XAUUSD Monday 23rd June: Weekly technical outlook and review.

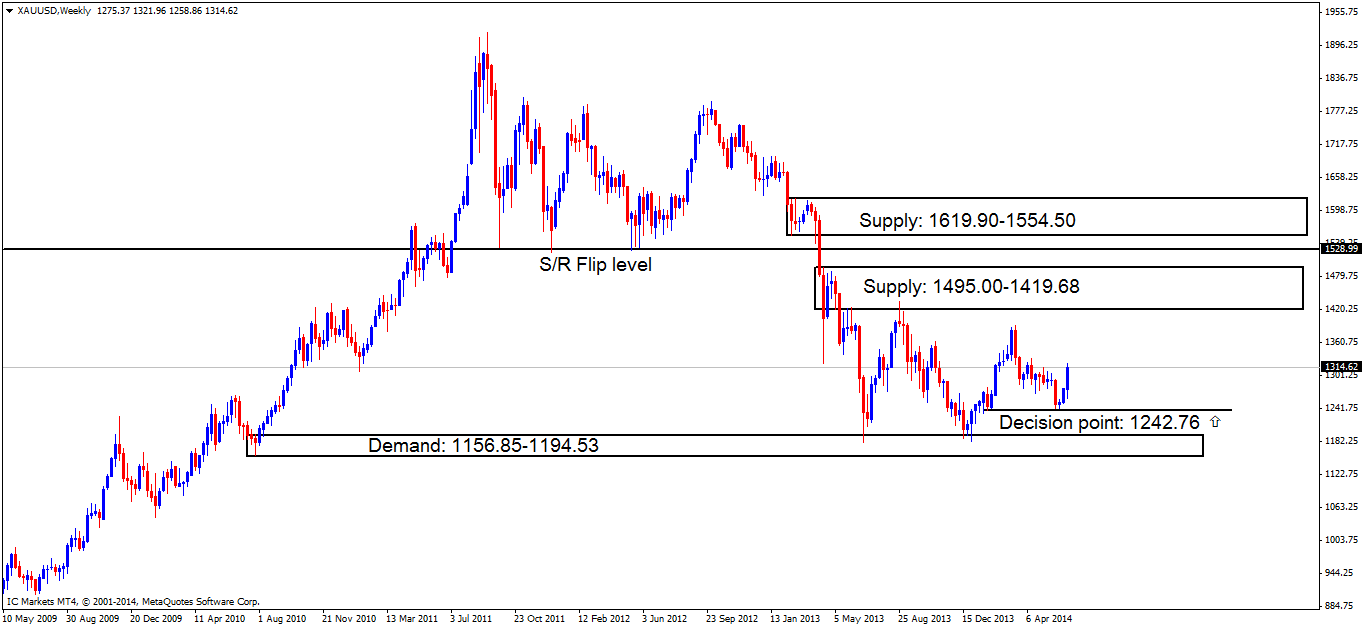

There is an obvious decision point area seen at 1242.76 that is worth noting down for future buying opportunities which is between supply above at 1495.00-1419.68 and demand below at 1156.85-1194.53. Buyers remained in control for the majority of last week, with little to no interest shown by the sellers on this timeframe.

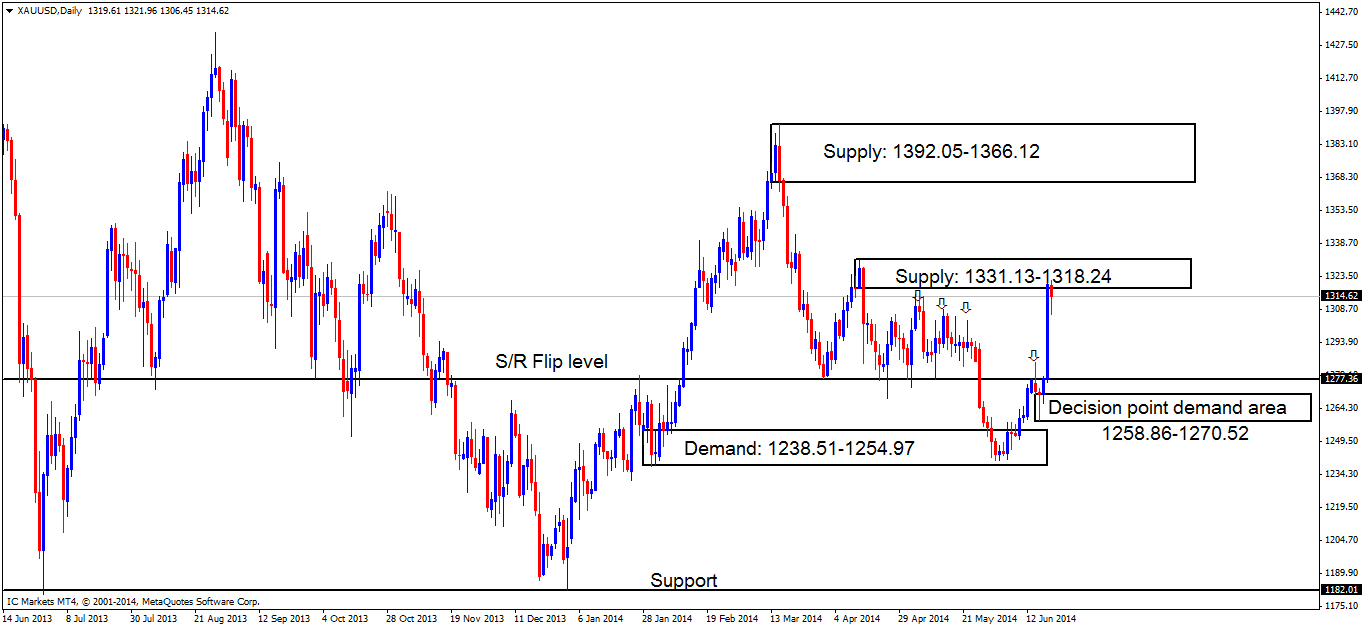

Daily TF.

Look at the strength of that daily candle! Price was able to move this far due to supply already being consumed to the left, notice how the wicks consumed supply as price moved down (marked with arrows), little selling pressure – big buy orders = a full bodied candle such as this. This momentum candle traded right into supply at 1331.13-1318.24 where the sellers started to show interest, albeit not a lot of interest, but there was some. Traders should be careful here though, as all this could have been is traders taking profit on the recent move up, so do not be fooled!

A new decision point area (demand) at 1258.86-1270.52 has been formed due to this momentum seen last week, pro money only have the accounts to move price like this, hence there may be unfilled buy orders still there.

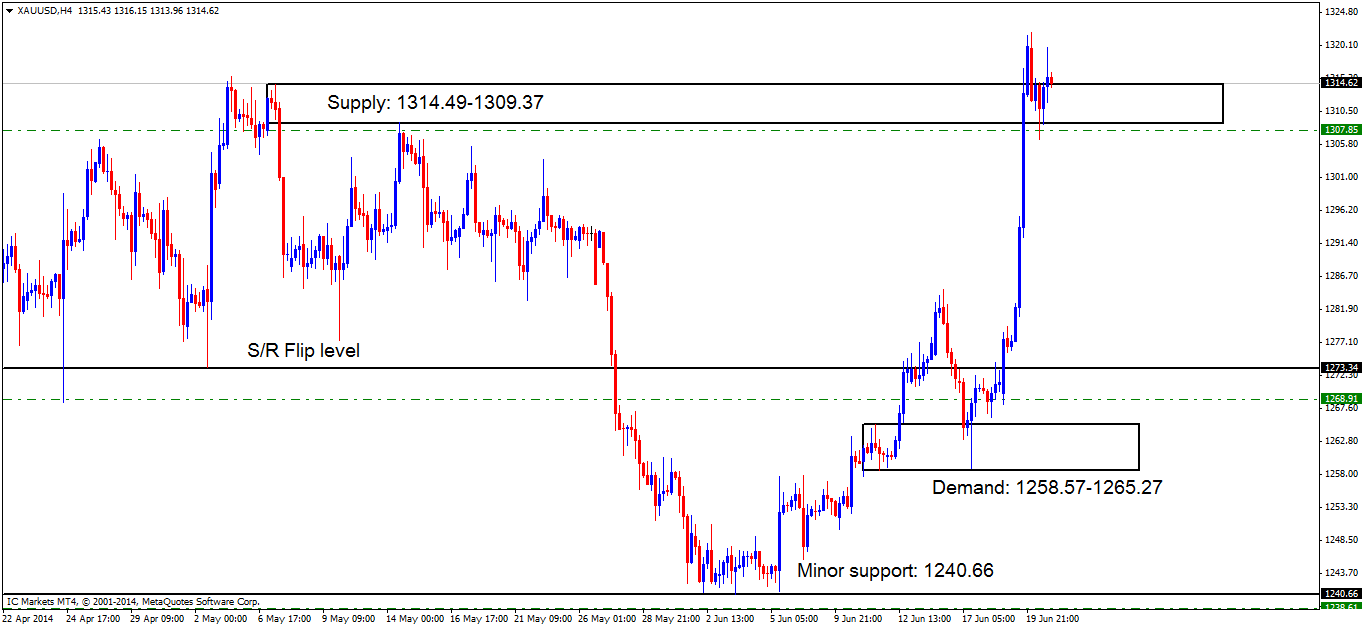

4hr TF.

Chart one below shows how price consumed supply at 1314.49-1309.37, giving the sellers no chance!

Chart 1:

Pending/P.A confirmation orders:

- The pending buy order (Green line) set above demand (1231.56-1237.57) at 1238.61 has been removed due to price moving too far away from the entry level.

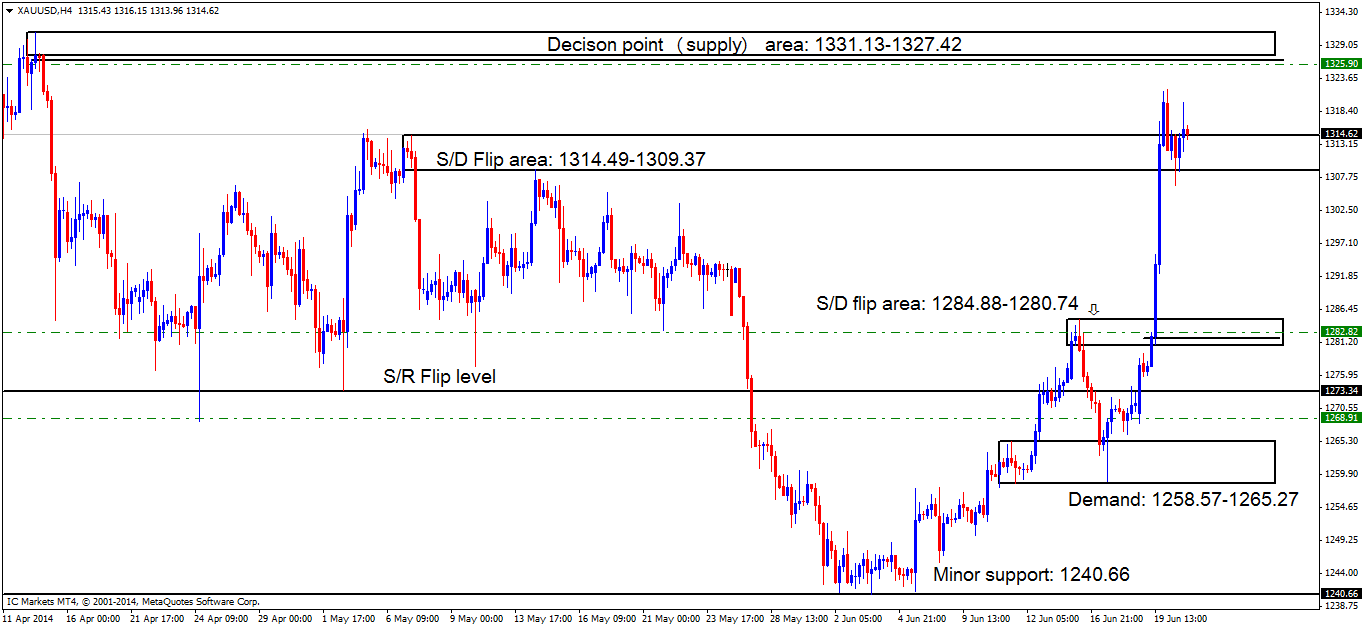

- New pending buy orders (Green line) are seen within demand (S/D flip area… 1284.88-1280.74) at 1282.82. We have set a pending buy order here due to the fact there was a decision made here (marked by the black horizontal level, when decisions are made by pro money, they may be unfilled buy orders left there, hence the fact we have set our pending order there.

- Pending buy orders (Green line) are seen just above demand (1258.57-1265.27) at 1268.91. We are permitted to set a pending buy order here as the buyers have consumed sellers within supply above at 1293.47-1285.52 as per the previous confirmation buy order originally set at 1266.00(See Thursday 19th June).

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- The pending sell order (Green line) set just below supply (1314.49-1309.37) at 1307.85 has been stopped out (See Friday’s analysis for the corresponding chart).

- New pending sell orders (Green line) are seen just below the supply/decision point (1331.13-1327.42) at 1325.90. A pending sell order was set here because this area is deep within daily supply (1331.13-1318.24) and the momentum away from the area indicates unfilled orders may well be left there.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Chart two below shows the alterations that have been made. Supply at 1314.49-1309.37 is now demand, a new decision point (supply) has been spotted above at 1331.13-1327.42 which is located deep within daily supply at 1331.13-1318.24 (see above).

Price now remains capped between supply above at 1331.13-1327.42 and demand (S/D flip area) below at 1314.49-1309.37.

Quick Recap:

The Daily timeframe currently shows price is trading with supply at 1331.13-1318.24, and the 4hr timeframe shows price is currently trading in between supply at 1331.13-1327.42 and demand below at 1314.49-1309.37. Price will likely see a small rally up to the 4hr supply area just mentioned, filling our pending sell order set at 1325.90, before lower prices are seen.

- Areas to watch for buy orders: P.O: 1268.91 (SL: 1264.30 TP: Dependent on approaching price action) 1282.82 (SL: 1275.12 TP: Dependent on approaching price action). P.A.C: There are currently no P.A confirmation buy orders seen in the current market environment.

- Areas to watch for sell orders: P.O: 1325.90 (SL: 1332.71 TP: Dependent on approaching price action). P.A.C: There are currently no P.A confirmation sell orders seen in the current market environment.

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Sources: IC Markets Trading Desk