Wave analysis of EUR/USD and GBP/USD for June 26, 2019

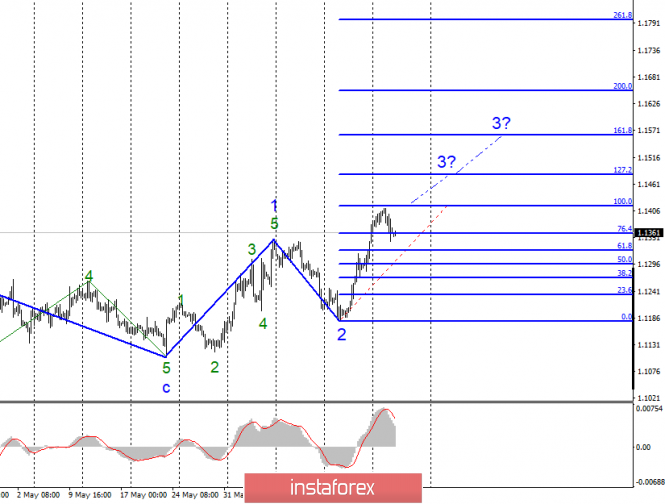

EUR / USD

Tuesday, June 25, ended for the pair of EUR / USD with a decline of 30 basis points. Thus, a correctional descending wave consisting of 3 upward trend segments of the trend has presumably begun its construction. If this is true, then the increase in instrument quotes will resume the other day with targets located above the 14 figure. At the same time, an alternative scenario is the completion of the upward trend, which in this case will be treated as a three-wave, and the construction of a new descending trend section. In favor of the second option can play a news background. In recent weeks, it has been very strong for the euro currency. But it can’t stay that way all the time. Jerome Powell’s speech yesterday was considered as “weak” again, and the report on business activity in America turned out to be significantly worse than expectations of the foreign exchange market. Nevertheless, it was the US dollar that grew. Although it may be a coincidence, and maybe the beginning of a new downward trend. Today, therefore, I recommend paying close attention to the report on changes in orders for durable goods in America. The forecasts are very weak, but the main thing is how real the values will be relative to these forecasts.

Purchase goals:

1.1417 – 100.0% Fibonacci

1.1480 – 127.2% Fibonacci

Sales targets:

1.1180 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro / dollar pair is presumably located within the 3 waves of the upward trend. I recommend buying the euro currency with targets located near the estimated marks of 1.1417 and 1.1480, which equates to 100.0% and 127.2% Fibonacci, with the MACD signal up. Now, it started building a correctional wave.

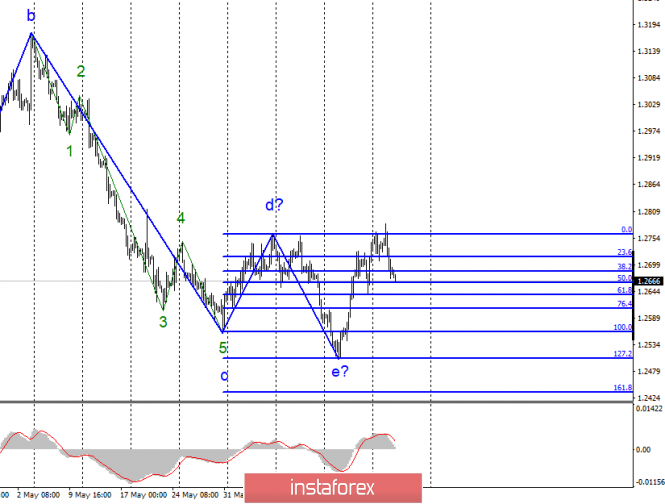

GBP / USD

The pair GBP / USD declined by 50 basis points the day before, and the attempt to break through the level of 0.0% Fibonacci, which is also the maximum of the supposed wave d, failed. Proceeding from this, the pound-dollar instrument can now resume the construction of a downward trend section with targets below the minimum of the assumed wave e. As in the case of the euro, the news background will play a big role. Today, in addition to a report on durable goods orders in the United States, Mark Carney’s presentation will be interesting. After the last meeting of the Bank of England, Carney was very stingy with comments, and his rhetoric could not be called either “hawkish” or “dovish”. Perhaps today, one will bend to one of the parties, which will tell the markets what strategy to follow in the coming days. In any case, before the breakthrough of the high of June 7, the upward prospects of the pound remain in great doubt.

Sales targets:

1.2434 – 161.8% Fibonacci

1.2359 – 200.0% Fibonacci

Shopping goals:

1.2767 – 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound / dollar instrument has changed and is now suggesting the construction of a new upward trend. At the same time, I recommend waiting for a successful attempt to break the maximum of wave d, which confirms the willingness of markets to further increase, and only then you can buy the instrument.

The material has been provided by InstaForex Company – www.instaforex.com