Forecast for USD/JPY on Mar 13, 2020

USD/JPY

The Japanese stock index Nikkei 225 lost 4.41% yesterday, and now it is losing 8.41% this morning, following the crushing collapse of the US market by almost 10%. Yesterday, Bank of Japan Governor Haruhiko Kuroda had an emergency meeting with Prime Minister Shinzo Abe, after which he announced his readiness to “saturate financial markets”. But the “saturation” of the market occurred yesterday: the volume of trading on the yen was a record for almost the entire history of trading, so after proto-trading in the range of 300 points, the USD/JPY pair closed the day by adding 40 points.

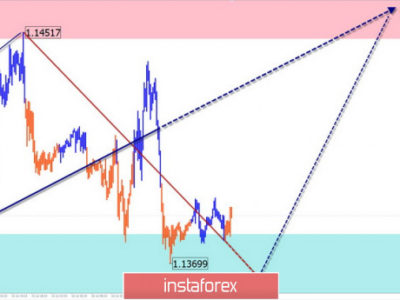

At the moment, the price is consolidating before the resistance of the embedded price channel line on the daily scale chart. The continuation of the correction growth looks as possible up to the embedded price channel line at 107.14, since historically, the Bank of Japan’s interventions (in relation to a targeted change in the yen exchange rate) have always been short-term and have not changed the general direction of the trend.

On the four-hour chart, the price is kept from rising by the MACD line. Further corrective growth may be to the Fibonacci levels of 110.0% at the price of 106.40 and 123.6% at the price of 107.06, which is close to the target mark on the daily chart (107.14). But to continue the growth, the price needs to be fixed on the MACD line, above 105.30. If the Japanese central bank weakens the cash injection, it is likely that the pair will decline from the current levels, in this case, the goal is to support the price channel at 102.90.

The material has been provided by InstaForex Company – www.instaforex.com