Wednesday 20th May: European Open Briefing

Global Markets:

- Asian stock markets: Nikkei up 1.10 %, Shanghai Composite gained 1.30 %, Hang Seng declined 0.25 %, ASX rose 0.05 %

- Commodities: Gold at $1208 (+0.15 %), Silver at $17.10 (+0.15 %), WTI Oil at $58.66 (+1.15 %), Brent Oil at $64.70 (+0.60 %)

- Rates: US 10 year yield at 2.27, UK 10 year yield at 1.96, German 10 year yield at 0.605

News & Data:

- Japan GDP 0.6 % q/q, Expected: 0.4 %, Previous: 0.3 %

- Japan GDP 2.4 % y/y, Expected: 1.5 %, Previous: 1.1 %

- Japan GDP Price Index 3.4 % y/y, Expected: 3.6 %, Previous: 2.4 %

- Japan GDP Private Consumption 0.4 % q/q, Expected: 0.2 %, Previous: 0.4 %

- Australia Westpac Consumer Sentiment 6.4 %, Previous: -3.2 %

- Japan Econ Minister Amari: Improvements In Jobs, Income Conditions, As Well As Effect Of Oil Price Falls Likely To Underpin Recovery — RTRS

- Equities gain, euro slumps as ECB eyes faster bond buys – RTRS

- Oil prices rise on strong Japan, Australia economic data – RTRS

- Japan’s economy grows at fastest pace in a year on boost from inventory – RTRS

Markets Update:

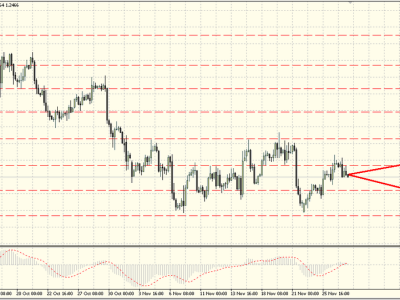

The Euro weakened sharply after comments from an ECB official that the central bank will buy more government bonds during this month and June and less during the summer months, when liquidity conditions are worse. Adding to the USD strength was US housing data, which beat expectations. Further, on-going concerns about the situation in Greece and whether the country will be able to remain in the Euro Zone are once again weighing on the Euro.

Overnight, Japanese GDP data arrived stronger than anticipated, which boosted APAC stock markets and oil prices. Dealers report that there was good demand for USD/JPY from a semi-official name, along with the usual corporate buyers. Offers noted in front of the 121.00 barrier option, but those are unlikely to hold much longer. The next major tech resistance level now lies at 122.00, which is the current 2015 high.

Upcoming Events:

- 07:00 BST – German PPI

- 08:00 BST – Chicago Fed President Evans speaks

- 08:30 BST – Swedish Unemployment Rate

- 09:00 BST – Norwegian GDP

- 09:30 BST – Bank of England Meeting Minutes

- 10:00 BST – Swiss ZEW Expectations

- 12:00 BST – Turkish Central Bank Interest Rate Decision

- 13:30 BST – Canadian Wholesale Sales

The post Wednesday 20th May: European Open Briefing appeared first on .