What are They Setting Us Up For?

Aah, summer’s finally here. The air conditioners are running again and each day seems warmer than the previous one. Each day the market seems to be going up, up, up with no end in sight. Isn’t it great? A seemingly never ending upward bull market? This could go on forever; are we finally getting it right? Wrong. The institutional players aka Smart Money wants you to think that. They want you to invest in the markets and if you happen to be a buy and holder, they like that even more.

Why?

They want you to believe that the markets will go up with no end in sight, in that way they can take your money out when they decide to short the market and when they do so; it will be dramatically painful. Tell me how it goes that the market seem to continue to rise on not too stellar economic news? We witnessed the same phenomena last summer. The markets kept rising on bad economic news as the fear then was of tapering Quantitative Easing. The mindset seemed to be “well the Fed won’t taper as long as the economic news is bad”. Wrong. The Fed started to taper in December. The fear now is of raising interest rates, which is reflective of the FFR (Federal Funds Rate) aka the “overnight rate”.

This past week we’ve seen the same phenomena occur multiple times. This past Friday the Non-Farm Payroll numbers were released in the United States that in my opinion weren’t stellar. But what did we see? Headlines that claimed “A Solid Jobs Report” or “The US has Regained all Jobs Lost”. These headlines are meant to confuse you, they’re meant to give you a false sense of security. As a trader you see the headlines, you see the markets going up, so what do you do? You go long. Why? You trade what you see. Now, there’s nothing wrong with that and as a trader you should trade what you see. But as a prudent trader you should also know what this is and if you took a longer view of things you would know what it is. It’s Market Manipulation at its worst.

Want proof?

One of the headlines claimed “the US has Regained all Jobs Lost during the Great Recession”. But what it doesn’t tell you is that the population in the US has grown by 12 million in the same time period. How many of those 12 million are newly minted college graduates with no job in sight? Or as Janet Yellen has no eloquently put it “shacking up with their parents”? I know as I have two right next door to me who have searched for YEARS and still haven’t found suitable and meaningful work that pay a living wage and both have college degrees. Here’s another measure:

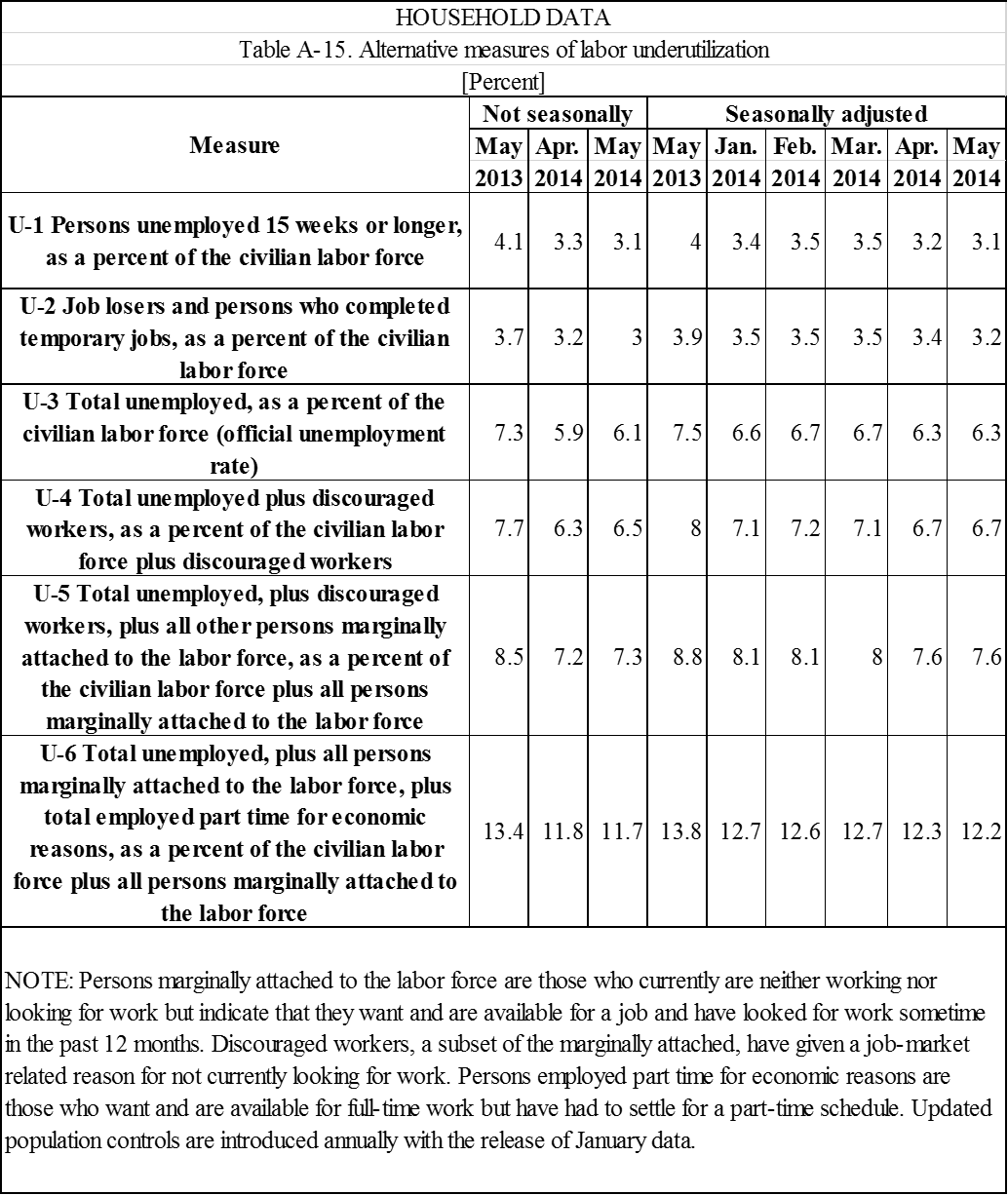

Table A-15. Alternative measures of labor underutilization (click to enlarge)

U.S. Bureau of Labor Statistics | Division of Current Employment Statistics, PSB Suite 4860, 2 Massachusetts Avenue, NE Washington, DC 20212-0001

U.S. Bureau of Labor Statistics | Division of Current Employment Statistics, PSB Suite 4860, 2 Massachusetts Avenue, NE Washington, DC 20212-0001

I am neither a bull nor a bear. I seek to capitalize on market conditions as they present themselves. However I am not blind to the fact that sooner or later the market will rear its ugly head and setup everyone for a major fall and it won’t matter if you trade stocks, bonds, options or currencies. I’m just hopeful that we will all be on the right side of the market.The above chart shows the U6 rate which is the rate of persons looking for and seeking full time, gainful employment in the United States. If this Non-Farm Payrolls number was so great, then how does it go that the U6 rate is at 12.2% for the month of May? If it was so great then why is the “official” unemployment still at 6.3%? By the way, the U6 rate is what Fed Chair Janet Yellen looks at. She knows all too well that this “recovery” is tepid at best. Why do you think the Fed is still keeping interest rates at all-time lows? And the report itself? 217,000 jobs created and yes it did beat expectation by 3,000 but did not beat the prior month. In April, 288,000 new jobs were created.