EURUSD Monday 23rd June: Weekly technical outlook and review.

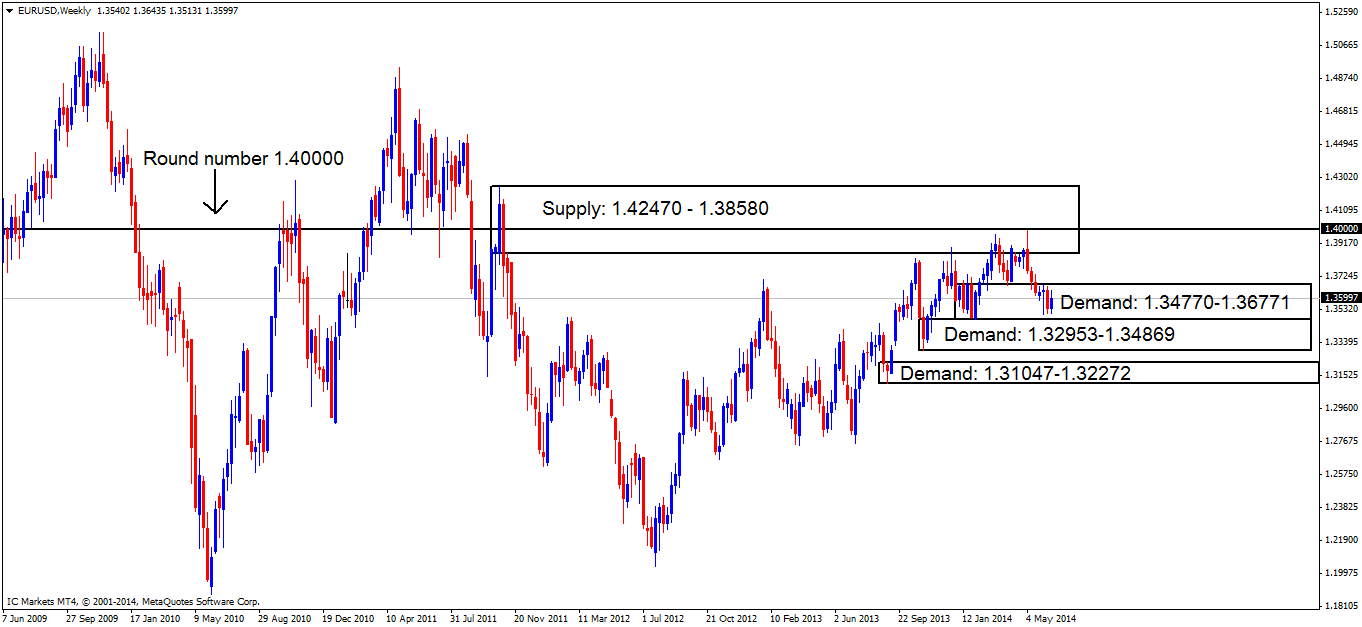

Price still remains trading within weekly demand seen at 1.34770-1.36771. No break was seen of the previous weekly high or low (1.36688/1.35124) with price closing just below the round number 1.36000 at 1.35997.

Supply at 1.42470-1.38580 is currently capping price to the upside, and demand below at 1.34770-1.36771 is capping price to the downside.

Weekly Chart (click to enlarge)

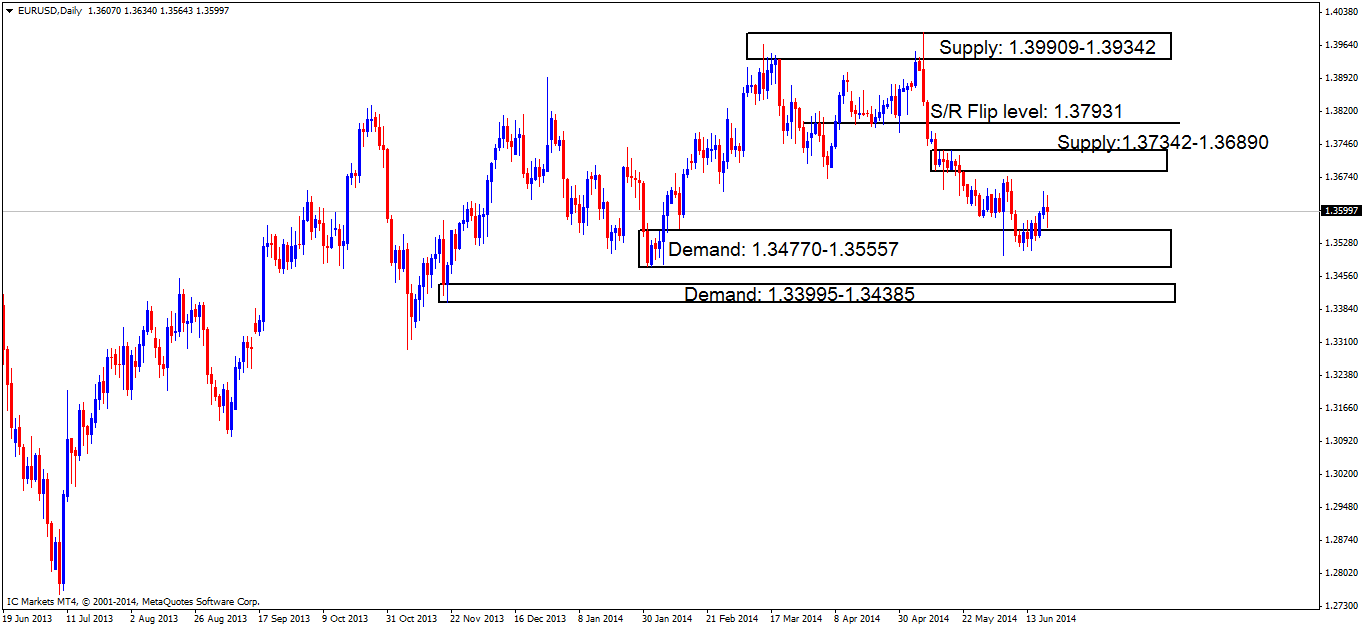

Daily TF.

The previous week’s trading action has shown there to be active buyers within daily demand at 1.34770-1.35557, which is also situated deep within weekly demand (1.34770-1.36771) as mentioned above.

Price remains capped between the daily demand area just mentioned (1.34770-1.35557) and supply above at 1.37342-1.36890. Anything in between here is secondary and considered insignificant on this timeframe.

If a break below demand (levels above) is seen, this would likely force price to test demand below at 1.33995-1.34385, which is situated within weekly demand below the current one at 1.32953-1.34869 (see above). Conversely a break above supply may clear the path for a test of the S/R flip level seen at 1.37931.

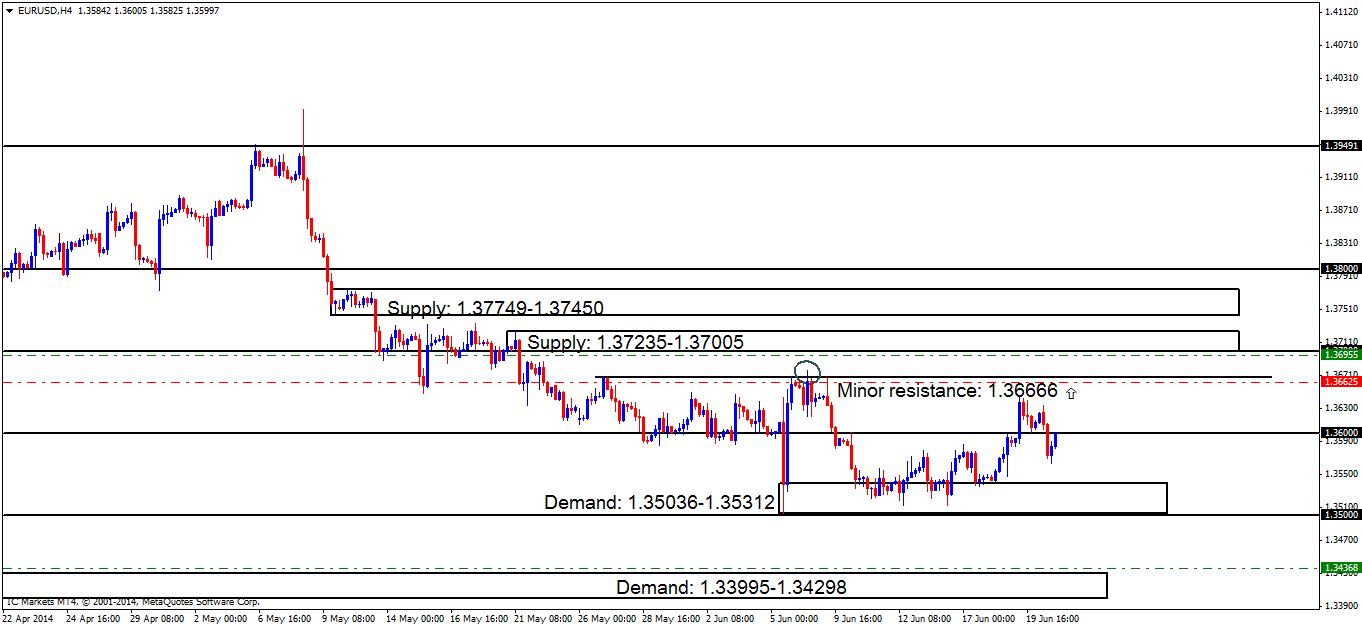

4hr TF.

The long-term bias still remains long due to the higher timeframes being seen trading around demand as explained above. However, on the 4hr timeframe, we are capped between demand below at 1.35036-1.35312 and supply above at 1.36666 (minor resistance) with the round number 1.36000 lurking in between.

A break above supply (1.36666) is more likely to happen before we see a break of demand below at 1.35036-1.35312. If a break above does indeed happen, price will likely test the lower of the two stacked supply areas at 1.37235-1.37005 where a reaction/bounce may be seen to the downside.

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen around demand (1.33995-1.34298) at 1.34368. This demand area will more than likely see some sort of reaction due to its location seen to the left.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- Pending sell orders (Green line) seen at 1.36955 just below supply at 1.37235-1.37005 are set here since this level remains untouched, meaning unfilled orders are likely still set around this area.

- P.A confirmation sell orders (Red line) are visible below the minor resistance 1.36666 at 1.36625, this level has proved valid in the past, but still needs to be confirmed due to a spike/wick (circled) seen above resistance, which may have consumed most of the sellers originally there.Do be on your guard with the sell orders above; the higher-timeframes are currently indicating that higher prices may be seen this week (Weekly demand: 1.34770-1.36771 Daily demand: 1.34770-1.35557).

Quick Recap:

Price will likely remain trading within where price is currently capped (Supply: 1.36666 Demand: 1.35036-1.35312). Our confirmation sell order at 1.36625 sitting just below the supply area just mentioned above may be hit, as it is very doubtful price will break either one of capped areas (levels above) anytime today.

- Areas to watch for buy orders: P.O: 1.34368 (SL: 1.33926 TP: Dependent on how price action approaches the zone) P.A.C: No P.A confirmation orders seen in the current market environment.

- Areas to watch for sell orders: P.O: 1.36955 (SL: 1.37270 TP: [1] 1.36666 [2] 1.36000) P.A.C:1.36625 (SL: 1.36810 TP: Dependent on where price ‘confirms’ the level).

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Sources: IC Markets Trading Desk