Wave analysis of EUR/USD and GBP/USD for June 20, 2019

EUR / USD

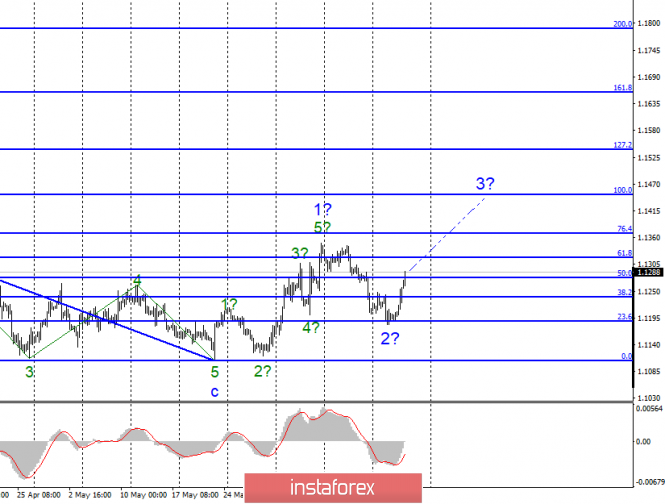

On Wednesday, June 19, trading ended with an increase of 30 basis points for the EUR / USD pair, and today, during the first half of the day, the pair added another 65 bp. However, it is not going to stop there. Based on this market reaction, it can be assumed that the Fed lowered the rate, but none of this happened. As usual, it is not the nature of this or that news that matters, but it’s based on how the markets interpreted this news. Of the 10 members of the monetary committee, only one voted for a reduction in the rate, there were no major adjustments to the forecasts for GDP or inflation, and Powell did not hint at an indispensable reduction in the rate until the end of the year. However, markets still found Powell’s statements as negative. What’s interesting is that according to wave analysis, everything is fully consistent with the current picture. Wave 2 completed its construction around the level of 23.6% Fibonacci, and the euro-dollar tool went to the construction of the third wave. It is not known how much the news background will support the euro currency, but now, we can count on the increase to the 14th figure.

Purchase goals:

1.1367 – 76.4% Fibonacci

1.1447 – 100.0% Fibonacci

Sales targets:

1.1106 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro / dollar pair completed the second wave of the upward trend. I recommend buying Eurocurrencies with targets located near the estimated marks of 1.1367 and 1.1447, which equates to 76.4% and 100.0% of Fibonacci, since an unsuccessful attempt to break through the level of 23.6% indicates the pair’s readiness to build rising wave.

GBP / USD

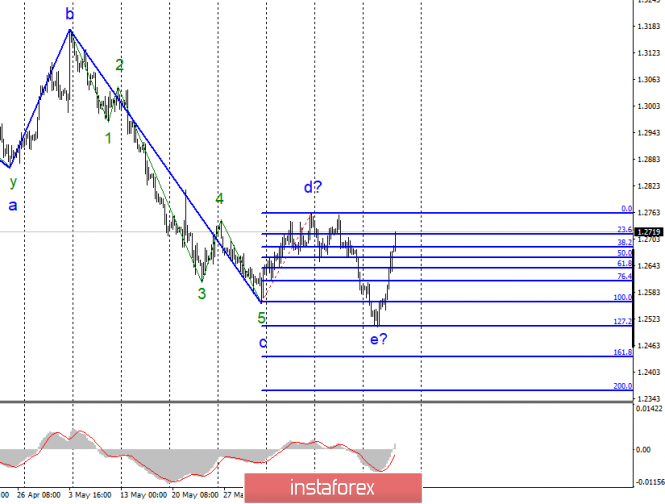

The pair GBP / USD gained 85 bp in the evening. Today, it continues to rise. The reaction of the currency markets to the outcome of the Fed meeting is somewhat exaggerated. The wave pattern of the instrument now implies almost the completion of the construction of the downward trend section and its wave e, which has taken a very shorter appearance. If this is true, then from the current position, the construction of the first wave of the new upward trend will continue. A successful attempt to break through the level of 0.0% by Fibonacci will indicate the willingness of the bulls to take the pound-dollar tool in their hands. Today, the second crucial event will be held for the pound sterling – the meeting of the Bank of England and the speech of Mark Carney. The markets do not expect any changes in the balance of power when voting at the rate. Most likely, all 9 members of the monetary committee will vote for preservation. So, like yesterday, more priority will be the speech of the head of the Bank of England Pound which badly needs Carney’s hawk attitude to continue climbing.

Sales targets:

1.2434 – 161.8% Fibonacci

1.2359 – 200.0% Fibonacci

Purchase goals:

1.2767 – 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound / dollar instrument has changed which suggests the construction of a new upward trend. At the same time, I recommend waiting for a successful attempt to break through the maximum of wave d, which confirms the willingness of markets to further increase, and build a correctional wave against the first impulse wave and only then, will buy the instrument.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Wave analysis of EUR / USD and GBP / USD for June 20. Jerome Powell caused massive dollar sales