Crude Tests and Hold Support Levels Despite Large Inventory Build

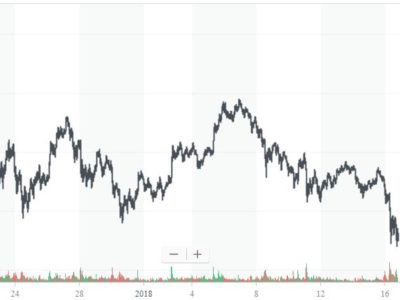

Crude oil prices whipsawed on Thursday following stronger than expected inventory numbers released mid-morning by the U.S. Department of Energy. After testing support near the 20-day moving average at $43.02, prices pushed higher topping out at $45.52. Prices continue to hold up well despite the overhand of crude oil and a rising dollar.

According to the Department of Energy, U.S. commercial crude oil inventories increased by 2.6 million barrels from the previous week. Total gasoline inventories increased by 0.4 million barrels last week, but are in the middle of the average range. Distillate fuel inventories increased by 1.0 million barrels last week but are in the middle of the average range for this time of year.

On the demand side of the equation, total products demand over the last four-week period averaged over 20.2 million barrels per day, up by 4.2% from the same period last year. Over the last four weeks, gasoline demand averaged over 9.3 million barrels per day, up by 3.8% from the same period last year. Distillate fuel demand averaged 3.7 million barrels per day over the last four weeks, down by 1.2% from the same period last year. The brightest outlook was Jet fuel product demand which is up 7.5% compared to the same four-week period last year.

The post Crude Tests and Hold Support Levels Despite Large Inventory Build appeared first on Forex Circles.

Source:: Crude Tests and Hold Support Levels Despite Large Inventory Build