EUR Analysis – 16th of February

While the ECB failed to meet market expectations by expanding the current QE program at the December 3 meeting, the prospects for another round of easing were announced at the January 21 meeting. Draghi and the ECB have signalled their commitment to do whatever it takes to combat low inflation and this should keep the longer-term bearish bias on the euro intact. Nevertheless, any exacerbation in risk-off sentiment and continued USD weakness could see further short-term strength in the currency. The opposing forces of bearish monetary policy, bullish safe-haven flows, and a broad USD decline could make the euro a somewhat difficult currency to trade until the March meeting gets closer. Still, significant rallies should be viewed as selling opportunities.

EUR Analysis

Interest Rate

Main Refinancing Operations (MRO) Rate: 0.05%

Last Change: September 4, 2014 (0.15%)

Deposit Facility Rate: -0.30%

Last Change: December 5, 2015 (-0.20%)

Expected Future Change: Potential further rate cuts and expansion of QE

Quantitative Easing: €60 billion per month

Next Rate Decision: March 10

Inflation

Inflation Target: <2%

Period: Year ending January 31

Flash CPI: 0.4% Prior: 0.2%

Flash Core CPI: 1.0% Prior: 0.90%

Next Release: February 25

Employment

Month: December

Unemployment Rate: 10.4% Expected: 10.5%

Next Release: March 1

Growth

Period: Q4 2015 Annual (Y/Y)

Preliminary GDP: 1.5% Expected: 1.6%

Next Release: May 13 ( Q1 2016)

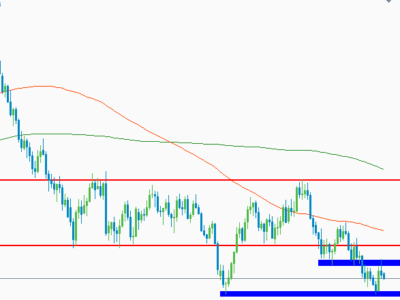

The EURUSD has seen a recent surge largely due to USD weakness as expectations decline for the number of Fed hikes through 2016, and due to haven flows as the market has seen extreme risk off sentiment. After trading in a tight 350 pip range through most of December and January, the pair has rallied over 550 pips (+3.92%) through the first 2 weeks of February. This recent strength due to a depreciating USD and continued safe haven flows on the back of risk off sentiment, gives the ECB even more reason to take further action in March.

At the ECB meeting on January 21, Draghi stated that monetary policy will need to be reviewed at the next meeting in March and that further measures will be taken if necessary in an attempt to boost inflation. The tone of the statement was very dovish and brought forward expectations of further easing. The EURUSD consequently saw a 140-pip drop from the release but since retraced the move before heading lower again.

Minutes released January 14, from the December 3 meeting, revealed that some members wanted a deeper cut than 10bps; this implies that the ECB are still not at the lower bound and are willing to reduce the deposit rate further if economic conditions were to warrant such a move.

Flash CPI for January was released on January 29 and showed a pick up in both headline and core inflation. Headline showed a 0.4% increase since a year ago, up from prior of 0.2%, and core rose 1.0% y/y, beating expectations and prior of 0.9%. The rise in core inflation is a positive sign for the ECB, however they will need to see a confirmed rise in inflation for the January final and February flash for them to consider abstaining from action in March.

Preliminary GDP for the fourth quarter showed the EZ economy grew at a modest quarterly rate of 0.3% at the end of 2015. The increase in total output matched its third quarter gain and put the annual print at 1.5% down a tick from last time, and slightly below expectations.

The jobs market proved slightly more healthy than expected in December. Mainly due to a steeper revised 223K drop in November, a 52K decline in the number of people out of work saw the unemployment rate dip another tick to 10.4%. This equaled its lowest mark since August 2011, and was the third fall in the rate in the last four months.

The post EUR Analysis – 16th of February appeared first on Jarratt Davis.

Source:: EUR Analysis – 16th of February