WEEKLY OUTLOOK: FOCUS ON SOUTH KOREA AND CRYPTOCURRENCIES RATINGS BY WEISS

Last week, there was panic selling in the cryptocurrencies space after South Korea’s finance minister reaffirmed his stance on shutting down the exchanges.

This move would be the second largest in scope following last year’s decision by China to ban ICOs and exchanges since South Korea remains one of the largest markets for cryptocurrencies. After the Chinese government pulled the plug on exchanges, investors moved their operations to other countries, including South Korea, which led to a somewhat stable market.

Last week’s sell off saw bitcoin trade below $10,000 while ethereum dropped to less than $900. Ripple dropped by more than 50%, which saw its co-founder lose more than $44 billion in paper wealth. In total, traders lost more than $100 billion.

This week, the focus among traders will be on countries and regulatory issues. They will focus on South Korea, which seems torn between shutting the exchanges and retaining them. On Monday, the country announced that it would seek to demand millions of dollars from the exchanges in taxes. For example, Bithumb will be required to pay more than $50 million in taxes.

Without a doubt, this measure will present the exchanges with major challenges since some of them have already been affected by the recent slump in the value of the cryptocurrencies.

Apart from that, a source from the government recently told YonHapNews that as part of the country’s crackdown on cryptocurrencies, the government would soon start asking exchanges to share users data with banks. This is a significant piece of information that when applied, would impact the price of these currencies. Remember, the main appeal of cryptocurrencies is on the anonymity of the transactions.

More pertinent news came from the United States where a renowned ratings agency announced that it will start offering letter grades to cryptocurrencies. In a notice on its website, Weiss Ratings, which tracks more than 55,000 institutions and investments, said that it will release its first ratings on all the major coins on Wednesday.

This is a very important information coming at a time when many large investors are considering putting some of their money on cryptocurrencies. Overly negative ratings could lead to a slump in the affected currencies.

Following the slump last week, several analysts have commented on cryptocurrencies. Among the most vocal was Peter Boockvar, the chief investment officer at Bleakley Advisory Group who told CNBC that he expected bitcoin to fall to between $1000 and $3000. He called the currencies a perfect bubble, where people buy items without considering the intrinsic value.

On bitcoin, he contended that the costs of mining and transferring bitcoins, coupled with the delay of completing a transfer would hinder people from using it in large scale. In fact, a recent report by Fortune suggested that crooks were abandoning bitcoin for other currencies. In another report by Chainalysis found that the number of bitcoin-related transactions in the dark net had fallen from more than 30% to about 1%.

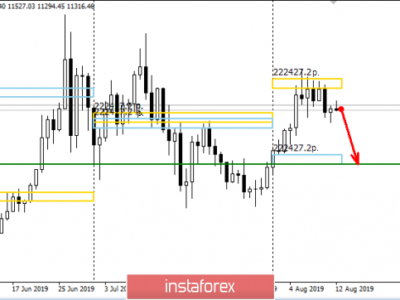

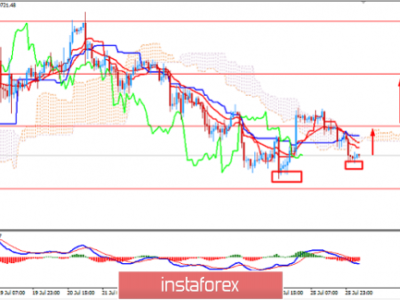

Today, bitcoin is down 4.25% to trade at $10,387. If the downward trend persists, traders should pay close attention to the monthly low level of $9,216.

In the past few years, the rise of cryptocurrencies proved how difficult it is to make solid analysis and predict their future prices. What is obvious is that traders should take caution and always be on the lookout for major market news, which could affect their prices. Wednesday’s ratings by Weiss could be such news.