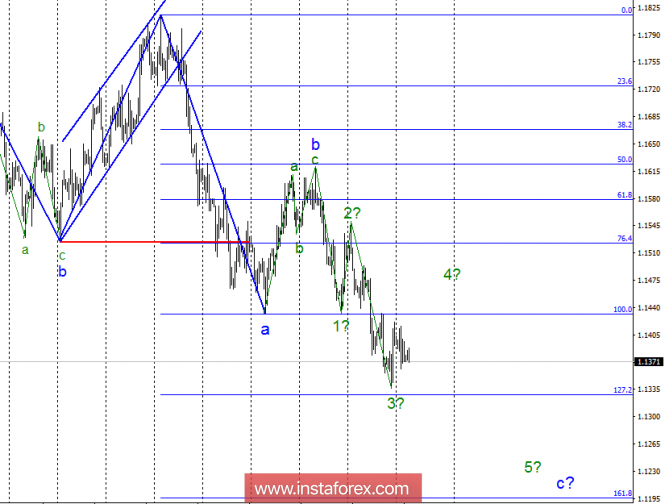

Wave analysis of EUR / USD for October 30. Corrective waste within wave 4 is possible.

Wave counting analysis:

In the course of trading on Monday, the EUR / USD currency pair lost about 30 basis points, however, it remains allegedly as part of building wave 4, c. If this is true, then the pair will resume raising with targets located near the 100.0% of Fibonacci level, or slightly higher. After that, the decline will resume within wave 5, c. The news background now suggests the continuation of the construction of the downward trend. The GDP report, which will be released today in the EU, may return the pair to the construction of a downward wave.

The objectives for the option with sales:

1.1327 – 127.2% of Fibonacci

1.1194 – 161.8% of Fibonacci

The objectives for the option with purchases:

1.1522 – 76.4% of Fibonacci

1.1432 – 100.0% of Fibonacci

General conclusions and trading recommendations:

The currency pair is supposed to continue building wave 4, c. Thus, now I recommend not to open new sales, but to wait for the completion of this wave. Since the wave counting involves the construction of at least one more descending wave, sales remain the working variant for the pair, with targets located near the calculated elevations of 1.1327 and 1.1194, which equates to 127.2% and 161.8% according to Fibonacci.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Wave analysis of EUR / USD for October 30. Corrective waste within wave 4 is possible.