Yen slips on soft Japan inflation, oil retains gains

Asian markets were in positive territory on Friday following from a positive close on Wall Street and a rebound in oil prices on Thursday. Currency moves had a big influence on the direction of Asian markets.

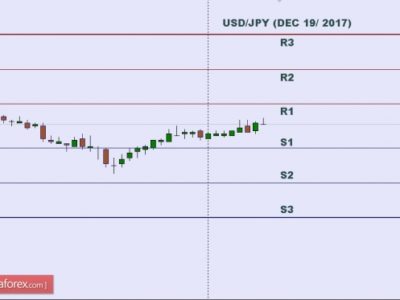

The yen initially weakened following the release of disappointing inflation data out of Japan. Consumer prices fell close to deflationary territory in January. But the yen’s weakness was soon reversed ahead of, and then after, the PBOC (China’s central bank) fixed the reference rate for the yuan weaker.

This week, the Chinese yuan reference rate has declined by 0.2 per cent, the biggest drop since the first week of January.

The British pound remains in focus, as it has been under pressure on Brexit fears. This week the pound slid below $1.40 for the first time since 2009 on rising odds Britain could vote, at a June 23 referendum, to leave the European Union. This morning, sterling edged up by 0.2 per cent to trade at $1.3984.

The euro was up 0.3 per cent at $1.1049.

Oil prices surged on Thursday, with WTI crude rising into the $32 a barrel handle. Meanwhile, Brent crude, the international benchmark, traded in the $34 handle.

Gold has been buoyed this week by safe haven demand. The precious metal traded up 0.3 per cent so far today at $1,236.19 an ounce.

Focus shifts to US inflation data later today as well as the G20 meetings that begin today in Shanghai.

The post Yen slips on soft Japan inflation, oil retains gains appeared first on FXTM Blog.

Source:: Yen slips on soft Japan inflation, oil retains gains