Wave analysis of EUR/USD and GBP/USD for June 27, 2019

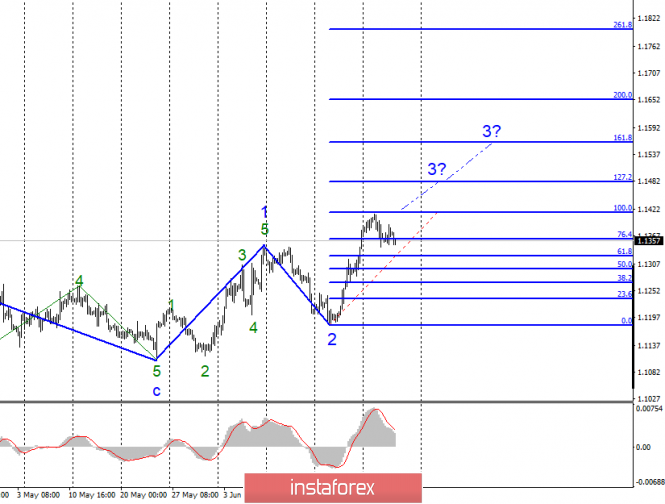

EUR / USD

On Wednesday, June 26, trading ended with a rise of several base points for the EUR / USD pair. This increase was so small that in no way affected the current wave counting, suggesting a slight pullback down as part of the correctional wave in the future 3 upward trend segments. Thus, we are waiting for the signal upwards from MACD to identify the possible beginning of wave 3, 3. The news background for the instrument does not favor the dollar, based on what is reasonable in expecting a continuation of the upward trend plot. Today, for example, another important report will be released in America, which will show changes in GDP in the first quarter. Forecasts suggest a growth of 3.1%. If in reality the increase is not that huge, it will give the markets a reason to re-sell the US currency. At the same time, an alternative variant of the development of events is the completion of about 14 figures for the construction of an upward trend, which is thus transformed into a three-wave structure. But so far, there are no compelling reasons to assume this particular option.

Purchase goals:

1.1417 – 100.0% Fibonacci

1.1480 – 127.2% Fibonacci

Sales targets:

1.1180 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro / dollar pair is presumably located within the 3 waves of the upward trend. I recommend buying Eurocurrency with targets located near the estimated marks of 1.1417 and 1.1480, which equates to 100.0% and 127.2% Fibonacci, with the MACD signal up. Now, the correctional wave continues its construction.

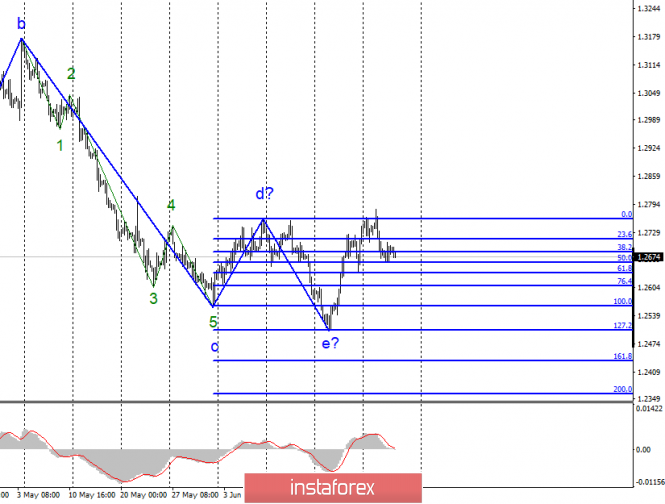

GBP / USD

The GBP / USD pair did not change even one base point on June 26. The activity of the foreign exchange market yesterday was at a very low level, although its participants had something to discuss and analyze. Brexit still remains in a state of pause. In the UK, discussions are in full swing on who will become the new prime minister and what version of Brexit will he follow. Although many associate the post of prime minister with the name of Boris Johnson, the election victory is still not in his pocket. Jeremy Hunt is a calmer candidate, and ultimately his victory may embody the reluctance of voters to leave the European Union under a tough scenario that Johnson endorses, openly stating this in every interview. Of great importance was the speech of Mark Carney, Chairman of the Bank of England.

Sales targets:

1.2434 – 161.8% Fibonacci

1.2359 – 200.0% Fibonacci

Purchase goals:

1.2767 – 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound / dollar instrument has changed and is now suggesting the construction of a new upward trend. At the same time, I recommend waiting for a successful attempt to break the maximum of wave d, which confirms the willingness of markets to further increase, and only then, buy the tool.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Wave analysis of EUR / USD and GBP / USD for June 27. Euro and pound sterling took a break.