Wednesday 10th September: Daily technical outlook and review

Price action confirmation: Simplymeans traders will likely wait for price action to confirm a level by consuming an opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also. Pending orders: means pending orders are likely seen.

EUR/USD:

Weekly TF: The EUR/USD sold off sharply last week breaking below the weekly demand area at 1.31037-1.32262. This move potentially cleared the way down to a prominent weekly ‘buy zone’ seen at 1.26591-1.28010.

Daily TF: A reaction has been seen around the top of a daily demand area at 1.27541-1.28676, not surprising really considering this area is sitting just above a weekly ‘buy zone’ mentioned above at 1.26591-1.28010. The subsequent rebound rally produced a potential bullish closing price, but the only way find out if this buying is legit and not just traders covering their shorts with be a follow through to the upside. A key area in particular is the daily decision-point area (supply) above at 1.31589-1.31091.

4hr TF: Our P.A confirmation buy level set at 1.29056 was recently triggered (just above the 4hr S/D flip area at 1.28970-1.28590 and round number 1.29), a subsequent rally followed up to an important 4hr decision-point level at 1.29580, which in our opinion NEEDS to be consumed (essentially meaning price breaking above this level) before any pending buy orders are set.

Pending orders/P.A confirmation levels:

Pending orders/P.A confirmation levels:

- Areas to watch for buy orders:P.O: No pending buy orders are seen in the current market environment.P.A.C: 1.29056 (Active-awaiting confirmation) (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: No pending sell orders are seen in the current market environment. P.A.C:1.29950 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

GBP/USD:

Weekly TF: The weekend gap has forced prices to trade below the weekly R/S flip level support at 1.62591, if follow-through selling is seen, the weekly demand area at 1.58533-1.60157 will likely be hit soon.

Daily TF: The gap below daily demand at 1.62510-1.63401 seen at the beginning of the week likely signals a continuation move down to around a fantastic-looking area of daily support at 1.58992 (neatly located within the aforementioned weekly demand area), since looking to the left of current price, most of the daily demand zones appear to have already been consumed.

4hr TF: Since price is currently trading quite close to a weekly demand area (1.58533-1.60157), beginning to look for buying opportunities may not be a bad idea for the time being. The British pound is quite frankly a mess at the moment seen trading around the number 1.61 with no real decision being made yet. We have a sneaky suspicion that pro money may be accumulating buy orders to sell into, ultimately with the plan to test the 4hr demand area below at 1.59875-1.60350, since deep within this zone is a huge psychological number (1.6), these levels tend to be magnets for price! We currently have a pending buy order set just above this round-number level at 1.60112.  Pending orders/P.A confirmation levels:

Pending orders/P.A confirmation levels:

- Areas to watch for buy orders:P.O: 1.60112 (SL: 1.59586 TP: Dependent on how price approaches) P.A.C: No P.A confirmation buy levels are seen in the current market environment.

- Areas to watch for sell orders: P.O: 1.62667 (SL: 1.63517 TP: Dependent on how prices approaches) P.A.C: No P.A confirmation sell levels are seen in the current market environment.

AUD/USD:

Weekly TF: A break below the weekly consolidation area (0.94600/0.92046) is taking place at the time of writing, could this be just a fakeout to stop sellers out, or is it really a continuation move in the making? Let’s go down to the lower timeframes to see what we can find.

Daily TF: There is a clear break of a daily demand area at 0.92046-0.92354, this may very well encourage follow-through selling down to at least the daily R/S flip (support) level at 0.91323.

4hr TF: Clearly, our P.A confirmation buy level set just above the 4hr fakeout area (0.92619-0.92780) at 0.92807 stood no chance against the recent selling onlsaught seen. With a break below the weekly consolidation area at 0.94600/0.92046, we will be attempting to take full advantage of any follow-through selling that may materialize, but also, at the same time remaining aware this could indeed be a fakeout (below the weekly consolidation area) and buying could very well be seen! With that being said, we have set two near-term P.A confirmation sell levels, anticipating that buying may be seen off of the round number 0.92 where price is currently trading at the moment (confirmation is needed for the reasons stated above). Our first P.A confirmation sell level is set just below an ignored 4hr demand level (0.92384) at 0.92350, the second just below a beautiful-looking 4hr decision-point area (0.92875-0.92718) at 0.92684.

Pending orders/P.A confirmation levels:

Pending orders/P.A confirmation levels:

- Areas to watch for buy orders: P.O: No pending buy orders are seen in the current market environment P.A.C: No P.A confirmation buy levels are seen in the current market environment.

- Areas to watch for sell orders: 0.93911 (SL: 0.94049 TP: Dependent on how price approaches) P.A.C: 0.92350 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed) 0.92684 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

USD/JPY:

Weekly TF: Follow-through buying is currently being seen on the USD/JPY after price broke above the weekly supply area at 105.432-104.065. From here, we see very little on this timeframe stopping price from hitting the heavy-weight weekly supply area at 110.652-108.123.

Daily TF: The buying seen on this pair is pushing prices deeper within a daily supply area at 106.946-105.083. This area will not likely hold up since most, if not all of the major supply has already been consumed, take a quick look in history within the zone, can you see all those wicks/spikes north (from 106.946 to 106.124)? Unfortunately, we do not have the historical data to go deeper on the lower timeframes, but from this timeframe we see very little supply stopping prices from reaching the weekly supply area mentioned above at 110.652-108.123.

4hr TF: At the time of writing, price is standing strong just above the round number 106. This level could be a potential buy area on the lower timeframes with confirmation, but as it stands on this timeframe we see no safe buying opportunities just yet. If this round number level gives way, then a key level to watch would be the ignored QM level (now support) at 105.301, these levels usually give a bounce at the very least! We would’ve liked to have set a pending buy order just above this level, however looking just below there seems to be ‘space for price to move’ i.e. pro money may perform a deep test (spike) on this level down to the round number 105 which could result in traders getting stopped out, hence confirmation is needed on this one (P.A confirmation buy level set at 105.377). We certainly have no interest in selling this market, buying at any logical area suits us fine for the time being on this pair.  Pending orders/P.A confirmation levels:

Pending orders/P.A confirmation levels:

- Areas to watch for buy orders:P.O: No pending buy orders are seen in the current market environment P.A.C:105.377 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: No pending sell orders are seen in the current market environment. P.A.C: No P.A confirmation sell levels are seen in the current market environment.

EUR/GBP:

Weekly TF: The Euro initially gapped higher at the open (0.80099) allowing price to once again trade around the upper limits of the weekly decision-point area at 0.80328-0.79780. This move has potentially confirmed higher prices may be seen up to weekly supply coming in at 0.81571-0.80805.

Daily TF: The gap in price appears to have well and truly consumed the sellers around daily supply at 0.80161-0.79846, which has likely cleared the path north up to around daily supply at 0.81515-0.81145.

4hr TF: A break above the high 0.80351 has recently been seen (marked with a blue arrow at 0.80359). This move has likely cleared some of the sellers sitting around this area, meaning a push up to the fresh 4hr supply area at 0.80619-0.80409 may well happen sometime this week. Following this, the sellers pushed price down into the round number 0.8; this may have only been short-covering though, judging by the pathetic attempt to trade higher. The selling pressure seemed to have dried up when the market tested an obvious-looking 4hr demand area at 0.79771-0.79848. However, things are not looking too good for the buyers at present, active sellers are currently trading around the round number 0.8; presumably these sellers are attempting to play the retest. A break above this round number level will likely encourage follow-through buying up to the 4hr QM resistance level at 0.80104 (We know this is not a genuine QM level as no lower low has been seen yet, all the same, it’s a level worth watching), at which we have a P.A confirmation sell level set just below at 0.80090. The reasoning for not setting a pending sell order here was simply because prices would be too close to a potential troublesome support (0.8), taking a trade short there without confirmation just would not make sense to us from a risk/reward perspective.  Pending orders/P.A confirmation levels:

Pending orders/P.A confirmation levels:

- Areas to watch for buy orders: P.O: No pending buy orders are seen in the current market environment. P.A.C: No P.A confirmation buy levels are seen in the current market environment.

- Areas to watch for sell orders: P.O: 0.80533 SL: 0.80660 TP: Dependent on how price approaches).P.A.C:0.80090 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

USD/CAD:

Weekly TF: Once again, price is currently trading around a weekly supply area at 1.10522-1.09996. Was the initial touch at 1.09967 just to draw the sellers in, only to retrace price back up to this area forcing traders to cover their positions? We have seen this kind of move time and time again, and it usually results in a heavy being seen.

Daily TF: A small push above a daily supply area at 1.09967-1.09401 has likely opened up the possibility for a test of the daily supply area at 1.10522-1.10133 (Set deep within the weekly supply area just mentioned above). So, with this in mind, a push deeper into the weekly supply area may well be seen sometime this week.

4hr TF: After the heavy round of buying seen on the Loonie, selling interest has come into the market around the huge psychological number 1.1. Is this selling interest genuine, or is it just traders covering their long positions? If it’s genuine, we can expect a drop down to at least the 4hr S/R flip level support at 1.09311. On the contrary, a push above the round number level up to the 4hr supply area at 1.10388-1.10163 is what we’re currently watching for at the moment. One can only imagine the amount of stops situated just above this level, not to mention the breakout buyers’ buy orders as well. Now, if these stop orders get filled, automatically becoming buy orders, this would likely generate liquidity for pro money to sell into. Therefore, this is what we have in our favor for a short trade just below the aforementioned 4hr supply area (pending sell order set just below at 1.10127):

- Currently trading within not only daily supply at 1.10522-1.10133, but also weekly supply at 1.10522-1.09996 as well.

- Fresh, untouched 4hr supply mentioned above.

- A perfect fakeout zone for pro money take full advantage of (the area in between the round number 1.1, and the aforementioned 4hr supply area.

Pending orders/P.A confirmation levels:

Pending orders/P.A confirmation levels:

- Areas to watch for buy orders:P.O: 1.08028 (SL: 1.07884 TP: Dependent on how price approaches). P.A.C:No P.A confirmation buy levels are seen in the current market environment.

- Areas to watch for sell orders: P.O: 1.10127 (SL: 1.10440 TP: Dependent on how price approaches) P.A.C: No P.A confirmation sell levels are seen in the current market environment.

USD/CHF:

Weekly TF: Price is now currently trading around a strong-looking weekly supply area at 0.94546-0.93081. If sellers enter the market here, we can likely expect active buyers to be situated around the weekly R/S flip level support at 0.90927.

Daily TF: A beautiful to-the-pip reaction has been seen around daily supply at 0.94546-0.93702. If this selling continues, the first trouble area for the sellers on this timeframe is likely around a daily decision-point level at 0.93019.

4hr TF: It seems we may have missed the boat on this one! The 4hr supply area at 0.93911-0.93746 was untouched, and neatly located within not only a daily supply area at 0.94546-0.93702, but also a nice-looking weekly supply area at 0.94546-0.93081, making this zone an ideal place to short at, and we did not see it! All is not lost though, we know pro money love to get the best prices on all of their trades, and this one is no different. Price may very well still trade deeper into this 4hr supply area aiming for where the initial ‘decision’ was made to push prices south. We have placed a pending sell order around where the decision was likely made at 0.93845. Having our sell order so deep within this 4hr supply area may work to our advantage (if it’s filled of course), since we are now avoiding the possibility of pro money faking above this 4hr supply area to the round number 0.94. So, for now it’s a waiting game.

Pending orders/P.A confirmation levels:

Pending orders/P.A confirmation levels:

- Areas to watch for buy orders: P.O: 0.92635 (SL: 0.92410 TP: Dependent on how price approaches) P.A.C: No P.A confirmation buy levels are seen in the current market environment.

- Areas to watch for sell orders: P.O: 0.93845 (SL: 0.94078 TP: Dependent on how price approaches) P.A.C: No P.A confirmation sell levels are seen in the current market environment.

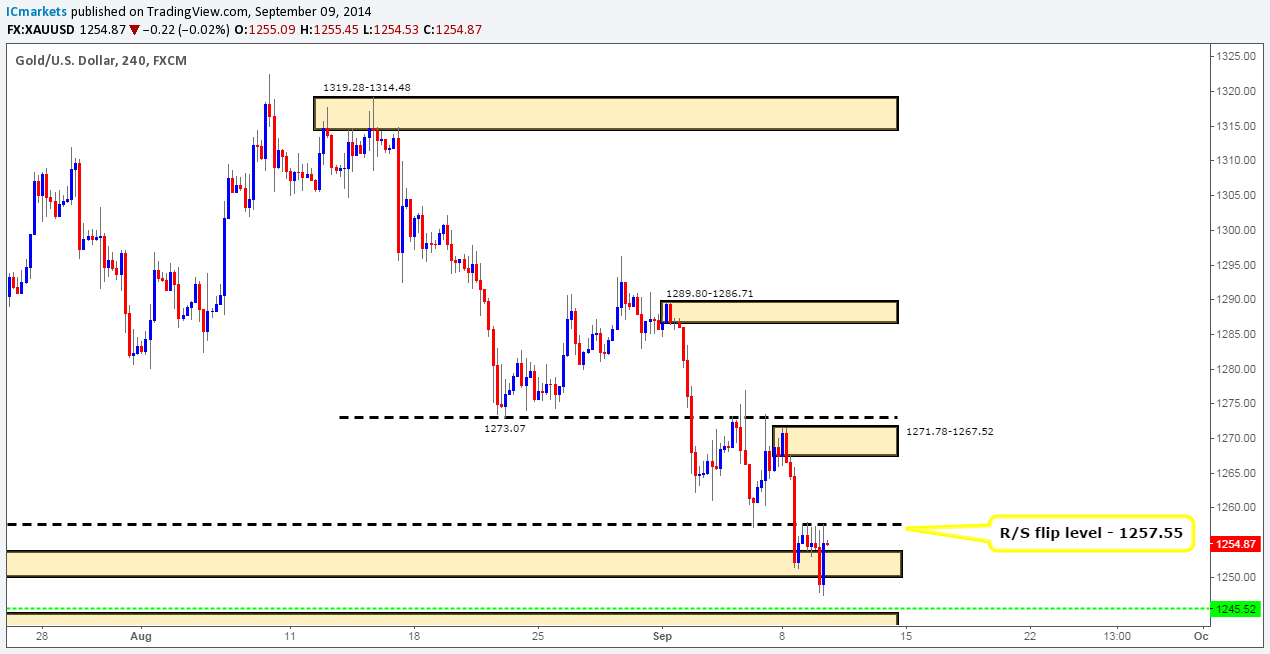

XAU/USD (GOLD):

Weekly TF: At the time of writing, price is trading just above a weekly decision-point (support) level at 1244.08. In our humble opinion, it may be time to be locking in profits on any shorts open, and thinking about looking for buying opportunities.

Daily TF: On the daily timeframe price is seen entering a daily demand area at 1238.41-1254.85. This area of demand appears weak from the deep test seen on 03/06/14 at 1240.23. Nonetheless, price is currently trading around a small daily decision-point level (demand- 1252.02) at the moment, notice this level was not a reaction to anything, and until now remained untouched.

4hr TF: Considering where price is located on the higher timeframes at the moment (weekly decision-point (support) level at 1244.08, daily demand area at 1238.41-1254.85), we are naturally expecting to see higher prices sometime soon. With that in mind, strong selling opposition around the 4hr R/S flip (resistance) level at 1257.55 is clear; just take a look at those wicks!! A break below the 4hr demand area at 1250.15-1253.79 has been seen, traders should be wary here, this could very well be a fakeout performed by pro money to accumulate orders to go long, and does not necessarily mean price is free to hit the next fresh 4hr demand area below at 1240.92-1244.87, no matter how good it looks. Our plan here is to patiently watch price action, if a close above the aforementioned 4hr R/S flip (resistance) level is seen, we will then be looking to play the retest up to at least 4hr supply at 1271.78-1267.52. If follow-through selling is seen from here, we have a pending buy order (1245.52) set ready and waiting above the lower of the two 4hr demand areas already mentioned.  Pending orders/P.A confirmation levels:

Pending orders/P.A confirmation levels:

- Areas to watch for buy orders: 1245.52 (SL: 1239.58 TP: Dependent on how price approaches) P.A.C: No P.A confirmation buy levels are seen in the current market environment.

- Areas to watch for sell orders: P.O: No pending sell orders are seen in the current market environment. P.A.C: No P.A confirmation sell levels are seen in the current market environment.