Bullet Report: The reason for the USD slide and why it could continue

Yesterday’s ISM news release showed the biggest contraction in the services sector in the US since 2008. As per rough estimate the US Services sector amounts to about 70% of the US GDP, which gives some indication that coming Q/Q GDP numbers will suffer. As a result, the expectations for a September rate hike have now taken a massive hit as the FED has mentioned that rate hike paths are data dependent. Bank of Canada rate decision will be the main focus today and it’s widely expected to keep key interest rate unchanged at 0.50%. UK industrial and manufacturing production will be the main focus in European session.

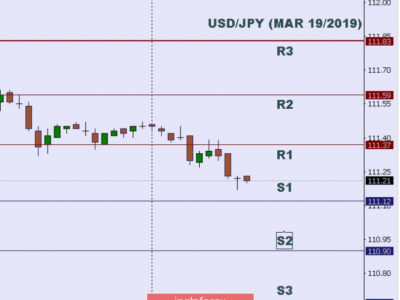

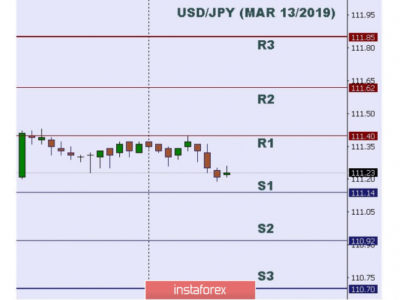

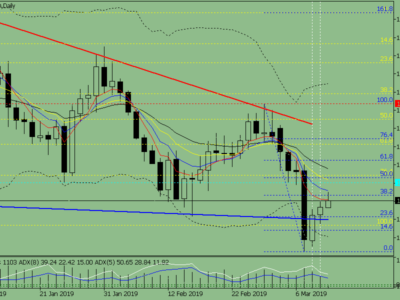

Currencies: The USD suffered on the back of the weak ISM reading. Indicative is the fact that the GBP/USD closed above 1.34 for the first time since the Brexit Vote. Sterling has been boosted by a string of strong data recently. USD/JPY took a nosedive since Fridays mediocre NFP report and is now trading 101.50 from 104+ on Friday. EUR/USD also rebounded strongly from 1.1140 to over 1.1260. Further direction for the USD index will now be the actual September FOMC meeting and the data that will lead until this event.

Stocks: Stocks had an overall quiet session, with the direction skewed to the downside. The Nikkei Stock Average was down 0.7%, after falling as much as 1% in early trade as the yen gained nearly 0.5% against the U.S. dollar. A stronger yen reduces the competitiveness of Japan’s exports. U.S. stocks close higher Tuesday and the tech-heavy Nasdaq logs a new closing high as investors digest a weak services-sector report, which might stay the Federal Reserve’s hand as it considers raising interest rates.

Oil and Gold: Oil futures settled on a mixed note Tuesday, with West Texas Intermediate crude ending at a one-week high and Brent crude finishing with a loss as traders eyed a pact between the world’s two largest crude producers, Russia and Saudi Arabia, aimed at stabilizing the market. Gold increased its rise from Fridays $1304 levels to over $1350 on the back of a sliding USD.

The post Bullet Report: The reason for the USD slide and why it could continue appeared first on Forex.Info.

Source:: Bullet Report: The reason for the USD slide and why it could continue