Technical analysis of USDX for May 8, 2018

Posted On 08 May 2018

Comment: 0

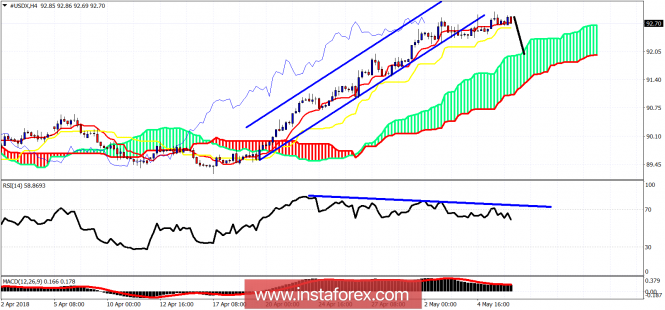

The US dollar index made a new higher high yesterday but the price is very close to long-term resistance and the bearish divergence signs by the RSI imply weakness and limited upside. So a pull back towards at least 92 is expected.

Blue lines – bullish channel

Downward sloping blue line – bearish divergence

The dollar index is expected to make a strong pullback at least towards cloud support around 92. A break below the cloud and below the 91.40 level will open the way for a bigger downward move. I’m bearish on the dollar index. The short-term support for an intraday sell signal is at 92.60. Breaking this level will reinforce the selling pressures.

The material has been provided by InstaForex Company – www.instaforex.com

Previous Story