Friday 18th July: Daily Technical Outlook and Review.

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming an opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

EUR/USD:

The higher-timeframe picture resembles the following:

- Sellers on the weekly timeframe are seen pushing deeper within weekly demand at 1.34760-1.36314.

- The daily timeframe shows price is trading just above the upper base of daily demand at 1.34760-1.35265.

Current price action on the 4hr timeframe shows the sellers have pushed price deeper into the 4hr demand area below at 1.35018-1.35375, as reported would likely happen in the last analysis.

A small bullish reaction has been seen around the 1.35240 area. This reaction will likely not see many new highs; the most we can likely expect out of it if it does happen is the 4hr decision-point area at 1.35714-1.35609. A break below the aforementioned 4hr demand area will make things very interesting. Below this level a 4hr demand area is seen at 1.34760-1.34943; do be careful with this area though, as a tail formed on 06.02.2014 has likely consumed most of the important demand around this area already. A more favorable fresh 4hr demand area is seen even lower at 1.33984-1.34404 which will likely produce a nice reaction when, or indeed, if price reaches this far.

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- The P.A confirmation buy order (Red line) set just above demand (1.35018-1.35375) at 1.35417has now been cancelled, price dropped too far from the entry level making this trade invalid now.

- Pending sell orders (Green line) are seen just below the decision-point supply area (1.36632-1.36485) at 1.36416. The reasoning behind placing a pending sell order here is due to the simple fact we have seen buyers consumed at multiple lows and demand areas below, thus making it a low-risk high-probability trade.

- New pending sell orders (Green line) area seen just below the 4hr decision-point area (1.35714-1.35609) at 1.35596. The reason a pending sell order was allocated here is because this is where pro money (on this timeframe) possibly made the decision to sell price into the 4hr demand below at 1.35018-1.35375.

- P.A confirmation sell orders (Red line) are seen just below supply (1.37224-1.37028) at 1.36894. A P.A.C order was selected here due to the reaction seen at the aforementioned supply area proving its validity. However, pro money may well decide to push price higher into this supply area if/when price returns to it, thus making it a risky trade for a stop above the high 1.36995 which could be very easily be stopped out if a pending sell order was set, hence the need to wait for confirmation.

Quick Recap:

Our P.A confirmation buy order originally set at 1.35417 has now been cancelled due to price dropping too far from the entry level. A small bullish reaction is being seen from around the 1.35240 area, with price only likely making it up to the 4hr decision-point area at 1.35714-1.35609 before the sellers begin to show serious interest again.

- Areas to watch for buy orders: P.O: No pending buy orders are seen in the current market environment. P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 1.36416 (SL: 1.36584 TP: Dependent on price action approach) 1.35596 (SL: 1.35768 TP: Dependent on price approach). P.A.C: 1.36894 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

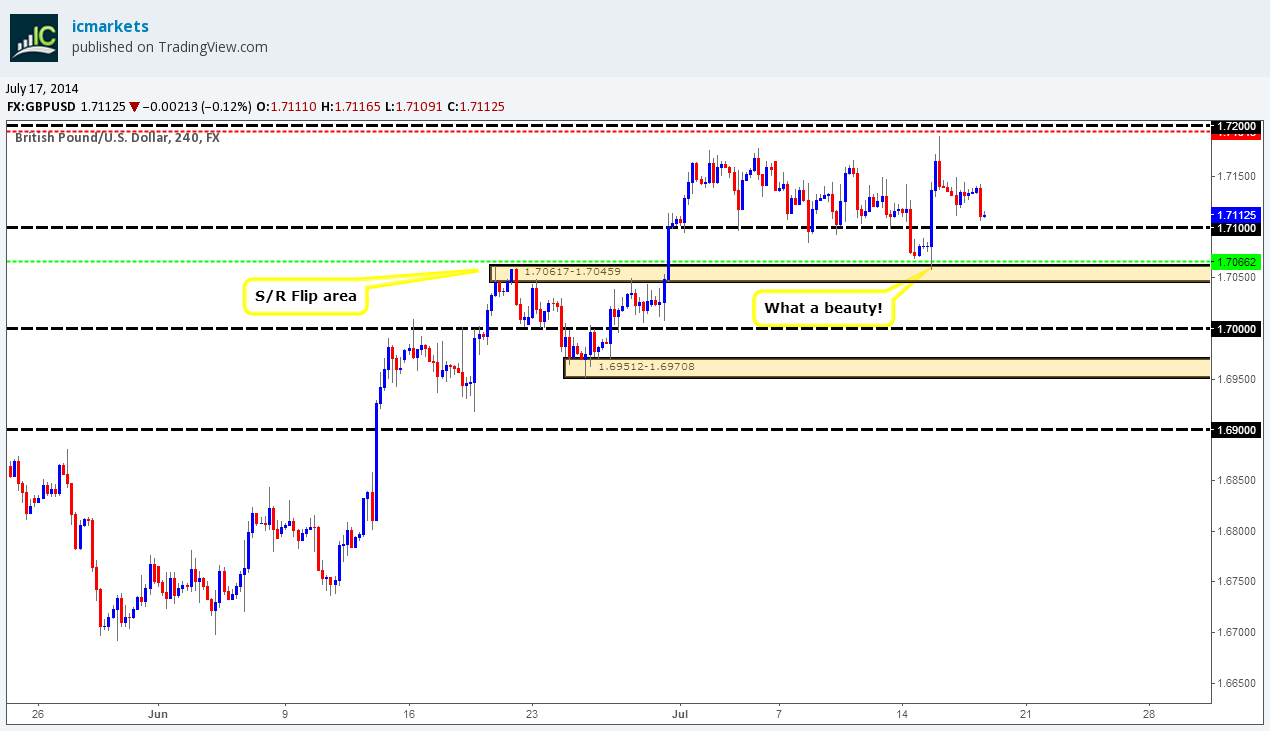

GBP/USD:

4hr TF.

The higher picture resembles the following:

- Buyers are still seen deep within weekly supply territory at 1.76297-1.67702, with a little interest being shown by the sellers at the moment.

- The daily timeframe still shows consolidating price action in no man’s land between daily supply above at 1.76297-1.73024 and daily S/R flip level seen below at 1.69712.

Technically, price has not changed much since the last analysis. We still favor a drop below the round number 1.71000 into the 4hr S/R flip area at 1.70617-1.70459. There are possibly countless traders awaiting there both attempting to fade the level and sell the breakout, and pro money knows this! So, a drop lower below the aforementioned round number level will stop out the majority of the traders going long, but also trigger in the breakout sellers who will likely think they have hit a good trade. However, if they trade only using the lower timeframes, and ignore the higher timeframes, in our opinion they are driving blind because all they’ve done is sold into a 4hr S/R flip area (levels above). Once pro money reaches this area they will likely have enough buy orders in the market as they were no doubt buying up all those sell orders (Stops from the traders who were buying at the round number and breakout sellers’ orders) on offer. By rebounding price from here they will stop out the original breakout sellers forcing them to cover their positions likely adding more fuel to the rally higher (breakout sellers covering their positions will turn their stops into buy orders).

Taking all of the above into consideration we still favor (as mentioned above) a drop lower into the 4hr S/R flip area at 1.70617-1.70459, and a nice bullish reaction is expected to be seen from there.

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen just above demand (1.70617-1.70459) at 1.70662. The reason a pending buy order has been set here is because the buyers have now proved this area by consuming sellers around multiple highs above possibly clearing the path north up to the round number 1.72000. A drop down to the 4hr S/R flip area at 1.70617-1.70459 is expected soon to gather liquidity, which should in turn fill the aforementioned pending buy order in the process.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- No pending sell orders (Green line) are seen in the current market environment.

- P.A confirmation sell orders (Red line) are seen just below the round number 1.72000 at 1.71943. We have placed a P.A confirmation sell order here simply because these psychological levels are prone to deep tests/spikes, so sometimes it is better to wait for that all important confirmation.

Quick Recap:

Price has not changed much since the last analysis, a drop down below the round number 1.71000 into the 4hr S/R flip area at 1.70617-1.70459 is likely, where a likely bullish reaction will follow from here.

- Areas to watch for buy orders: P.O: 1.70622 (SL: 1.70423 TP: Dependent on price approach) P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: No pending sell orders are seen in the current market environment. P.A.C: 1.71943 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

AUD/USD:

4hr TF.

The higher picture resembles the following:

- The weekly timeframe shows price is consolidating at the moment (0.94600/0.92046) with a breakout yet to be seen.

- Buyers and sellers are currently seen trading in between daily supply at 0.95425-0.94852 and an important daily low below at 0.93208 where price is currently trading off of at the moment.

A decision was indeed made on this pair to rally prices higher form the 4hr demand area at 0.93208-0.93417. Buyers and sellers are currently seen battling it out around the minor 4hr S/R flip area at 0.93765. A break above this level is probably on the cards; however a small retracement down to around the 0.93609 area may be seen beforehand.

If a break above is seen, price is relatively clear up to the 4hr decision point level at 0.94408 as most of the sellers around the 4hr supply area (circled) at 0.93933 were more than likely consumed by wick seen at 0.93974 marked with an arrow. This only leaves the aforementioned 4hr decision-point level above, which is definitely an area to watch.

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- P.A confirmation buy orders (Red line) are seen just above the decision point level (0.92566-0.92736) at 0.92775. The reason for placing a P.A confirmation buy order here rather than pending buy order is simply because we were trading just above a daily demand ‘buy zone’ at 0.92046-0.92354, meaning pro money could very well just ignore this level completely and trade deeper into the aforementioned daily demand area, so, confirmation is the order of the day!

- Pending sell orders (Green line) are seen just below supply (0.95425-0.95096) at 0.95052. A pending sell order is placed here due to this being an area where pro money was interested in before; see how close price came to the supply area? (Levels above), this indicates possible strong supply (selling pressure), so the next time price visits we can expect some sort of reaction.

- The pending sell order (Green line) set just below the decision point level (0.94408) at 0.94382 is now active. Our second take-profit target has been hit at 0.93360, so do keep an eye on our third and final target seen just below at the round number 0.93000.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

A rally has been seen from the 4hr demand area at 0.93208-0.93417 up to the minor 4hr S/R flip level at 0.93765. A break above this level will likely be seen soon potentially opening the path up to at least the 4hr decision-point level at 0.94408.

- Areas to watch for buy orders: P.O: No pending buy orders seen in the current market environment. P.A.C: 0.92775 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 0.95052 (SL: 0.95467 TP: Depending on price approach)0.94382 (Active-2nd target hit) (SL: 0.94677 TP: [1] 0.93678 [2] 0.93360 [3] 0.93000. P.A.C: No P.A confirmation sell orders seen in the current market environment.

USD/JPY:

4hr TF.

The higher picture resembles the following:

- The weekly timeframe shows price is trading around a long-term S/R flip level support at 101.206 with a positive close below yet to be seen.

- Buyers and sellers on the daily timeframe are currently trading within a range with daily resistance being seen above at 102.713 and daily demand seen below at 100.747-100.967.

This is just beautiful; the action being seen on this pair is fantastic at the moment. The tail marked with an arrow at 101.425 was very likely sent down by pro money to consume the buyers lurking around the D/S flip area at 101.400-101.465, as price is currently seen trading just below the low of the aforementioned tail.

Now with a direction being possibly shown, we can expect prices to drop to at least the 101.227 area, as this was an obvious area where pro money decided to advance price north in the first place, so do be prepared for a nice bullish reaction around this area when/if price reaches this far.

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen just above the round number 101.000 at 101.020. The reason for setting a pending buy order here is because we are currently trading around a weekly support level (101.206). We would not normally set a pending order around psychological levels such as these, but since we are in a great higher-timeframe location it is worth the risk.

- Pending buy orders (Green line) are seen just above the 101.227 area at 101.249. The reason a pending buy order has been set here is because this was clearly an area where pro money buyers decided to rally prices higher, thus opening the possibility of unfilled buy orders still being active there.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- Pending sell orders (Green line) are seen just below supply (103.294-102.983) at 102.953. A pending sell order was set here due to this being an area where likely unfilled sell orders are.

- The pending sell order (Green line) set just below a decision-point level (resistance, 101.754) at101.696 is now active, our first-take profit level set at 101.465 has been hit, do keep an eye on our second, and final take-profit level set below at 101.227.

- P.A confirmation sell orders (Red line) are seen just below supply (102-191-102.104) at 102.074. A P.A confirmation sell order was used here purely for the simple fact we are trading around a higher-timeframe weekly support level at 101.206 meaning we may see a small reaction, but nothing to write home about, hence the need for confirmation!

Quick Recap:

Our pending sell order set at 101.696 is currently looking in great shape with our first take-profit level being hit already at 101.465. We expect the selling to continue from here down to at least the 101.227 area, which is where our final take-profit level is situated. Once/if price reaches this area, we should be prepared for a healthy rally higher, as this seems to be an important level that pro money used to rally price up to the 4hr decision-point level at 101.754 in the first place.

- Areas to watch for buy orders: P.O: 101.020 (SL: 100.786 TP: Dependent on price approach) 101.249 (SL: 101.153 TP: Dependent on price approach). P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 102.953 (SL: 103.317 TP: Dependent on price approach)101.696 (Active) (SL: 101.862 TP: [1] 101.465 [2] 101.227) P.A.C:102.074 (SL: 102.214 TP: Dependent on approaching price action after the level has been confirmed).

EUR/GBP:

Daily TF.

The sellers have pushed price so very deep into the daily demand area at 0.78862-0.79206 which possibly consumed all of the major buyers within this area. If we do not see much in the way of buying enthusiasm, be prepared for a strong break to the south.

4hr TF.

Price has dropped very deep into 4hr demand at 0.78862-0.79048 consuming the round number 0.79000 in the process. Just before most were thinking this areas going to break south going, the buyers made an appearance and bought heavily into it. The first trouble area seen for any current buyers in the market has to be (on this timeframe) around the high 0.79170, if we see a clean break above here, price could very well advance to the 4hr S/R flip level at 0.79358.

Pending/P.A confirmation orders:

- The pending buy order (Green line) set just above demand (0.78862-0.79048) at 0.79076 is now active, so do keep an eye out for our first take-profit level to be hit at 0.79170.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- New pending sell orders (Green line) are seen just below a supply area (0.79795-0.79684) at 0.79651. The reason for a pending sell order being set here, rather than a P.A confirmation sell order was because this area looks very hot for a first-time reaction. Notice how price faked above the S/R flip level at 0.79679 then dropped back down, there is very likely unfilled sell orders still lurking around this area, hence the need for a pending sell order.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

The sellers have traded very deep into the 4hr demand area at 0.78862-0.79048, and just when this area looked like it was going to collapse, the buyers stepped in and bought price quite heavily, meaning our pending buy order set at 0.79076 is safe for the time being. However, we would feel a lot more confident in the trade, if a positive close above the high 0.79170 was seen.

- Areas to watch for buy orders: P.O: 0.79076 (Active) (SL: 0.78846 TP: [1] 0.79170 [2] 0.79358 [3] 0.79679) P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 0.79651 (SL: 0.79828 TP: Dependent on price approach).P.A.C: No P.A confirmation sell orders are seen in the current market environment.

USD/CAD:

4hr TF.

The higher picture resembles the following:

- Price is currently seen trading out of weekly demand at 1.05715-1.07008.

- Much like the weekly timeframe above, the daily timeframe shows price has traded out of daily demand at 1.05874-1.06680 into a daily decision-point area at 1.07508-1.07293, which has now been broken north.

What an aggressive-looking candle (High 1.07930 Low 1.07222) that is! It traded deep within the 4hr decision-point level at 1.07207-1.07324, and missed the round number above at 1.08000 by about 8 pips or so.

The buyers are now beginning to show interest around the aforementioned 4hr decision-point level with the area above still remaining clear. Clear it may be, we should still keep a watchful eye on the circled area around the 1.07731 area as there may be some active sellers sitting there from the lower timeframes.

Price will likely rally from where it is currently trading at the moment to at least the round number 1.08000, and possibly a break above it may be seen.

Pending/P.A confirmation orders:

- The pending buy orders (Green line) set just above the decision point (1.07207-1.07324) at1.07347 is now active; do keep an eye out for our first take-profit level set at 1.08000.

- P.A confirmation buy orders (Red line) are seen just above the round number 1.07000 at 1.07047. The reason a P.A confirmation buy order was set here is simply because a pending buy order would be too risky as (on this timeframe) there is no logical area for a stop loss order to be placed.

- No pending sell orders (Green line) are seen in the current market environment.

- P.A confirmation sell orders (Red line) are seen just below the round number 1.08000 at 1.07952. The reason a P.A confirmation sell order was set here is simply because a pending sell order would be too risky as (on this timeframe) there is no logical area for a stop loss order to be placed.

Quick Recap:

The area above the 4hr supply area at 1.07508-1.07434 was indeed free of any obstacles (supply), as price shot straight up just missing the round number 1.08000 by 8 pips or so. Price is currently reacting to the 4hr decision-point level at 1.07207-1.07324 which in turn has filled our pending buy order set just above at 1.07347. Price will likely rally higher from here to at least the round number 1.08000. Do remain aware though, there is a possible minor trouble area (supply) around the 1.07731 area for the buyers to contend with first.

- Areas to watch for buy orders: P.O: 1.07347 (Active) (SL: 1.07184 TP: 1.08000 [May be subject to change]). P.A.C: 1.07047 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: There are no pending sell orders seen within the current market environment. P.A.C: 1.07952 SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

USD/CHF:

4hr TF.

The higher picture resembles the following:

- The weekly timeframe is showing price consolidating just above weekly demand at 0.85664-0.88124.

- Daily supply at 0.90372-0.90042 has seen a lot of action over the past few weeks with no break north seen yet. Price is currently capped between the daily supply level just mentioned, and the daily S/R flip level below at 0.88608.

It was reported in the last analysis price appeared to be well on its way towards the huge figure number 0.90000, however some unexpected selling pressure has been recently seen around the 0.89885 area.

Take a look at the most recent price action, it is very interesting in that the sellers seem to be spiking price north (marked with three arrows) consuming what supply is left, and also at the same time, spiking price south possibly clearing the way for a move to the downside. In our opinion, there is only one logical place to bring price down to, and that is the 4hr decision-point level just above the high 0.89557 at 0.89540-0.89614. This area will likely see a nice bullish reaction once/if price reaches south this far.

Pending/P.A confirmation orders:

- New pending buy orders (Green line) are seen just above the decision-point level (0.89540-0.89614) at 0.89624. A pending buy order was placed here because price is currently seen retracing, and this area being the most likely place unfilled buy orders are remaining, so it seemed logical to set this type of order.

- P.A confirmation buy orders (Red line) are seen just above the low 0.88546 at 0.88586. The reason that a P.A confirmation buy order was set here rather than a pending buy order was simply because there is no logical area for a stop loss, and the low (level above) will be likely prone to deep tests, or worse, a positive break below, hence the need to wait for confirmation.

- Pending sell orders (Green line) are seen just below the round number 0.90000 at 0.89974. The reason a pending sell order was set here is because there is a logical area for a stop-loss order, and this is a huge round number level which will likely see a reaction on its first touch.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

Price has hit some unexpected selling pressure around the 0.89885 area. If this selling pressure continues, we may see a drop down to the 4hr decision-point area at 0.89540-0.89614, which in turn would likely fill our pending buy order at 0.89624 in the process.

- Areas to watch for buy orders: P.O: 0.89624 (SL: 0.89523 TP: Dependent on price approach).P.A.C: 0.88586 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 0.89974 (SL 0.90140 TP: Dependent on price approach).P.A.C There are currently no P.A confirmation sell orders seen in the current market environment.

XAU/USD (GOLD)

Daily TF.

The ignored daily decision-point area at 1292.52 is proving to be a level of worth with the rebound (at the time of writing) forming an extended higher high.

4hr TF.

It was reported in the last analysis that we should not discard the fact that price may rally back up to the 4hr S/R flip level at 1304.77 before price finally drops to the 4hr S/D flip area below at 1284.77-1280.53.

Price has indeed rallied up to the aforementioned 4hr S.R flip level, the selling activity is not exactly convincing at the moment, a push deeper into the 4hr D/S flip area above at 1307.58-1315.67 may be needed for a sell-off to commence. What gives us the confidence to say that a sell-off may commence is the way price has approached the aforementioned 4hr S/R flip level (take a look at the small trendline). Notice how as the buyers were rallying price they were also ever so subtly spiking south to consume any likely demand, thus possibly clearing the path south for the sellers.

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- P.A confirmation buy orders (Red line) are seen just above the S/D flip area (1284.77-1280.53) at 1285.71. We have set a P.A confirmation buy order here simply because we could not find a logical area for the stop-loss order, so to avoid any deep spikes; we have decided to wait for confirmation.

- No pending sell orders (Green line) are seen in the current market environment.

- The P.A confirmation sell order (Red line) set just below the S/R flip level (1304.77) at 1303.40 is now active. The sellers will need to prove this level by consuming some of the buyers around the low 1292.04, we will then be permitted to set a pending sell order waiting for a possible retracement.

Quick Recap:

Price has seen a rally to the 4hr S/R flip level at 1304.77, where our P.A confirmation sell order at 1304.40 has been triggered in the process. Very limited selling action is being seen there at the moment. Price may push above this level (1304.77) into the 4hr D/S flip area at 1307.58-1315.67 before a sell-off commences. The reason a sell-off will likely commence is due to the price approach, it shows demand was possibly consumed as price was rallying higher.

- Areas to watch for buy orders: P.O: There are currently no pending buy orders seen in the current market environment. P.A.C: 1285.71 (SL: (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: There are currently no pending sell orders seen in the current market environment. P.A.C: 1303.40 (Active-awaiting confirmation) (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).