Technical analysis of USD/CHF for December 08, 2017

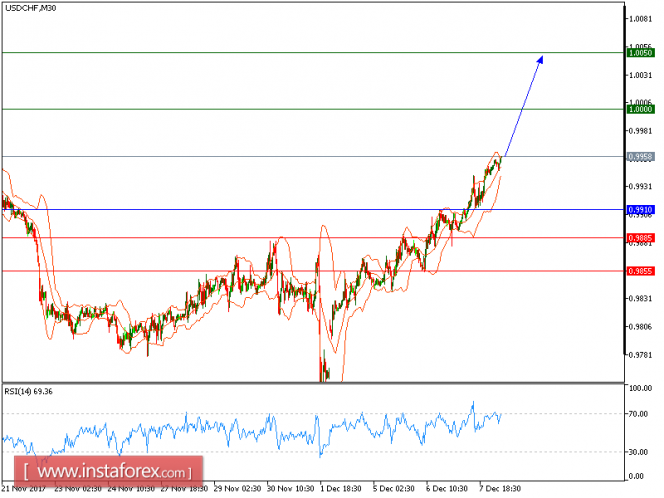

Our first upside target which we predicted in yesterday’s analysis has been hit. USD/CHF is expected to continue its upside movement. The pair remains within a bullish trend line, and should continue to post a new bounce to challenge 1.0000 (a key psychological level). The relative strength index is bullish and calls for a further advance. In addition, a strong support base at 0.9910 has been formed and should limit any downward attempts.

The U.S. dollar kept receiving bids as more investors are focusing on the potential economic benefits brought by the tax-cut bill. The currency’s strength also came ahead of Friday’s jobs report and next week’s meeting of the Federal Reserve, where officials are expected to raise interest rates.

To conclude, as long as 0.9910 is not broken, the pair is likely to advance to 1.0000 and 1.0050 in extension.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot points indicates a short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY, Stop Loss: 0.9910, Take Profit: 1.000

Resistance levels: 1.000, 1.0050, and 1.0075

Support levels: 0.9885, 0.9855, and 0.9835

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Technical analysis of USD/CHF for December 08, 2017