect news from America, and in Europe there will be just one report – on industrial production for May.

Purchase goals:

1.1367 – 76.4% Fibonacci

1.1447 – 100.0% Fibonacci

Sales targets:

1.1106 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro / dollar pair allegedly completed the first wave of a new upward trend. I recommend waiting for the completion of wave 2 construction. Afterwhich, it is better to start the purchase of Eurocurrency with targets located near the estimated marks of 1.1367 and 1.1447, which equates to 76.4% and 100.0% Fibonacci. As a signal of the completion for the construction of wave 2, you can consider turning the MACD up.

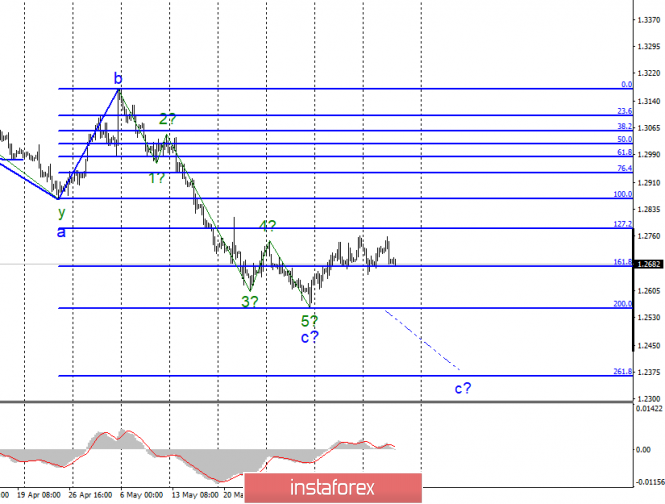

GBP / USD

The GBP / USD pair is currently making the third Fibonacci breakout attempt at 161.8%. Previously, trading ended with a decrease of 40 basis points, which indicates a weak potential of the bulls. The trend section, taking its start on May 31, raises some questions and looks ambiguous. It is likely that in the future, it will be an integral part of the overall downward trend, while wave c will become more complicated, or else the trend portion will be transformed to 5-wave. Much will depend on the news background, which remains the main opponent of the pound sterling. I recommend selling a tool upon receiving confirmation of market readiness to continue building a downward trend, that is, on a successful attempt to break through the level of 200.0% Fibonacci. The situation with Brexit still leaves many unanswered questions. Yesterday, deputies of the House of Commons of the Parliament refused to take control over the issue of withdrawal from the European Union according to a tough scenario on October 31. Thus, at the legislative level, there will be no obstacles for this scenario. However, the parliament can also vote against this option, when (and if) it comes to this.

Sales targets:

1.2554 – 200.0% Fibonacci

1.2360 – 261.8% Fibonacci

Purchases goals:

1.3175 – 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound / dollar instrument has not been changed which implies a resumption of the instrument decline within the estimated wave from the new or fifth wave. Thus, now, I recommend waiting for a breakout level of 200.0% and selling the pound with targets located near the calculated levels of 1.2360 and 1.2176, which corresponds to 261.8% and 323.6% in Fibonacci. Purchasing, from my point of view, still carries increased risks.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Wave analysis of EUR / USD and GBP / USD for June 13. British Parliament did not support Labor